(Bloomberg) — For Maurizio Cattaneo, the economic impact of the coronavirus outbreak in northern Italy’s Lombardy region became alarmingly clear when several clients called to scrap contracts with his haulage company.

“More than 50% of our work for this week has been canceled, and I’m scared that the situation will worsen,” the 48-year-old who runs a small company transporting heavy machinery in the regional city of Lecco said from his office 118 kilometers (73 miles) from the center of the outbreak south of Milan. “We have a real psychosis.”

Whether it’s supply disruptions, production halts or clients steering clear of Lombardy, businesses like Cattaneo’s in Italy’s economic heartland are counting the rising cost of the spread of the virus in a country that was already teetering on the brink of recession.

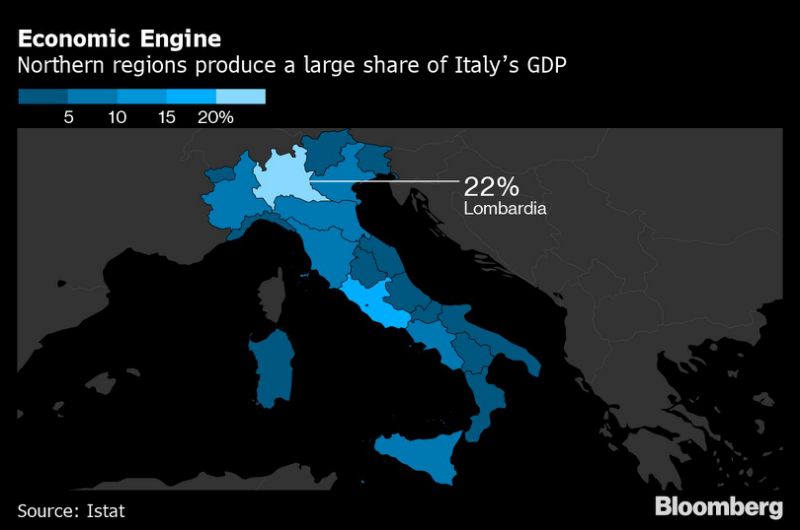

As the number of people infected by the virus in Italy rises above 300 — mostly in the rich, industrial north — restrictions imposed to stem its spread are threatening deeper economic woes. About a third of Italy’s output comes from Lombardy and Veneto, the two most-hit regions that are home to 1.1 million very small businesses with fewer than nine employees.

After a sharp contraction at the end of 2019, Italy was already headed toward a recession before the virus started disrupting its economy. With finances strained and a divided coalition, Prime Minister Giuseppe Conte has few tools to stimulate an economy that could slow by as much as 0.4 of a percentage point if the crisis lasts more than a couple of months, according to the business lobby Confocommercio.

Italy may seek to tap the European Union’s solidarity fund, depending on the extent of the economic damage, Deputy Finance Minister Antonio Misiani said an interview with newspaper La Stampa. Asked about the possibility of recession, he said “There will be an impact, but much depends on the duration of the emergency and the size of the zone directly affected.”

Conte said the government will soon present a number of measures to aid businesses harmed by the outbreak, “from manufacturing to tourism,” Corriere della Sera reported.

Related Story: Italy Insight – Europe’s Weak Link Ill Prepared for Coronavirus

“A large part of the production and commercial activities of our country are stopped with consequences that are certainly still very uncertain,” said Massimiliano Maxia, an analyst at Allianz Global Investors. “The fact that the regions that contribute the most to gross domestic product have been affected will obviously have an even more negative effect on this scenario.”

Vast swathes of the Lombardy and Veneto regions, stretching from Milan to Venice, are in a virtual lockdown. Events and conferences are being canceled, including the last days of the Milan fashion week. Venice suspended its annual pre-Lenten Carnival, and Serie A soccer matches were postponed or will be played behind closed doors.

Milan’s Salone del Mobile design event, which last year attracted almost 400,000 visitors, has been postponed to June from April due to the outbreak, Milan Mayor Giuseppa Sala said on the event’s Facebook page.

The death toll rose to 11 on Wednesday, with the mayor of Treviso north of Venice saying a 75-year-old woman died in the hospital there. Cases totaled 322 as of Tuesday evening, according to Italian emergency chief Angelo Borrelli.

Many large companies, including Unicredit SpA and Fiat Chrysler Automobiles NV, have asked employees to work from home and cut back on business travel. Software maker Zucchetti SpA, with 6,000 employees in Italy and headquarters in Lodi, just a few kilometers from the epicenter of the outbreak, has mandated employees from affected regions to work remotely.

But laptops and phone conferences can only go so far. Giorgio Armani, who held his fashion show behind closed doors to avoid any contagion risk, has closed a textile factory near Trento. Design and engineering company Italdesign Giugiaro SpA shut two plants near Turin after one of its workers tested positive to the virus.

Also with people staying home, a whole slew of ancillary businesses are taking a hit — from restaurants, bars and cafes to car services. That in turn is hurting waiters, drivers, assistants and other temporary workers.

Take the case of Ferdinando Dossan, 47, for example. Dossan has a private transport company, working mostly with businessmen and tourists arriving at Malpensa, Milan’s main airport.

“Nothing is moving,” he said Tuesday. About 80% of his bookings have been canceled, not just for the coming weeks but even into May and June. Instead of the three seasonal drivers he usually hires to cope with the spring influx of holidaymakers on Lake Como, he has need for only one now, he said.

The crisis could shave 3.9 billion euros ($4.2 billion) from consumer demand, according to the Confesercenti retailers’ group, and may lead to the closing of some 15,000 small companies. Restaurants, cafes and bars may see losses of about 2 billion euros in the first four months of 2020, according to industry lobby group FIPE.

Granted, the outbreak has been an export opportunity for some Italian companies gaining from China’s partial lockdown.

“We receive calls from France and Germany and just a few days ago an Italian client doubled the volume of an order,” Andrea Beri, CEO of steelmaker ITA SpA in Lecco, was quoted as saying by Il Sole 24 Ore. “These are companies that have trouble sourcing material from China.”

But such opportunities are few and far between. For the most part, companies will be looking for help. The government has announced tax relief and other support measures for the most-hit areas, but the sum on the table for now is a mere 20 million euros.

Opposition leader Matteo Salvini has called for a 10 billion-euro stimulus package, but this would most likely lead to Italy breaking its European Union budget commitments, even if more flexibility were to be granted to cope with the crisis.

Meanwhile in Lecco, the big question for businessmen like Cattaneo who can’t cope with the uncertainty is: how long is this going to last?

He has had a Florence-based client cancel a contract to supply a large crane because the pylons that needed to be moved hadn’t arrived. Then a Milan-based multinational company nixed a machine order because its employees had been idled.

“My family, my workers all depend on this business,” the heavy machinery transport company owner said. “Coronavirus may not kill people, but it will surely kill small businesses and manufacturing.”

–With assistance from Marco Bertacche, John Follain and Chiara Remondini.

To contact the reporters on this story: Alessandro Speciale in Rome at [email protected];Sonia Sirletti in Milan at [email protected];Flavia Rotondi in Rome at [email protected]

To contact the editors responsible for this story: Chad Thomas at [email protected], Ross Larsen, Marco Bertacche

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”50″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”51″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment