First published on Simply Wall St News

While NVIDIA Corporation (NASDAQ:NVDA) has made a significant 87% return in the past year, current sector movements indicate that the market is losing interest. Markets and even some insiders might be a bit shaken by the high valuation and some large investors may decide to take profits and move on.

In this analysis, we will review recent market movements in the semiconductor industry, peer P/E valuations and insider transactions for NVIDIA.

Before jumping in, here is what we found in our analysis:

Industry Performance

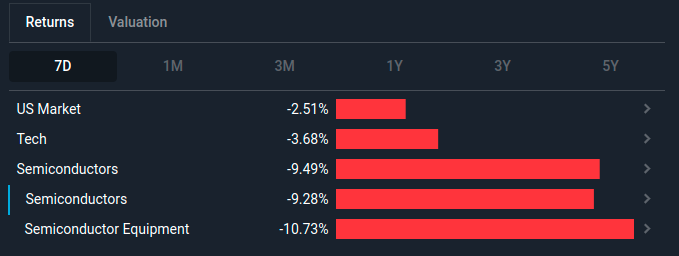

Let’s start with what is happening in the semiconductor industry. It seems that U.S. semiconductor stocks have been declining in the last 7 days.

We can see, that in the last 7 days, the Semiconductor industry lost between 9% and 10%. When things start falling, we need to check if this is an industry phenomenon or if a few stocks are responsible for the majority of the decline.

In this case, it seems that large semiconductor stocks are falling across the board, which indicates that this move is not related to the performance of individual companies, but rather a sector or possibly a market rotation.

This means that large (also called marginal) investors, with the ability to move the price, may have decided that most of these stocks can experience issues in the future and may perform lower than their stock price requires them to.

Hence, we see the following performance:

The chart above illustrates, that while it is the highest performer, NVIDIA is also the most exposed on a price to earnings level – Investors are paying US$66.6 for every US$1 of earnings. These levels may be sustainable if a company is entering a high growth stage or is building a global monopoly. However, in most cases the price tends to converge to the industry average plus the growth expectations for the company.

In the semiconductor industry, the 3-Year median P/E is 31.8x, and NVIDIA is trading some 109% higher than this historical benchmark.

Other companies, especially Advanced Micro Devices (NASDAQGS:AMD) are also highly exposed and investors should keep watch over their performance.

Insider Transactions

View our latest analysis for NVIDIA

While NVIDIA has an outstanding historical performance, and we encourage you to review the fundamentals, one thing struck us as highly informative.

It seems, that over the last 12 months, multiple insiders have been selling their company’s stock.

This may be somewhat revealing about management’s expectations for the future of the stock price. As you will see in the char below, there is also no reported insider buying. The latest reported transaction, was on the 28th March and constituted a US$27.4m worth of stock sold at a max price of US$274.06 per share.

Insider transactions are not the only thing we should consider when evaluating a stock, which is why we need to form an opinion based on our estimates of the fundamentals and market conditions, as discussed above.

Conclusion

While NVIDIA is a high performing stock, it seems that the price has gotten significantly ahead of the fundamentals, and there are some indications that the market is starting to be more risk averse in this industry.

The actions of insiders also show that there might be limited upside for the stock in the short term.

Next Steps:

Investing requires that we take multiple factors into consideration, so here is a list of ways you can continue your analysis:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.