Crypto markets on Tuesday are attempting to clawback from recent lows, which briefly triggered shades of the 2017-18 digital-asset winter.

At last check, bitcoin prices BTCUSD, +4.16% were changing hands at $36,313.86, or up around 6%, while the No. 2 most prominent crypto, Ether ETHUSD, +3.58% on the Ethereum blockchain was changing hands at $2,229.19, up around 10% on CoinDesk.

Tuesday’s gains for bitcoin and its ilk come amid a flurry of what crypto enthusiasts refer to as FUD, fear uncertainty and doubt. FUD out of China, where the country has banned bitcoin mining and trading, has been hamstringing enthusiasm for digital assets that earlier in the year had driven meme assets like dogecoin DOGEUSD, +2.17% into the stratosphere before returning closer to earth. Dogecoin was trading at 26.5 cents on Tuesday, but down from its early May peak at 74.07 cents.

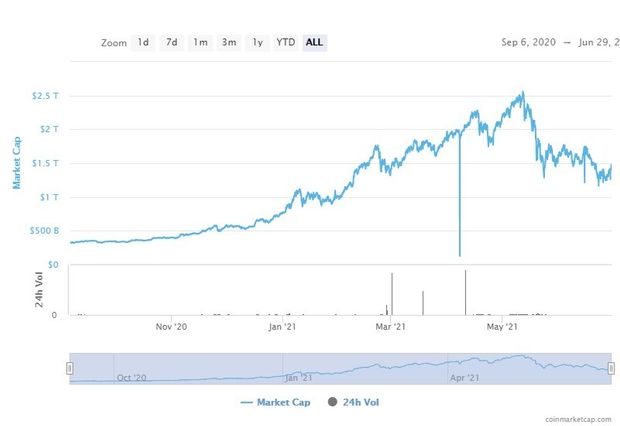

Despite, the recent gains, the total value of crypto tracked by CoinMarketCap.com is near $1.5 trillion, down $1 trillion from a peak achieved just over a month ago.

The latest bit of FUD for crypto markets has been authorities in the U.K. and Japan taking aim at affiliates of Binance Holdings Ltd., the world’s largest cryptocurrency exchange network.

The U.K.’s Financial Conduct Authority, the country’s lead financial regulator, over the weekend told Binance’s local unit that it wasn’t permitted to conduct operations related to regulated financial activities.

However, some industry analysts are viewing scrutiny of the space as a positive sign.

“Investors see the crackdown as a sign that the crypto markets are maturing, and that the company will have to accelerate its process of becoming a regulated exchange, which will likely lead to increased trust among crypto traders,” writes Naeem Aslam.

The move higher in crypto also comes as gold GC00, -0.99% was under heavy selling pressure, with bullion contracts on pace for a decline of more than 1% on Tuesday, perhaps, fueling the debate that some investors are rotating out of gold and into crypto.

Meanwhile, plays considered risky, including investments in the Dow Jones Industrial Average DJIA, +0.20%, the S&P 500 index SPX, +0.11% and the technology-laden Nasdaq Composite Index COMP, +0.03% were seeing some reinvigorated bids.

Against that backdrop, some analysts see bitcoin, the biggest catalyst in the crypto world, possibly testing resistance at around $40,000 as a bullish sign.

News that Cathie Wood’s ARK Invest has teamed up with 21Shares to submit an application for the first bitcoin exchange-traded fund also may be improving crypto sentiment.