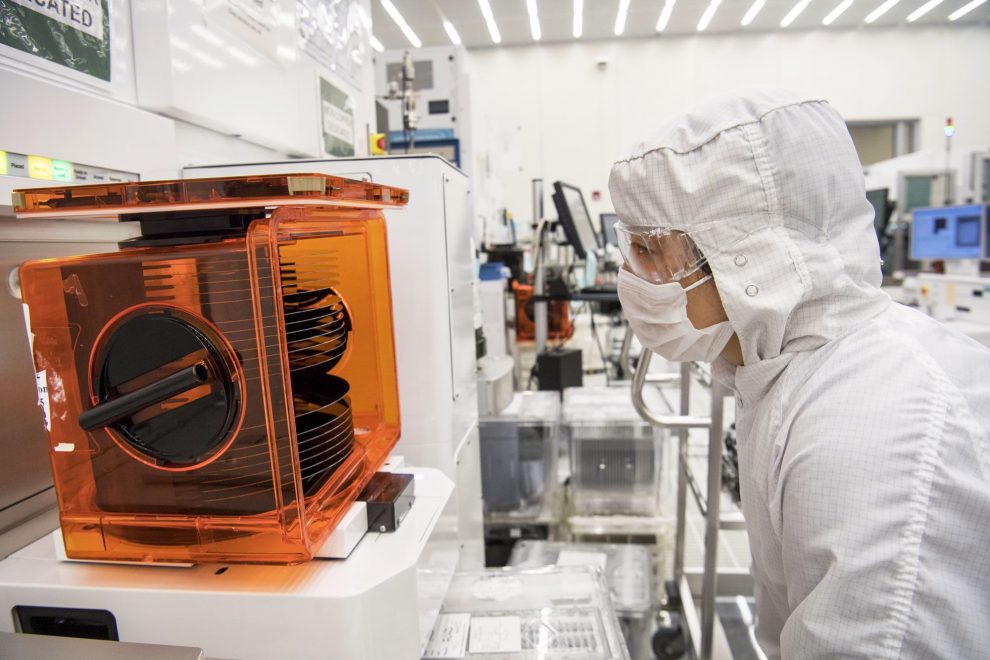

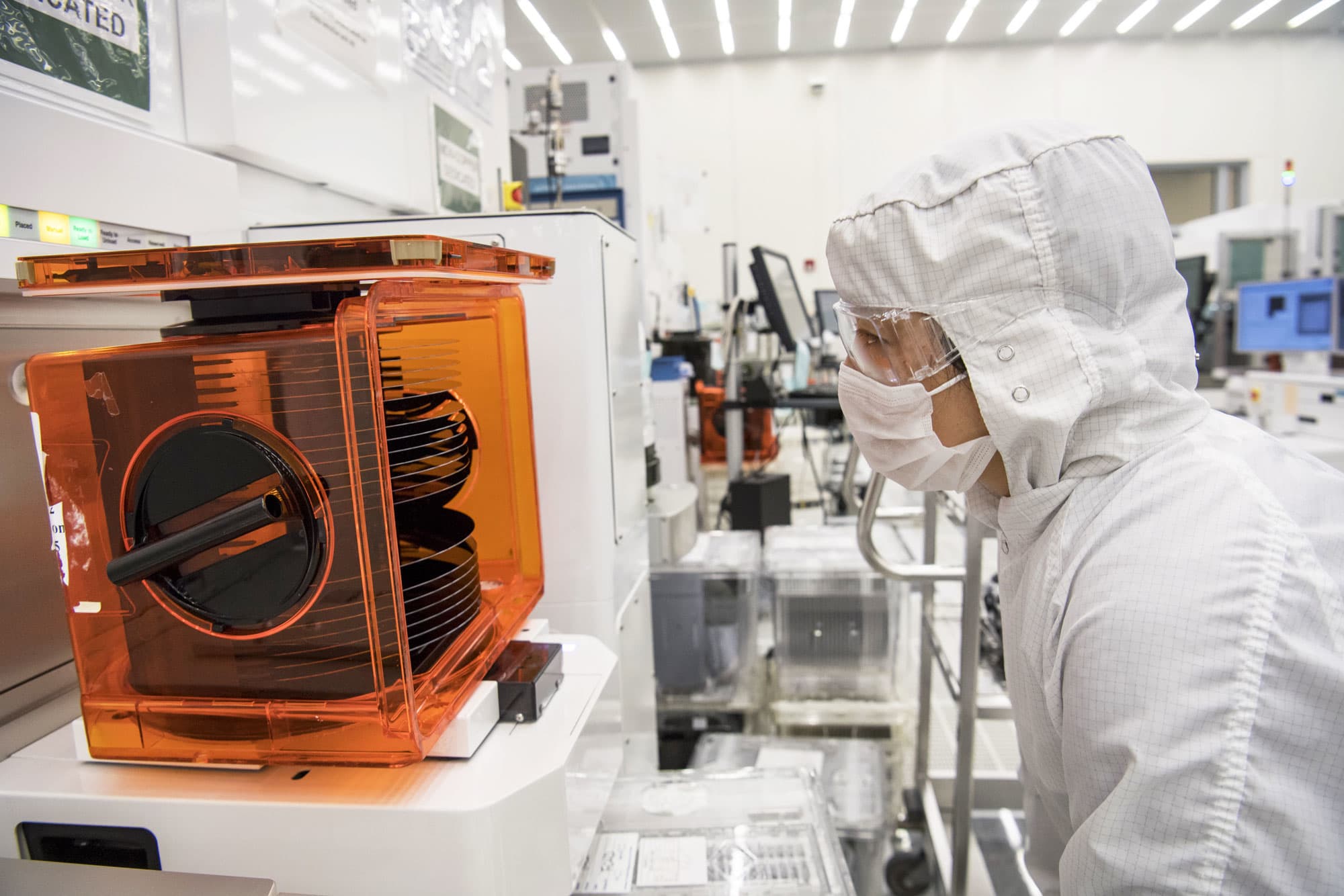

A technician checks on a stack of wafers at the Applied Materials facility in Santa Clara, California.

David Paul Morris | Bloomberg | Getty Images

Applied Materials forecast third-quarter profit and revenue above estimates and reported better-than-expected quarterly results on Thursday, allaying investor concerns about slowing semiconductor demand.

Shares of the company rose nearly 6% in extended trading.

The semiconductor industry has been grappling with slowing demand that bellwether Texas Instruments warned was a cyclical downturn which could last for another two years.

Applied’s Chief Financial Officer Daniel Durn said the chip market was expected to be flat for the year.

“While we’re still not ready to call the bottom of the semi equipment cycle, I believe our industry thesis is very much intact,” Durn said in a post-earnings conference call about the broader semiconductor industry.

Overall, however, the company expects to grow in 2019, with strong demand from services and display markets.

Applied Materials forecast third-quarter revenue at about $3.525 billion, the mid-point of which is above analysts’ estimate of $3.51 billion. It forecast earnings per share of 67 cents to 75 cents, the mid point of which is above analysts’ estimate of 69 cents.

Net sales fell 22.7% to $3.54 billion in the second quarter, but were above estimates of $3.48 billion, according to IBES data from Refinitiv.

The company’s adjusted net income fell to $660 million, or 70 cents per share, in the second quarter ended April 28, from $1.24 billion, or $1.19 per share, a year earlier.

Analysts were expecting earnings of 66 cents per share.

No Impact From Tariffs

Durn told investors the company had plans in place to ensure that the net impact of any tariffs related to the U.S.- China trade tension would be immaterial.

“It’s clearly something we’re going to watch very closely… But right now, given where we sit and what we know today, we think the net impact is going to be immaterial for the overall results of the company,” Durn said.