Credit scores. Most of us have them—more than one—and many of us hate them. If you’re like a lot of Americans, your credit score is in the fair zone—from 580 to 699, depending on which scoring model is used, FICO FICO, -3.16% or VantageScore. And that fair credit score can be, well, unfair. It places you the subprime category where you won’t get approved for the best rates or even the best credit cards.

Most people with fair credit already have at least one credit card. They also have a total credit line of less than $5,000. That’s proof that with a fair credit score, you can still find a credit card. What you may not know is that you can find a card that fits your needs. You may even find one that helps you boost your score and/or lets you earn rewards.

Before delving into credit cards for fair credit, just what is a fair credit score?

Just what is fair credit?

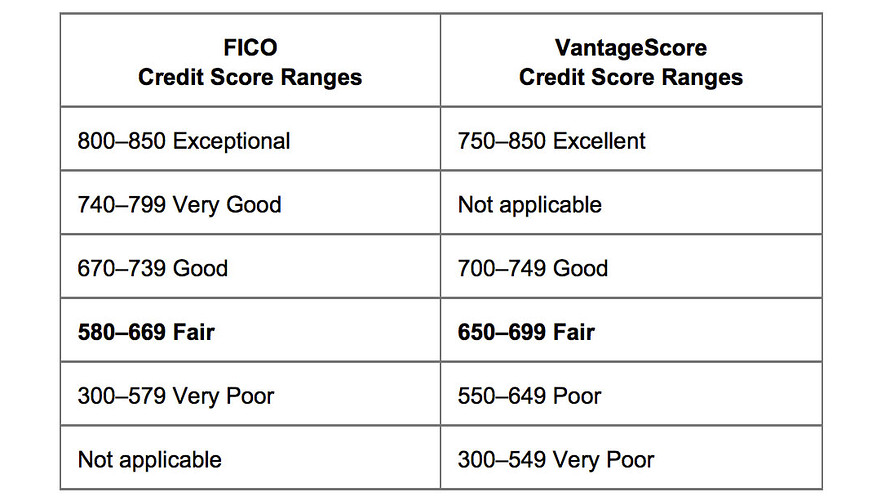

FICO credit scores and VantageScore credit scores are the two most popular credit-scoring models. FICO scores were developed by the Fair Isaac Corporation. VantageScore scores were developed by the major credit bureaus—Experian EXPGY, -1.03% , Equifax EFX, -1.18% and TRU, -2.64% Scores in both models range from 300 to 850. Within this range, the models group potential borrowers into five categories:

Source: FICO/VantageScore

Source: FICO/VantageScore

A lot of factors go into a credit score. Payment history is the single biggest factor for both FICO and VantageScore. It accounts for roughly 35% of your total score. If you have a fair score, chances are you’ve made at least one payment more than 60 days late in the last 12 months. That fair score also affects your chances of getting loans and credit cards and good interest rates on those you can get.

Your credit score and getting credit cards and loans

Your credit score is your lifeline to getting approved for new credit cards and loans. If you have a low score or no credit history, your odds of approval go down and/or your interest rate goes up.

- Poor and very poor credit means you’re unlikely to qualify for a loan or credit card. Individuals in this category may benefit from a secured credit card, which requires a security deposit but helps to rebuild credit.

- Fair credit means you can probably qualify for credit cards and some loans, but not at optimal interest rates.

- Good credit lets you get approved for most loans and credit cards at lower interest rates than people with fair credit.

- Very good, exceptional or excellent credit typically qualify you for the very best interest rates, credit card rewards programs and credit card and loan terms.

Your credit card options for fair credit

If you have fair credit and need a new credit card to build or rebuild your credit or just to use, you have a few options.

- Option 1 is to work to improve your credit before you apply for a new card.

- Option 2 is to find the best credit card option available to you now—one that’s known to approve someone with a fair credit score.

A credit card can actually help you improve your credit. So, choosing option 2 may be a good idea depending on your situation. If you get a credit card now, you can always ask your card issuer to review—and increase—your interest rate when your credit score does improve.

Also on MarketWatch: Your partner’s credit score could reveal red flags that have nothing to do with money

These are some solid unsecured credit cards for fair credit.

Capital One QuicksilverOne Cash Rewards Credit Card

The Capital One QuicksilverOne Cash Rewards card is not only accessible to people with fair credit, it’s also a rewards credit card. That combination makes this card a fairly unique offering.

Note though that the cash back does come at a cost. It will cost you a fairly high ongoing annual percentage rate (APR) of 26.96% (variable) for both purchases and balance transfers. It will also cost you an annual fee of $39.

For those fees though, you do earn 1.5% cash-back rewards on all purchases every day. You also have $0 fraud liability if your card gets lost or is stolen.

And with your opportunity to earn cash back, you also have the chance to earn a better credit score and credit limit. Use your card responsibly and make your first five monthly payments on time, and Capital One COF, -0.27% will automatically increase your credit line. And you get complimentary access to Capital One’s CreditWise app, which lets you track your credit profile as you improve your score.

Credit One Bank Platinum Visa with Cash Back Rewards

The Credit One Bank Platinum Visa with Cash Back Rewards is also a rewards card. It lets you earn 1% cash back on eligible purchases—some terms do apply. Your rewards post to your account automatically each month. You also get access to offers only to Credit One Bank card members through Visa Discounts. The card also includes travel accident and auto rental collision insurance from Visa V, -1.00% .

You can see if you prequalify for the card quickly, easily and securely. So you can find out if you’re likely to get approved before putting a hard inquiry on your credit report.

The card does have an annual fee of $0 to $99. But that fee depends on your credit score. With a fair score, you’re more likely to pay on the lower end of that range. The ongoing APR is a bit nicer than the two Capital one cards at 20.24% – 26.24% variable for purchases. You can’t do balance transfers with this card, so there’s no APR for that.

Credit One Bank will give you a chance to increase your credit line down the road, but a fee might apply. As you use this card responsibly, your account will be automatically reviewed to see if you’re eligible for an increased credit line.

Last, but not least, this card speaks to your unique self by letting you pick from multiple card designs, a fee may apply.

Capital One Platinum Credit Card

If you’d rather skip an annual fee and don’t care about rewards, the Capital One Platinum Credit Card has no annual fee which is a rare perk among credit cards for fair credit. This card carries the same ongoing APR of 26.96% (variable) for purchases and balances transfers as the Capital One QuicksilverOne Cash Rewards card. But if your goal is to solely build credit without having the temptation of spending more to earn rewards, this card is a great option.

This card offers fraud protection if your card is lost or stolen. And if you make your first five payments on time, Capital one will increase your credit line.

This card also gives you the option to choose your monthly payment due date as well as to pay online, by check or at a local bank branch.

Petal Visa Credit Card

The Petal Visa credit card is unique among credit cards for fair credit. Why is it so special? This card not only has no annual fee, but you’ll never be charged a late fee, foreign transaction fees or any other type of fee. It also offers a credit line of up to $10,000, which is higher than typically available for this type of card, but dependent on your credit score nonetheless.

The unique thing about the Petal Visa card, though, is that it uses your bank account activity, income level and other factors to determine your eligibility as well as your credit score. So if you have a weaker score or no credit history—or a weaker score due to a lack of credit history—but spend wisely, you may still get approved. Petal is giving people with smart spending habits a fair shake at getting a solid credit card.

This card has an ongoing APR of 15.24% – 26.24% variable for purchases. No balance transfer APR as you can’t use the card for balance transfers.

Your payments are reported to all three major credit bureaus, so by using the Petal card responsibly, you can boost your credit score over time. You don’t need a deposit to qualify and can be preapproved in minutes with no impact to your credit score. You can effortlessly track your account from the free Petal mobile app to manage your money on the go.

Avant Credit Card

The Avant credit card is another solid card for you if you have fair credit. It’s a true unsecured credit card, like the Petal Visa card. It has a smaller annual fee of $29 compared with some cards. But, it has no penalty APR and no hidden fees.

Like the other cards here, use it responsibly and improve your credit history and score.

Helping your fair credit score

Some of the factors that lower your credit score include late payments, using more than 30% of your available credit, significant outstanding debt compared with your income, negative public records like judgments and bankruptcies and several credit inquiries in a short time period. The length of your credit history and the mixture of different types of accounts also plays a role.

Using a credit card wisely can help you work toward a higher credit score. Increasing your available credit with a newer card lowers the amount of overall credit you’re using, which has a positive impact on your score.

When you get your new credit card, keep your combined balances of all cards below 30% of your combined credit limit to lower your credit utilization ratio, make on-time payments and pay off other debt to see the benefits of your hard work in improving your credit.

Even increasing your score from the fair to good category will let you qualify for credit cards, car loans and personal loans with lower interest rates. It also boosts the chances of approval for a mortgage or rental home. Auto and home insurance premiums are also lower for people with good credit.

Not sure what your credit score is?

Knowing your credit score can help you narrow your search for a credit card. If you don’t know your score, you can get your Experian VantageScore credit score free at Credit.com or annualcreditreport.com.

This article originally appeared on Credit.com.

Get a daily roundup of the top reads in personal finance delivered to your inbox. Subscribe to MarketWatch’s free Personal Finance Daily newsletter. Sign up here.