Starbucks Corp. SBUX, +0.31% is making headlines, not just for new summer beverages, but for a shortage of ingredients and supplies, making it hard for consumers to purchase their favorite drink.

That’s just one example of the challenges facing retailers, consumer companies, and their loyal shoppers as a supply chain, upended by the coronavirus pandemic, tries to right itself for the post-COVID recovery.

“It is unwinding. In some cases we’re seeing similar effects from the first few months of the pandemic. Some of it is in reverse,” said Dan Kowalski, vice president of CoBank’s Knowledge Exchange Division. CoBank provides loans and other financial services to the U.S. rural community.

Early in the pandemic, some shoppers heading to the grocery store to stockpile food and other items were greeted with empty shelves. Businesses worked feverishly to shift distribution away from restaurants, cafeterias and other away-from-home dining venues that were now off limits during lockdowns.

Fitness equipment and other items also became hard to find as all sorts of activities moved to home offices, living rooms and backyards.

See: What is inflation? Hint: It’s not the 12% increase in rental-car prices last month

Now with vaccines rolling out and consumers heading back out into the world, there’s renewed demand for things that were of no use during COVID.

“There’s a part of the economy that’s been relatively quiet for the last year that’s reopening,” said Chedly Louis, vice president and senior credit officer at Moody’s. “The part of the economy that was quiet is revving up at a faster pace than the manufacturer thought at the beginning of the year. That’s the rebalancing that’s happening in the supply chain.”

Companies have spoken in detail about the supply chain hurdles they’re currently facing.

Sumit Singh, chief executive of pet-care retailer Chewy Inc. CHWY, -5.81% said on the late Thursday earnings call that a high level of out-of-stock items were a headwind during the most recent quarter.

“This is clearly a supply-driven situation, which we expect to abate in the second half of this year as additional production capacity comes online,” he said, according to a FactSet transcript.

“Until then, we will keep actively managing our inventory and using our recommendation engines to help customers find attractive alternatives.”

Read: Chewy swings to surprise profit, but warns of labor shortages, supply disruptions

Costco Wholesale Corp. COST, -0.31% described a wider range of supply chain problems.

“From a supply chain perspective, port delays are continuing to have an impact,” said Richard Galanti, Costco’s chief financial officer, on the company’s fiscal third-quarter earnings call last month, according to a FactSet transcript.

The company also faced shortages of pallets, ships and containers. Pent-up demand is also an issue.

“The biggest way we’ve handled supply chain delays is adjusted ordering and front-loading, if you will, of orders of many items,” he said. “And we think we’ve got that pretty well under control. The feeling is that this will continue for the most part of this calendar year.”

Clorox Co. CLX, -0.09% discussed the higher price of raw materials, particularly the resin that’s used in its trash bags, during its last earnings call. The company has announced price increases to cover the cost.

Clorox is one of a few companies, including Kimberly-Clark Corp. KMB, +0.07%, Hormel Foods Corp. HRL, +0.23% and Procter & Gamble Co. PG, -0.68% that have announced price hikes.

Moody’s Louis also notes that the supply chain has been affected by weather and other factors over the past couple of months.

Also: Why supply-chain bottlenecks, price pressures may ease by year-end

“In terms of price increases, manufacturers are doing it in a thoughtful way,” Louis said. “Most companies aren’t increasing prices to increase margins. Most of it is to offset costs. It will be interesting to see, when we establish higher pricing and raw materials start to moderate a bit, what will happen to that higher pricing.”

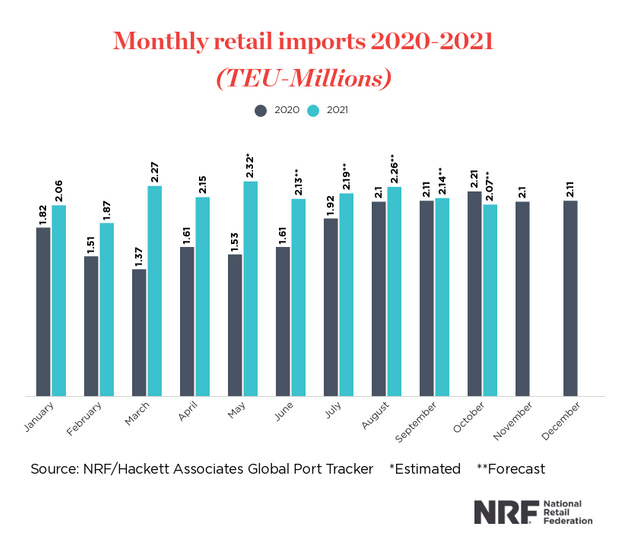

The National Retail Federation said in a Monday announcement that April was the busiest on record at the nation’s retail container ports, with May possibly setting a record.

“There’s no shortage of demand from consumers, but there continues to be shortages of labor, equipment and shipping capacity to meet that demand,” said Jonathan Gold, vice president for supply chain and customs policy at the organization.

“Supply chain disruptions, port congestion and rising shipping costs could continue to be challenges through the end of the year.”

Cowen analysts, in their State of the Ports report, describe “a fight for equipment and space,” a lack of drivers and high fees for “dwell times,” with shippers unable to move freight.

“While the backlog has been partially worked through, there are still huge (triple digit growth year-over-year and double-digit growth compared to 2019) volumes coming in the ports,” the June 3 report said.

“Port workers, warehouse workers, and other essential transportation workers are finally getting vaccinated (75-80%) which has also allowed the ports to improve productivity.”

And: U.S. consumer prices soar again and push CPI inflation rate to 13-year high

Mikey Vu, partner with retail and operations practices at Bain & Co., says there has been a shift since the beginning of the pandemic now that consumers are shopping increasingly online and companies have solved some of the problems that arose early in the pandemic.

But more change is necessary.

In a Bain report titled “It’s Time to Build Resilience into Retail and Consumer Goods Supply Chains,” researchers note that 67% of companies in these categories expect to bring supply chain managers into the decision-making process after COVID-19.

“We are seeing an overwhelming majority of retailers say they’re going to increase investment and make major changes to supply chain,” Vu, one of the researchers on the report, told MarketWatch.

Companies are still sorting out what consumer behaviors will stick post-pandemic, what will revert to pre-COVID behaviors and how businesses can best meet demand.

“Retailers know there’s a range of outcomes and have been preparing,” he said. “I don’t expect us to see as dire of inventory issues as we saw at the beginning of the pandemic. That said, the consumer experience will be slightly different from pre-pandemic.”