There’s no denying the fact that Nvidia (NVDA 1.18%) has turned out to be a life-changing investment for anyone who bought shares of this chipmaker a decade ago. That’s because Nvidia stock has delivered remarkable gains of more than 26,800% in the past 10 years, significantly crushing the 195% gains that the S&P 500 index has clocked over the same period.

Investors who bought and held Nvidia stock for such a long time have been able to benefit from multiple catalysts, such as the growth in the video gaming market, the increasing deployment of its graphics processing units (GPUs) in data centers, and additional growth opportunities in markets such as automotive and digital twins.

However, the stunning surge in Nvidia stock over the past decade has made it the second-largest company in the world, with a market cap of just under $3.4 trillion. Expecting Nvidia stock to replicate its eye-popping performance over the coming decade looks like a far-fetched idea, considering that the size of the global economy is expected to hit $110 trillion this year. That number is expected to jump to almost $140 trillion by 2029, which means that a 35-fold jump in Nvidia stock over the next five years would make it bigger than the global economy.

Of course, that’s absurd. Moreover, investors should note that betting on just one stock in anticipation that it could change your life may not be the best idea. But at the same time, Nvidia may still have more upside to offer to investors in the long run in view of the huge addressable revenue opportunity it’s sitting on, which is why it could find a place in a diversified portfolio.

Let’s take a closer look at the potential catalysts for Nvidia and check why having this stock as a part of your portfolio could turn out to be a smart long-term move.

Nvidia’s total addressable market is well above $1 trillion

In its investor day presentation of 2022, Nvidia management pointed out that it has a $1 trillion revenue opportunity. The company broke down this opportunity as follows: $100 billion in gaming, $300 billion in automotive, $150 billion in enterprise artificial intelligence (AI) software, $150 billion in Omniverse enterprise software, $150 billion in enterprise chips and systems, and another $150 billion in hyperscale chips and systems.

However, that addressable opportunity seems to have grown immensely in the past couple of years. For instance, Nvidia management now sees a $1 trillion revenue opportunity in data center chips alone. That’s because the chipmaker is now forecasting a transition from general-purpose computing to accelerated computing in data centers to help reduce electricity consumption and increase computing power at the same time.

On Nvidia’s August earnings conference call, CEO Jensen Huang remarked that accelerated computing “enables you to do computing at a much larger scale, for example, scientific simulations or database processing, but what that translates directly to is lower cost and lower energy consumed.” He added that it won’t be “unusual to see someone save 90% of their computing cost” by moving from general-purpose computing to accelerated computing.

Accelerated computing is made possible by accelerators such as GPUs, a market that Nvidia dominates. It reportedly controlled 98% of the data center GPU market last year. That’s not surprising, since rivals such as AMD are way behind Nvidia when it comes to data center revenue.

So, if we assume that Nvidia’s revenue opportunity in gaming, automotive, enterprise AI software, and Omniverse software has remained constant over the past couple of years at a combined $700 billion, its overall total addressable market now sits at an impressive $1.7 trillion. Given that Nvidia is expected to finish the ongoing fiscal year 2025 with $129 billion in revenue, the massive addressable market indicates that the company’s outstanding growth could be sustained for a long time.

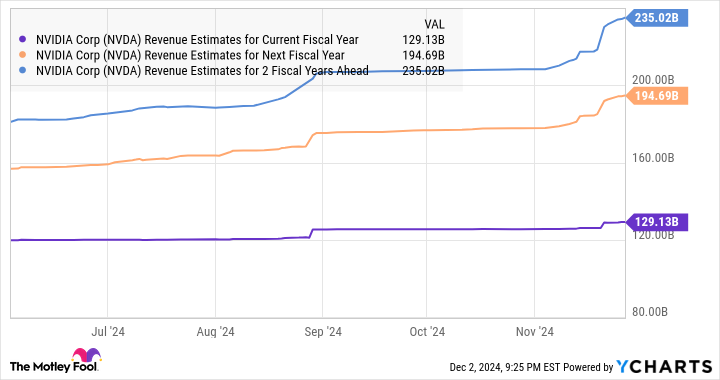

This is probably the reason why there has been a notable increase in Nvidia’s consensus revenue estimates for the next couple of years.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

Consistent growth in Nvidia’s earnings could result in terrific upside

The healthy growth in Nvidia’s top line explains why the company’s earnings are also expected to grow at a nice pace going forward.

NVDA EPS Estimates for Current Fiscal Year data by YCharts.

Nvidia finished the previous fiscal year with earnings of $1.30 per share, and its bottom line is on track to more than double this year. The chart above shows that its earnings could increase by 50% in the next fiscal year, followed by a 26% increase in fiscal 2027. If we assume that Nvidia manages to make the most of the lucrative addressable market on offer and clocks 15% annual earnings growth for the next 10 years, its bottom line could hit $11.93 per share (using the current fiscal year’s projected earnings of $2.95 per share as the base).

The stock is currently trading at 32 times forward earnings, which is a discount to the company’s five-year average forward earnings multiple of 41. If the market decides to reward Nvidia with a richer multiple and it trades at 41 times earnings after a decade (in line with the five-year average), its stock price could hit $489 per share based on the projected earnings of $11.93 per share.

Reaching that level would be a 254% increase from current levels, and it doesn’t look impossible. Hence, investors can consider buying Nvidia stock to hold it for the long run, as it still could help them get richer.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.