“ A pause in rate hikes simply isn’t good enough. ”

We’re nearing the tipping point where the U.S. economy and banking system either back away from the edge and return to safety or fall off the cliff and into a full-blown banking crisis.

The Federal Reserve could solve this in one step: Cut interest rates at its meeting this week.

Yet the odds of the Fed taking this step are slim. While most forecasts now have the U.S. central bank holding off on a rate increase, a pause simply isn’t good enough.

Cutting rates releases an economic pressure valve. However temporary this move would be, the respite is necessary for the health of the financial markets and the banking system.

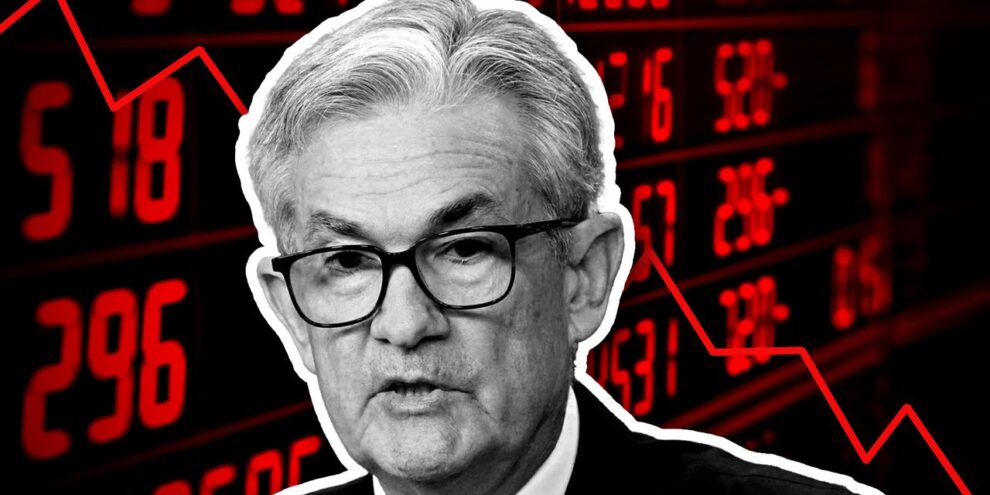

Yes, the Fed wants to tighten the leash on inflation and, no, a rate cut will not help on that front, but someone needs to tell Fed Chair Jerome Powell that this is not a “kill-at-all-costs” mission, because none of us can afford for the stability of the banking system to be a price paid in the effort.

Squeeze and bleed

Most of the coverage so far of the collapse of Silicon Valley Bank SIVB, -60.41%, Silvergate Bank SI, -3.30% and Signature Bank SBNY, -22.87% — and the instability at First Republic Bank FRC, -32.80% and others – has focused on how these banks managed their way into troubles. It hasn’t looked hard at the squeeze these businesses faced.

Here’s the issue that several experts tell me is being ignored, summed up by Bryce Doty, senior portfolio manager at Sit Investment Associates: “Most banks are insolvent right now.”

That sounds horrible, but it is more about regulatory rules and interest rates than a complete inability to pay all debts.

Read: From SVB’s sudden collapse to Credit Suisse’s fallout: 8 charts show turbulence in financial markets

To bring it home, consider if you took a long-term fixed-rate mortgage on a home about 10 years ago, when the average mortgage rate was around 3.6%. That was roughly double the rate of the 10-year Treasury TMUBMUSD10Y, 3.430% back then, which meant that some institution would want to buy your loan rather than settle for a safer Treasury bond.

Nowadays you’re still paying 3.6% on the mortgage, but that’s about what the 10-year Treasury pays. As a result, the value of your mortgage on the books of your lender is less now than it was a decade ago. In the banking world, events like that are not a problem until the paper must be “marked to market,” priced as if it were being sold today.

Federal regulations allow banks to plan to keep a portion of their assets to maturity, allowing them to ride out temporary paper losses because the hold-forever securities don’t get marked to market (staying on the books at the value they had when purchased). This gives banks needed flexibility but can create issues of the “not a problem until it becomes a problem” variety, foreseeable only if you’re looking particularly carefully.

Where the financial crisis of 2008 was caused by banks taking default losses, the system’s current problem is not about worthless paper (at least not yet). This time, rates went up so quickly that it created paper losses.

“ The Fed should have seen this coming.”

The Bloomberg U.S. Aggregate Bond Index fell 13% last year; previously its worst year ever was a 3% loss in 1994. Since 1976, the index has been down in just five calendar years — including the past two years.

The Fed should have seen this coming; its own balance sheet shows about $9 trillion of bonds losing north of 10% of their value during rate increases. “The Fed kept rates so low and then just jacked them up so fast that no [financial institution] could possibly readjust their bond portfolios to avoid the losses,” Doty said in an interview on my Money Life with Chuck Jaffe podcast.

Off-air, Doty estimated that if the Fed cuts interest rates 100 basis points – one percentage point – “it would eliminate half of [the banking industry’s] unrealized losses in one fell swoop. That would make the easiest and most short-lived banking crisis in history.”

Moreover, this would ensure no “contagion” from the imploding banks; keep in mind that it was banks that came to the rescue of First Republic this week, sowing the seeds for one bank’s mark-to-market problems to become the next institution’s default loss.

That’s how you turn a problem into a disaster. If the Fed pushes rates higher without giving time for a respite, it dramatically increases the chance of a liquidity crisis and credit crunch.

Hello Recession, your table is ready.

Jurrien Timmer, director of global macro at Fidelity Investments, said in a recent interview on my show that he can’t see the Fed letting up, noting that no one wants to be the next Arthur Burns, the infamous Fed chairman during the great inflation of the 1970s.

Said Timmer: “They are committed to never repeating those mistakes, which in the 70s was to keep policy too loose for too long, letting the inflation genie out of the bottle.”

But this is not the 1970s, and whoever thought the Fed was too soft on inflation then — which is why it is taking a hardline stance today — should consider that maybe the central bank backed away then because higher rates were causing widespread systemic problems.

The Fed needs to be solving problems, not contributing to them. If that means living with higher inflation for longer, it’s still a better choice for the country than turning a containable banking problem into a global liquidity crisis and a hard landing for the economy.

A cut doesn’t end the war on inflation, it just pauses the battle to reinforce and secure its fighting position. Sometimes, the best way to move forward is to start with a rocking step backwards. Let’s hope the Fed has the guts to do it.

Read: What it may take to calm banking-sector jitters: Time, plus a Fed rate hike.

More: First Republic was rescued by rivals. Silicon Valley Bank was abandoned by its friends.