The U.S. death toll from the coronavirus that causes COVID-19 has surpassed the number of lives lost in the Vietnam War as more than 1 million Americans are confirmed to have had the deadly illness.

Data aggregated by Johns Hopkins University show the U.S. has had 58,471 fatalities from the virus, more than the 58,220 Americans who died in the Vietnam War that lasted about 20 years. The data show 1.01 million cases in the U.S.

President Donald Trump continued to defend his administration’s record on handling the pandemic on Tuesday, as he met with Florida Gov. Ron DeSantis, the Associated Press reported. DeSantis has been criticized for his slow response to the spread of the virus in his state.

Trump insisted that the U.S. was doing enough testing to protect Americans re-entering the workforce and said the rate of testing would soon reach 5 million a day, without specifying details. The U.S. has only conducted 5.7 million tests to date, according to the Johns Hopkins data.

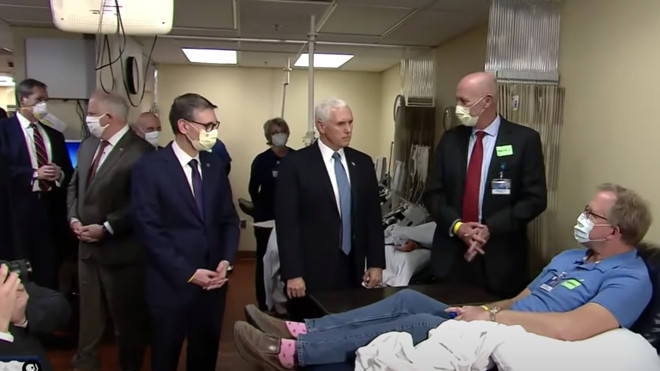

Vice President Mike Pence drew the ire of public-health officials—and the internet—by visiting the Mayo Clinic without wearing a face mask. In a now-deleted tweet, the Mayo Clinic said Pence had been informed ahead of his visit that face masks were compulsory during the pandemic. Photos from the trip show Pence to be the sole person who is not wearing a mask. Health-care workers said his example may encourage others not to wear masks, which are compulsory in some states, including New York.

There was tragic news from Massachusetts where 68 people at a home for veterans died of COVID-19, according to state officials cited by the Guardian. The state-run Holyoke Soldier’s Home has another 82 residents and 81 employees, who have tested positive. Federal officials, including State Attorney General Maura Healey, are investigating whether residents were denied proper medical care and whether legal action is required.

Latest tallies

There are now 3.14 million cases of COVID-19 worldwide and at least 218,564 people have died, according to the Johns Hopkins data. At least 948,545 people have recovered.

Spain continues to have the highest number of cases in Europe at 236,899 and 24,275 deaths. Italy has 201,505 cases and 27,359 deaths, the highest fatality rate in Europe.

France has 169,053 cases and 23,694 deaths, followed by the U.K. with 162,350 cases and 21,745 deaths. The U.K. has overtaken Germany in case numbers. Germany has 160,479 cases but just 6,314 deaths.

Turkey has 114,653 cases and 2,992 deaths, followed by Russia with 99,399 case and 972 deaths. Iran has 93,657 cases and 5,957 deaths. China, where the illness was first reported late last year, has reported 83,940 cases and 4,637 deaths.

In the U.S., New York remains the epicenter with about 300,000 cases and almost 25,000 deaths. New York state counted another 330 deaths on Tuesday, down from the 335 reported on Monday, according to Gov. Andrew Cuomo. Hospitalizations are down on a three-day basis, along with intubations, he said, but the number of new patients showing up with infections remains flat.

What’s the economy doing?

The pandemic continued to stress the U.S. economy and caused the biggest drop in gross domestic product in the first quarter since 2008 in a prelude of an even more massive decline in the spring, as MarketWatch’s Jeffry Bartash reported.

GDP, the official scorecard for the economy, shrank at a 4.8% annual pace from the beginning of January to the end of March, the government said Wednesday. Economists polled by MarketWatch had forecast a 3.9% decrease.

The worldwide spread of the coronavirus began to nip at the edges of the U.S. economy early in the quarter before exploding in March into the biggest crisis since the Great Depression some 90 years ago. The economy is likely to contract by 25% or more in the second quarter, with some forecasts putting the decline at a record 40%.

“The upshot is this was already an economic catastrophe within two weeks of the lockdowns going into effect. The second quarter will be far worse,” said U.S. economist Paul Ashworth of Capital Economics.

Separately, the index of pending home sales dropped 20.8% in March as the coronavirus pandemic took a significant bite out of real-estate activity, the National Association of Realtors reported.

This represented the lowest level of pending sales since 2011.

The index measures real-estate transactions where a contract was signed but the sale had not yet closed, benchmarked to contract-signing activity in 2001. It serves as an indicator for existing-home sales reports in the coming months.

Read now: The ‘Great Repression’ is here and it will make past downturns look tame, economist says

Positive, if preliminary, medical data

The stock market looked past the grim GDP number to focus on a more upbeat story, that of positive data in two trials of Gilead Sciences Inc.’s GILD, +7.96% remdesivir as a treatment for COVID-19. Remdesivir is widely considered to be a front-runner among the investigational therapies being tested as treatments, as MarketWatch’s Jaimy Lee has reported.

That good news was countered later in the morning with the release of another study that found the therapy did not lead to clinical improvement in patients in China.

Gilead said an open-label Phase 3 trial testing the therapy in 6,000 severely ill patients found that those taking a 5-day or 10-day course of treatment led to similar results. At least 52% of participants taking either dosing regimen were discharged from the hospital after 14 days of treatment, and at least 53% of those patients were reported as reaching “clinical recovery.”

Minutes before this top-line data was released, Gilead said that a National Institute of Allergy and Infectious Diseases clinical trial evaluating remdesivir in hospitalized COVID-19 patients met the study’s primary endpoint. The federal agency is expected to provide additional information about that trial, Gilead said. The primary outcome in this trial is recovery by 29 days of treatment, according to the study’s listing on ClinicalTrials.gov.

However, data from a randomized, double-blind, placebo-controlled, multi-site trial in China that was published in The Lancet found that the drug was “not associated with statistically significant clinical benefits.” The 158 patients taking remdesivir (79 were on placebo) did report a quicker recovery, though researchers said that data point “requires confirmation in larger studies.”

Separately, Centene Corp. CNC, +0.26%, a Medicaid managed care organization, said it would help distribute 25,000 COVID-19 test kits a week that have been developed by Quest Diagnostics Inc. DGX, +1.60% to federally qualified health centers, which are government-funded organizations that provide primary care in underserved communities.

“Gaining access to COVID-19 tests has been a challenge,” Dr. Michael Brooks, The Family Health Centers of Georgia’s president and CEO, said in a news release. Quest has developed both molecular and antibody tests for COVID-19.

What are companies saying?

The first earnings from big tech came late Tuesday, with earnings from Google parent Alphabet Inc. GOOG, +8.55% GOOGL, +8.61% and chip maker Advanced Micro Devices Inc. AMD, -2.76% and the virus was of course the key focus. Alphabet pleased Wall Street by saying it is prioritizing share repurchases instead of continuing to spend on new employees and business development during the pandemic.

The company’s first-quarter numbers were predictably disappointing with ad sales falling more than 10% in March as stay-at-home orders went into effect around the world.

“As of today, we anticipate that the second quarter will be a difficult one for our advertising business,” Alphabet Chief Financial Officer Ruth Porat told analysts on the company’s conference call. “As we move beyond the crisis, and the global economy normalizes, this should be reflected in our advertising revenues. But it would be premature to comment on timing given all the variables here.”

Like many others, Alphabet is cutting spending, especially on global office buildings and construction, and is slowing hiring.

At AMD, strong demand for cloud and large enterprise services offset a slowdown in transactional business with Chief Executive Lisa Su saying there is less interest in new infrastructure during the crisis.

On the company’s earnings call, Su voiced confidence in all of the company’s core businesses in the second half of the year except for personal computers, which could be up to the whims of the overall economy and consumers’ willingness to spend on computers in the back-to-school and holiday seasons, as MarketWatch’s Jeremy Owens reported.

Read: AMD earnings hit target, but annual forecast trimmed as business spending slows

“We are potentially expecting some weakness in the second half due to consumer spending,” Su said in response to an analyst question. “You sort of have two forces at work there — one, is there a pull with the strong work-from-home trends, but then there’s also the view from a macro standpoint we’ll be weaker in the second half of the year.”

AMD increased the range on its forecast for full-year revenue in response, now predicting sales will grow 20% to 30% this year instead of 28% to 30%. Considering most other companies are rescinding annual guidance and providing quarterly forecasts only — including rival Intel Corp. INTC, +5.12% — the wider range could actually be seen as a confident move from the chip maker.

The next names to report are Tesla Inc. TSLA, +2.35%, Facebook Inc. FB, +6.41% and Microsoft Corp. MSFT, +3.66%, all due after the bell on Wednesday.

Here’s what companies are saying about COVID-19:

• Blue Apron Inc. APRN, -25.13% posted weaker-than-expected first-quarter earnings, but said stay-at-home mandates during the coronavirus pandemic have significantly boosted demand for its products. The pandemic did not have a material impact on first-quarter numbers, but the meal kit provider is expecting second-quarter revenue to grow in the high single digits. The company is hiring new workers and increasing production capacity, temporarily reducing variety in menus to limit the need to change production lines. The company has no supply chain issues or disruption at fulfillment centers. “The company believes there will be an ongoing positive impact on demand for its meals, although the duration and extent of this demand increase is unknown,” it said in a statement. Separately, the company said it has filed a shelf registration with the Securities and Exchange Commission to issue up to $75 million in stock or debt.

• Boeing Co. BA, +10.19% missed first-quarter profit and revenue expectations, as the company said the COVID-19 pandemic has affected every aspect of its business, while free cash flow was better than forecast. Commercial airplane revenue fell 48% to $6.21 billion, but was above expectations of $5.94 billion, while defense, space and security revenue declined 8% to $6.04 billion versus expectations of a rise to $6.76 billion. Boeing said “abnormal production costs” from the suspension of 737 MAX production have increased by $1 billion, bringing the estimated total to $5 billion. Boeing expects 737 MAX production will resume at “low rates” in 2020. “As the pandemic continues to reduce airline passenger traffic, Boeing sees significant impact on the demand for new commercial airplanes and services, with airlines delaying purchases for new jets, slowing delivery schedules and deferring elective maintenance,” said the company. It is reducing commercial airplane production rates, announced a leadership and organizational restructuring to streamline roles and responsibilities, and plans to reduce overall staffing levels with a voluntary layoff program and additional workforce actions as necessary.

• General Electric Co. GE, -1.10% missed first-quarter adjusted profit and free cash flow expectations, as the COVID-19 pandemic had a “significant financial impact,” but beat on revenue. Industrial free cash flow (FCF) was negative $2.21 billion, compared with guidance provided March of about negative $2 billion. The COVID-19 pandemic reduced FCF by about $1 billion and hurt industrial profit by about $800 million. Within GE’s business segments, revenue misses by Power and Aviation were offset by beats in Healthcare and Renewable Energy. GE Capital swung to a loss of $194 million from earnings of $171 million.

• Hasbro Inc. HAS, -3.64% reported first-quarter results that missed expectations and withdrew its full-year outlook, citing uncertainty related to the impact of the pandemic. Hasbro said it was committed to paying its dividend.

• Defense company Honeywell International Inc. HON, +2.81% is shifting manufacturing operations at two chemical facilities to produce hand sanitizer for government agencies suffering shortages during the pandemic. Sites in Muskegon, Michigan and Seelze, Germany will temporarily change production lines over the next two months. The Muskegon plant makes high-purity solvents and blends with more than 1,500 products used in high-end applications such as DNA and RNA synthesis, environmental analysis, precision cleaning, pharmaceutical testing and various other laboratory applications, said Honeywell The plant has begun production of hand sanitizer that it will donate to the Federal Emergency Management Agency (FEMA). The German plant produces more than 500 products used for laboratory research and testing, inorganic fine chemicals for agriculture and automotive industries, electronic chemicals used in semiconductors, and microchips and authentication technologies used in high security and brand protection applications, including personal protection equipment, or PPE, which is much in demand among health care workers and other frontline workers. The plant has already sent one batch of industrial hand sanitizer to the Saxony Ministry of Health, Social Affairs and Equality, which will distribute it to local hospitals and factories. Honeywell is already making N95 masks from production lines in Arizona and Rhode Island to help with COVID-19 workers.

• Roomba maker iRobot Corp. IRBT, -3.87% reported a narrower-than-expected adjusted loss in the first quarter and better-than-expected sales, but cast doubt on future sales of its pricey cleaning devices. “Cleaning products are increasingly top of mind with consumers today, although the uncertain economic environment now facing consumers is likely to weigh heavily on when, where and whether they will buy a new Roomba or Braava robot,” the company. iRobot also missed out on demand, saying it was unable to “completely fulfill anticipated first-quarter demand for certain premium robots due to design-driven engineering and supply chain challenges that were unexpectedly complicated by the impact of COVID-19” on itself, contractors and suppliers.

• Lyft Inc. LYFT, +5.25% announced deep cuts, including 982 layoffs and the furlough of an additional 288 employees. The layoffs represent 17% of Lyft’s workforce. In an SEC filing, the San Francisco-based company estimated it will “incur approximately $28 million to $36 million of restructuring and related charges primarily related to employee severance and benefits costs, the majority of which the Company expects to incur in the second quarter of 2020.” Lyft, like its rival, Uber Technologies Inc., has seen a steep decline in rides as America locks down during the pandemic.

• Mastercard Inc. MA, +6.33% topped earnings and revenue expectations for its first quarter. Gross dollar volume and purchase volume each rose 8%. Chief Executive Ajay Banga said the COVID-19 outbreak has led to “a very trying time” but that Mastercard has “seen early signs of spending levels stabilizing.”

• TripAdvisor Inc. TRIP, +6.46% is cutting nearly a quarter of its workforce due to the economic hit caused by the coronavirus shutdown. In a blog post, co-founder and Chief Executive Steve Kaufer said more than 900 employees will be laid off — mostly in the U.S. and Canada — and “a number” of employees will be furloughed, while most other salaried workers will be asked to take a 20% pay reduction and reduced work schedule through the summer months. “Sometimes, the most valiant of efforts aren’t enough to counter outside circumstances and, as a public company, it is our responsibility to adjust, adapt and evolve to the environment that surrounds us,” Kaufer wrote in a letter to employees, noting the company had already undertaken two rounds of cost reductions. Kaufer announced the launch of an “alumni network” to help the laid-off workers find new jobs. The company will also temporarily pause its 401(k) matching, and will close its offices in San Francisco and Boston, though remaining workers there will be able to work from home.

• The chief technology officer of Uber Technologies Inc. UBER, +5.72% is resigning, amid a report that the ride-hailing company is discussing plans to cut about 20% of its workforce. The departure of CTO Thuan Pham was disclosed Tuesday in an SEC filing, that said his last day will be May 16. Pham has been with Uber since 2013 and is its longest-serving executive, according to The Information, which also reported the potential layoffs. The Information said Uber could cut more than 5,400 jobs due to a sharp drop in ridership during the pandemic, including about 800 engineering jobs. Earlier this month, Uber withdrew its annual guidance and warned that its net losses would widen.

• WW International Inc. WW, +17.91% , the company formerly known as Weight Watchers, reported a narrower first-quarter loss and said it ended the three-month period with 9% more subscribers. The company ended first quarter with 5 million subscribers, a new first-quarter record and a 9% rise compared with the prior-year period. WW “took quick global coordinated action and pivoted to move all of our in-person group workshops, which serve about a quarter of our members, to a virtual platform, keeping the WW community connected no matter where they are,” Chief Executive Mindy Grossman said in a statement, referring to the pandemic. “We are accelerating our digital transformation,” she said. The company withdrew its 2020 guidance.

Add Comment