Advertising is currently the company’s bread and butter, but AI appears to be its future.

Alphabet (GOOGL 1.08%) (GOOG 1.06%) has come a long way since its founding in 1998, when the company went solely by Google. The tech giant has become a behemoth in the industry by essentially creating a gateway to the internet, amassing billions of users. Alphabet has used its vast network to branch out to multiple markets, including digital advertising, productivity software, cloud computing, smartphones, and more.

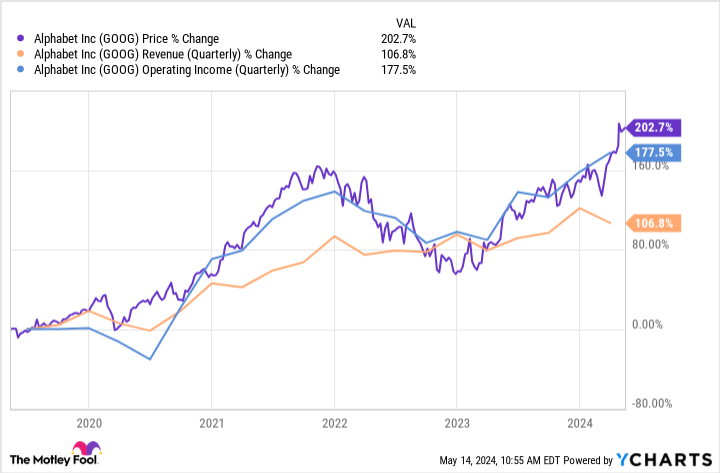

Data by YCharts.

The company’s success has seen its quarterly revenue, operating income, and stock price deliver triple-digit growth since 2019. Meanwhile, recent earnings indicate Alphabet is nowhere near hitting its ceiling. With a lucrative ad business and growth catalysts in multiple other markets, the company could have much more to offer new investors over the long term.

So, here’s why Alphabet stock could help you become a millionaire.

Benefitting from the tailwinds of the digital advertising market

In-house brands, like Android, YouTube, Chrome, and the many products under Google, have generated almost endless advertising opportunities for Alphabet. As a result, the company has achieved a leading 26% market share in digital ads, an industry Statista projects to hit $740 billion in spending this year.

Alphabet’s digital ad business accounts for about 80% of its revenue. The company’s dependency on ads left it vulnerable to macroeconomic headwinds in 2022 as spikes in inflation forced businesses to cut ad spending. However, market improvements have shown that Alphabet’s advertising division remains a fruitful long-term venture.

On April 25, the company posted its first-quarter 2024 earnings, where revenue rose 15% year over year and beat Wall Street estimates by almost $2 billion. Alphabet benefited from an uptick in ad sales, represented by a 14% increase in its Google Services revenue. Operating income for the segment climbed 28% year over year.

Digital ad spending is projected to expand at a compound annual growth rate of about 10% through 2033, suggesting Alphabet will continue to see gains from the market for years.

Alphabet is diversifying its business with an AI expansion

In addition to advertising, Alphabet is gradually expanding its role in artificial intelligence (AI) to stay competitive with rivals Microsoft and Amazon.

Over the last year, Alphabet added a range of new AI tools to its cloud platform, Google Cloud, and launched an AI model called Gemini. Analysts were wary of the company’s AI prospects at first, with less cloud market share than Microsoft and Amazon and a fumbled launch for Gemini. However, Q1 2024 earnings have seemingly tempered concerns for now.

During the quarter, Alphabet’s Google Cloud revenue increased by 28% year over year while operating income soared 371% to $900 million.

Moreover, Alphabet is working to bolster other areas of its business with AI, including using Gemini to offer more cost-efficient and effective advertising. Meanwhile, on May 14, the company announced major changes to Google Search, launching new generative AI features. The revamped search engine is designed to deliver more complete and direct answers to customers’ questions.

Advertising remains the company’s bread and butter, but AI appears set to play a major role in its future.

A vote of confidence from management

Alphabet executives illustrated a major vote of confidence during a recent earnings call by announcing its first-ever dividend. On April 25, the company revealed plans to buy back $70 billion worth of stock and offer a dividend of $0.20 per share.

The move comes three months after advertising rival Meta Platforms announced its first-ever dividend. However, Alphabet’s free cash flow of $69 billion compared to Meta’s $50 billion suggests the Google company is better equipped to continue offering its dividend and keep investing in its business over the long term.

Data by YCharts. PE = price to earnings.

Additionally, this chart shows Alphabet is one of the best-valued stocks in AI and the cloud market. The company has a significantly lower forward price-to-earnings ratio and price-to-free cash flow than Microsoft or Amazon, making its stock a bargain compared to its peers.

Alongside Alphabet’s booming ad business and promising venture into AI, the company’s stock is worth considering. With the right investment, it could make patient stockholders millionaires.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.