The company is the king of reliability and is on an exciting growth path.

Shares in Microsoft (MSFT 0.56%) have jumped 33% over the last 12 months, outperforming the S&P 500‘s already-impressive increase of 25%. The growth saw Microsoft surpass Apple as the world’s most-valuable company, achieving a market capitalization above $3 trillion.

The company has rallied Wall Street by becoming one of the biggest threats in artificial intelligence (AI), an industry projected to hit nearly $2 trillion in spending by 2030. Meanwhile, consistent earnings gains, significant cash reserves, and leading positions in multiple areas of tech have made Microsoft’s stock one of the most reliable investments out there.

So, here’s why Microsoft stock could make you a millionaire with the right investment.

Reliability and exposure to multiple markets

Microsoft’s diversified revenue streams have instilled long-term reliability in its business. Its strength was most prevalent during an economic downturn in 2022. During the challenging year, rival Amazon‘s revenue rose 9% year over year while its operating income declined by nearly 50%. However, the same period saw Microsoft’s revenue and operating income rise 7% and 6%, still delivering profit growth despite the marketwide pullback from consumers.

As a result, Amazon’s stock fell 50% in 2022, while Microsoft’s tumbled a more moderate 29%.

Microsoft owes much of its reliability to its varied activities in tech. The company offers investors the opportunity to back multiple industries, such as productivity software, cloud computing, digital advertising, video games, consumer products, AI, and more. That’s before even considering Microsoft’s dominance in sectors like operating systems with Windows and recent growth in its search engine, Bing.

Its diversified business model has delivered consistent earnings and stock growth over the years, allowing Microsoft to keep investing in new opportunities like AI. The company invested $1 billion in the ChatGPT developer in 2019 and has since increased that figure to about $13 billion.

The partnership has allowed Microsoft to bring AI upgrades to many of its products, including launching its AI assistant Copilot through its Microsoft 365 productivity suite. The new feature is a $30 monthly add-on to a 365 subscription and shows the company beginning to monetize its AI offerings.

Microsoft has growth catalysts across tech that will likely keep its stock price rising for decades.

A stock you can buy and forget about over the long term

Shares in Microsoft have steadily risen 237% over the last five years and 958% in the last decade. The company has proven time and time again its worth as a long-term growth stock. As a result, it’s an excellent option for investors looking for stocks to buy that will passively grow over the years.

Microsoft’s free cash flow hit $71 billion this year, more than competitors Amazon or Alphabet. The figure suggests Microsoft is potentially best equipped to keep investing in its business and overcome unforeseen hurdles.

Meanwhile, recent earnings gave a promising glimpse into the company’s long-term future. In the third quarter of 2024 (which ended in March), Microsoft’s revenue rose 17% year over year to $62 billion, beating Wall Street estimates by more than $1 billion. The company benefited from significant growth in its productivity and cloud segments, both boosted by AI.

Additionally, operating income climbed 23% to $28 billion after an over-30% increase in its intelligent-cloud segment. Microsoft is on a promising growth trajectory that’s just too good to pass up.

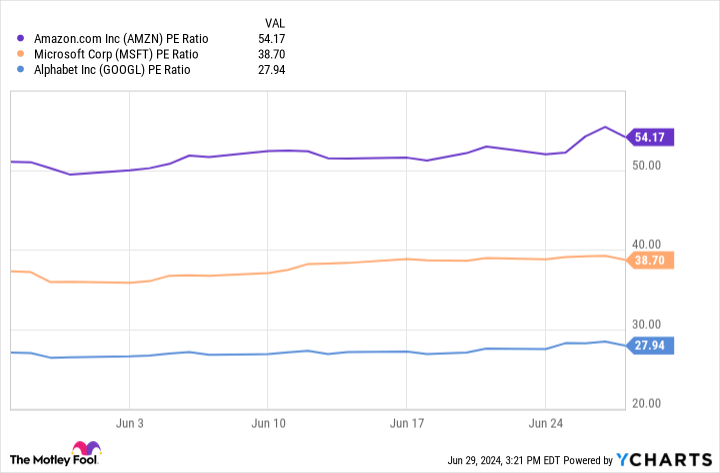

Data by YCharts.

The stock’s price-to-earnings (P/E) ratio of about 39 means it isn’t exactly a bargain. The chart above shows it’s a better value than Amazon but not quite as good as Alphabet. However, stellar gains over the years, a potent position in technology, and vast financial resources indicate that Microsoft’s stock is worth its premium price tag.

The company’s share price will likely continue trending up over the long term, making it an excellent option for patient investors. Microsoft has become a behemoth in tech, with its stock a compelling option that could make you a millionaire if you’re willing to wait.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.