It’s been a terrific investment over the past decade, and its strong growth drivers help it sustain momentum.

Microsoft (MSFT -0.78%) has been one of the top stocks on the market in the past decade. Buying and holding shares of this technology giant over this period has helped investors enjoy market-beating returns.

More specifically, Microsoft stock has delivered an annual return of almost 27% in the past 10 years, assuming the dividends paid out by the company were reinvested. For comparison, the S&P 500 index’s annual returns over the past decade stand at 13% (assuming the dividends were reinvested). So, if you purchased $10,000 worth of Microsoft stock a decade ago, your investment would now be worth $107,950.

Microsoft has turned out to be an ideal investment for those looking to construct a million-dollar portfolio in the past decade. Assuming you invested a larger amount — say $100,000 — into the stock 10 years ago, you would be a millionaire right now by buying Microsoft alone.

But, as they say, past performance is no guarantee of future earnings. Can Microsoft sustain its impressive momentum over the next decade as well and contribute to a diversified million-dollar portfolio?

Microsoft’s growth is accelerating

Microsoft released its results for fiscal 2024 (which ended on June 30) at the end of July. The company finished the fiscal year with revenue of $245 billion, an increase of 16% from fiscal 2023. Microsoft’s net income stood at $88 billion, increasing 20% on a non-GAAP basis.

For comparison, Microsoft’s revenue in fiscal 2014 stood at $86.6 billion, while its net income at that time was $22 billion. So, the tech giant’s revenue has nearly tripled in the past decade, while its net income has quadrupled. More specifically, Microsoft’s top line has clocked a compound annual growth rate (CAGR) of almost 11% in the past decade. The company’s earnings have clocked a faster CAGR of 15% during this period.

Microsoft is a much bigger company than it was a decade ago. It now has a market cap of $3.2 trillion, which makes it the second-largest company in the world. So, expecting Microsoft stock to grow at least tenfold over the next decade would seem a tad far-fetched considering the global economy itself was worth an estimated $105 trillion last year.

Microsoft’s valuation indicates that it contributes less than 3% to the global economy. So, if Microsoft becomes a $30 trillion-plus company, the global economy will have to grow at a significantly faster pace in the next 10 years, or else Microsoft will end up controlling a massive chunk of the world’s gross domestic product (GDP). The bigger a company gets, the harder it gets to maintain the pace of growth.

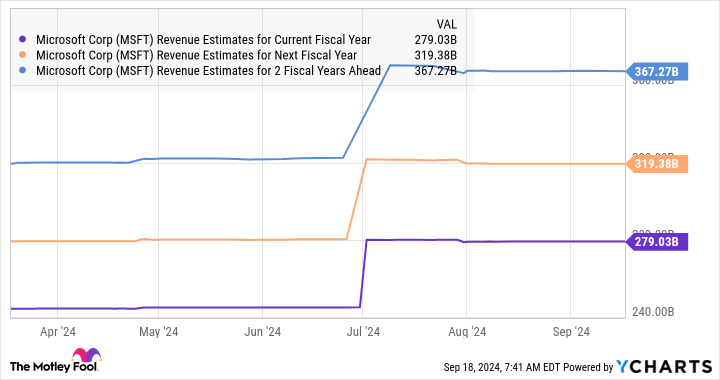

And yet, Microsoft’s growth in the previous fiscal year was higher than the average growth rate it has clocked in the past decade. Even better, the company’s top-line growth is projected to remain robust over the next three fiscal years as well, with the following chart indicating analysts are expecting an acceleration in its growth.

MSFT Revenue Estimates for Current Fiscal Year data by YCharts

A similar trend is expected as far as the company’s bottom line is concerned.

MSFT EPS Estimates for Current Fiscal Year data by YCharts

Lucrative end markets could help Microsoft sustain its impressive growth

The reason analysts expect Microsoft’s growth profile to improve is that it is sitting on a much bigger addressable market than it was a decade ago. The company’s cloud business was in its infancy at that time, with Microsoft pointing out that its commercial cloud revenue hit an annualized revenue run rate of $4.4 billion in the fourth quarter of fiscal 2014.

Microsoft’s business was dependent on sales of consumer devices such as the Xbox gaming console and Surface tablets, while the tech giant was also trying its hand at the smartphone business following the acquisition of Nokia‘s devices and services business. Of course, Microsoft’s Windows business was also a significant contributor to its revenue.

A closer look at Microsoft’s business segments now will show the company benefits from several lucrative growth opportunities. For instance, the cloud computing industry is expected to generate a whopping $2 trillion in annual revenue in 2030, according to analysts at Goldman Sachs, driven by the growing adoption of generative artificial intelligence (AI).

The investment bank points out that the cloud computing market clocked a CAGR of 26% between 2019 and 2023 to $496 billion. So, the size of this market is set to quadruple by the end of the decade, putting Microsoft in a position to sustain solid levels of growth. That’s because Microsoft is the second-largest player in the cloud infrastructure market with a market share of 20% (note too that its share increased by 2 percentage points year over year in calendar Q2).

Microsoft generated $105 billion in revenue from its cloud business in fiscal 2024, accounting for 43% of its top line. So, if the company manages to hold on to its 20% share of this market in 2030, its cloud revenue could hit $400 billion, or even more if it manages to grab a bigger share of this space.

Throw in other catalysts such as the booming market for cloud-based office productivity software that Microsoft is targeting with the help of AI-focused tools, and it is easy to see that the company has a bright future. More specifically, the cloud-based office productivity software market is expected to generate $128 billion in revenue in 2030, growing at an annual pace of 28%.

These huge end markets are the reasons why Microsoft could exceed the $500 billion revenue target that CEO Satya Nadella has set for the company for fiscal 2030. Assuming Microsoft does hit even $500 billion in revenue in fiscal 2030 and trades at 11.2 times sales at that time (in line with its five-year average price-to-sales ratio), its market cap could jump to $5.6 trillion.

That would be a 75% improvement from current levels, but don’t be surprised to see this tech stock delivering stronger gains as it seems capable of clocking faster growth.

So, Microsoft seems well-placed to deliver substantial gains to investors through the end of the decade. It is worth noting that Microsoft has just increased its quarterly dividend by 10% to $0.83 per share, translating into a forward dividend yield of 0.76%.

Investors looking to construct a million-dollar portfolio right now can consider putting $10,000 in investible cash (after paying their bills, clearing high-interest debt, and saving enough for a rainy day) into Microsoft stock as it seems built for more upside in the long run. It may not make you a millionaire all on its own over the next decade, but it will contribute its fair share toward attaining that goal.