(Bloomberg) — Meituan Dianping founder Wang Xing’s fortune has nearly doubled since his company emerged from the depths of China’s Covid-19 lockdown, cementing his place among a generation of the country’s most prominent tech entrepreneurs.

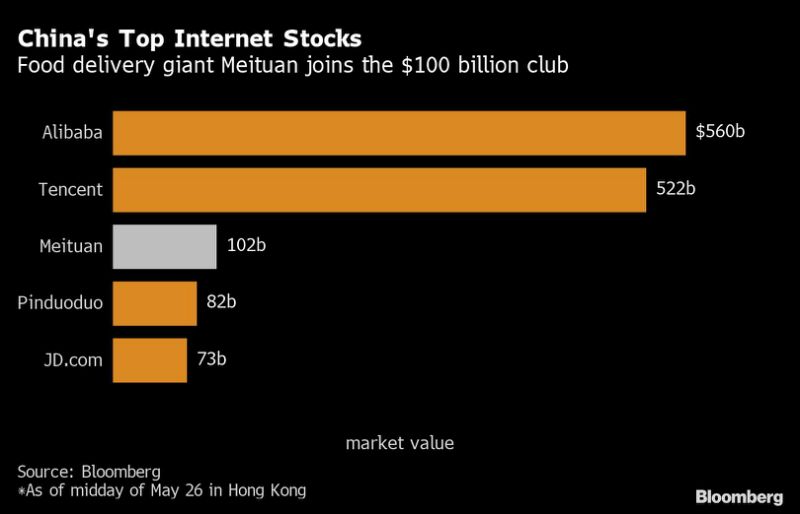

Meituan’s stock climbed 10.4% on Tuesday after it reported better than expected revenue, driving its market value past $100 billion for the first time and stoking hopes the world’s largest meal delivery business will bounce back as China regains its footing. Based on his 11.3% slice of the company, the chief executive officer’s wealth has soared since Meituan plumbed a low on March 19 to about $10.3 billion as of Tuesday.

Backed by Tencent Holdings Ltd., Meituan’s sprawling services from food delivery to hotel booking helped establish the company as one of a coterie of upstart challengers to incumbent tech leaders, Alibaba Group Holding Ltd. and Tencent itself. Meituan’s businesses — among the most vulnerable to a nationwide shutdown — began to climb out of a trough in April and May, offsetting slumps in harder-hit areas such as hotels. As of March’s final week, more than 70% of restaurants surveyed had recovered over half their normal order volumes, while 30% had exceeded pre-pandemic levels, Wang told analysts on a call Monday.

Wang relied on deals and expansion to turn what started as a Groupon-type service into a food delivery giant that now also spans food reviews and in-store dining services. A computer engineer by training, Wang — whose role model is Amazon.com Inc. founder Jeff Bezos — is putting growth ahead of the bottom line to secure Meituan’s place among China’s pantheon of tech giants. He’s part of a new generation of up-and-comers, along with fellow billionaires like ByteDance Ltd.’s Zhang Yiming and Didi Chuxing’s Cheng Wei.

“Looking into the next three quarters, we believe there will still be challenges as there are still uncertainties and potential downside from the ongoing evolution of the COVID-19 situation,” Wang said on the call. “Meanwhile, a large number of local service merchants are still struggling for survival. Short-term profitability is not our top priority.”

Read more: The Greatest Delivery Empire on Earth Has Alibaba’s Attention

Meituan’s stock surge came after it reported better-than-expected sales of 16.8 billion yuan ($2.4 billion) in the three months ended March. Morgan Stanley and CICC were among the brokerages that subsequently lifted their targets on the company, citing resilience across business lines and easing competition.

“COVID-19 had a negative impact on Meituan but results beat on top-line and bottom line by a wide margin,” Bernstein analysts led by David Dai wrote. In food delivery, the “long run potential is still there and the profitability level can be much higher” after the company pushes advertising, they added.

Longer term, the internet services giant will have to grapple with China’s worsening economy, which may further dent consumer spending. Subsidies and measures to help restaurants and merchants during the outbreak will again pressure profitability in the June quarter, executives said. Meituan reported a lower-than-projected net loss of 1.58 billion yuan, but that was after three successive quarters of profit.

What Bloomberg Intelligence Says

Meituan’s near-term growth may weaken as its in-store dining, hotel and travel businesses take time to fully recover from China’s coronavirus outbreak. Operating efficiency will likely improve in the longer term as the company expands its market-leading scale and competition with Alibaba moderates. Broadening service categories and providing technology solutions for merchants will aid sales and profit growth.

– Vey-Sern Ling and Tiffany Tam, analysts

Click here for the research.

Before the outbreak, Meituan had pushed aggressively into adjacent arenas from online travel to ride-hailing. While revenue from the business that encompasses hotels and travel plunged 31% during the March quarter, Meituan’s much smaller new initiatives segment — which includes bike- and car-hailing — grew sales 4.9%, aided by the launch of a new grocery delivery service. Hotels remained hardest-hit: in the week of May 11, domestic room nights were at about 70% pre-pandemic levels.

While Meituan is expanding offerings to sell things like handsets and farm produce, rivals including Ant Group and SF Express, both backed by Alibaba Group Holding Ltd., are elbowing their way into Meituan’s core takeout business. Alibaba’s food-delivery arm Ele.me is also engaging in a subsidy battle with the startup for market leadership.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”56″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”57″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment