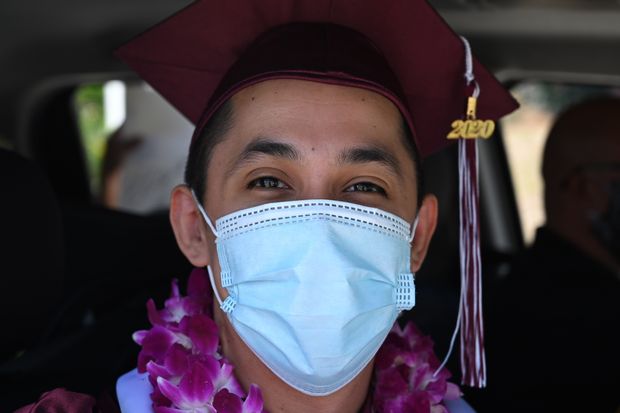

Student-loan borrowers have been allowed to pause payments on their loans during the pandemic-induced economic downturn, but they have to start making payments again on Jan. 1, 2021.

Photo by Robyn Beck/AFP via Getty Images

A top student loan official is warning of possible administrative and financial challenges for borrowers when the government resumes collecting on millions of student loans on January 1.

“It is reasonable to anticipate that there may be an increase in complaints,” when the coronavirus-related pause on student loan payments and collections resumes, Robert Cameron, the student loan ombudsman at the Consumer Financial Protection Bureau wrote in the ombudsman’s annual report released Wednesday. “It is also reasonable to anticipate that as with any transition, there may be potential for borrower confusion and consumer harm.”

The warning comes days after Congress abandoned plans for a new coronavirus relief package ahead of the election, and as advocates urge the Department of Education to extend the pause on student loan payments and collections beyond December 31.

In August, President Donald Trump extended the freeze — which began with the CARES Act in March and was set to end on September 31 —through the end of the year. But advocates have warned that borrowers likely won’t be in any better position to repay their loans, given still widespread unemployment.

What’s more, they say, the student loan system may not be ready to onboard millions of borrowers at once. The ombudsman’s report points to potential challenges with auto-debit, inaccurate billing and recertifying borrowers so they can stay in manageable repayment plans.

Persis Yu, the director of the Student Loan Borrower Assistance Project at the National Consumer Law Center, said the ombudsman’s insight that there would be challenges when payments resume was “absolutely right.”

“At some point repayment is going to restart and we need to be paying attention to ensure that borrowers are getting the best possible service at that time,” she said. “A lot of things are going to go wrong and it is the job of the CFPB to make sure that that doesn’t happen.”

Yu added that she would like to see more detail on borrowers’ complaints because they can provide insight into the challenges borrowers may be facing and the steps the CFPB is taking to resolve those issues.

The Department of Education and its contractors had difficulty implementing the payment pause at its outset. Up to 5 million borrowers experienced an erroneous ding in their credit score as a result of the payment pause. Months into the freeze, nearly 3,000 defaulted borrowers were still having their paychecks seized to repay student loans.

Between March 1 and August 31, an average of 20% of the complaints received weekly by the CFPB mentioned COVID-19, according to Wednesday’s ombudsman’s report. The agency received roughly 500 complaints of this type during this period. The most common issue reported was dealing with a lender or servicer.

The report outlines suggestions to prevent consumer harm when the student loan system gets turned back on. For one, the ombudsman suggests policymakers weigh making both types of federal student loan borrowers eligible for coronavirus-related relief — a step borrower advocates have urged. Right now, the freeze on payments and collections only applies to borrowers with federally-held student loans. That means at least $165 billion in federal student loans owned by commercial lenders are ineligible for the payment pause, according to Mark Kantrowitz, the publisher of SavingforCollege.com.

“Policymakers may wish to consider creating parity such that all federal loans, regardless of who holds them, have the same relief options, both now and in the future,” the report reads.

As for when the student loan system is ultimately turned back on, the report suggests that a variety of stakeholders, including consumer advocates and state regulators, consistently communicate and reach out to borrowers about the resumption of payments.

In addition, the report suggests that borrowers who face challenges with their student loan companies that can’t be resolved should contact regulators, including state law enforcement officials.

Seth Frotman, the executive director of the Student Borrower Protection Center and a former student loan ombudsman at the CFPB, described that approach as “a total repudiation of the Trump administration’s efforts to try to block state’s oversight over student loan servicers.”

“ “One of the things that they call out that’s going to be critical to protect borrowers is state law enforcement officials.” ”

Over the past few years, the federal government, states and student loan companies have been locked in a battle over who has authority to regulate the firms. The Department of Education has argued that state laws governing student-loan servicers — the companies that process payments for student loan borrowers — are essentially invalid because they undermine the federal government’s efforts to run the student loan program.

“The ombudsman is rightfully talking about the real risk that student loan borrowers are going to face when the payment pause gets alleviated,” Frotman said. “One of the things that they call out that’s going to be critical to protect borrowers is state law enforcement officials.”

In addition to highlighting the challenges borrowers may face once student loan payments resume, the report highlights other trends in the student loan market, including its disproportionate impact on Black and low-income borrowers.

“The thing that stands out the most is how the student loan ombudsman calls out the serious problems borrowers faced in the student loan market, while the larger CFPB does nothing to help those same borrowers,” Frotman said, noting that for example, the agency stripped its fair lending office of enforcement powers.

In the student loan market specifically, the Trump-era CFPB has focused its enforcement actions on debt-relief scams. For years, these fly-by-night companies have looked to take advantage of borrowers struggling to repay their loans by charging them to enroll in the government payment plans that allow borrowers to repay their debt as a percentage of their income — something borrowers can do themselves for free.

“ The freeze on payments and collections only applies to borrowers with federally-held student loans. That means at least $165 billion in federal student loans owned by commercial lenders are ineligible for the payment pause. ”

In many of those enforcement actions against debt relief scams, the agency has imposed penalties on the accused that were a small fraction of the amount they allegedly bilked from consumers. This is part of a broader, less aggressive approach to protecting borrowers, Frotman said.

For example, in 2018, the agency only released a report on the challenges college students face with credit cards a year after it was completed and under pressure. In 2018, when Mick Mulvaney was temporarily head of the agency and after Frotman — who began his tenure as the CFPB’s student loan ombudsman during the Obama administration — resigned in protest, the agency didn’t release its annual student loan report at all. This year, the report came roughly 10 days later than typical.

Dodd-Frank requires that the agency release the report on the “same date annually” to the Secretary of Education as well as certain committees in the House of Representatives and the Senate. The first report was released on October 16, 2012, which is why the reports came on or around that day in subsequent years.

In contrast to the Trump-era CFPB, the Obama administration’s CFPB focused on larger players in the student-loan market. The agency sued Navient, NAVI, -0.80% the nation’s largest student loan servicer in 2017, accusing the company of making it unnecessarily difficult for borrowers to repay their loans.

Add Comment