Two of the world’s most prominent billionaires, Tesla Inc.’s TSLA, +3.16% CEO Elon Musk and Jack Dorsey, are facing off over the merits of bitcoin, with the future of the world’s No. 1 crypto likely hanging in the balance.

On Friday, Dorsey, a longtime bitcoin advocate and co-founder and CEO of Twitter TWTR, +3.23% and Square SQ, +5.44% tweeted that bitcoin changes everything “for the better,” and that “we will forever work to make bitcoin better.”

His tweet was in response to a one from Square CEO Amrita Ahuja, who said that the payment platform’s bitcoin strategy hasn’t changed and that the corporation is working toward a “greener future.”

Square holds 8,027 bitcoins, worth over $400 million, but told MarketWatch’s sister publication Financial News that Square had no plans to buy more. Square’s Cash App was one of the first major exchanges to allow customers to buy the digital assets.

Their missives come after Musk, via Twitter on Wednesday, said his electric-vehicle maker had suspended accepting bitcoin BTCUSD, +1.11% as payment for its vehicles.

“We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal,” Musk wrote.

The tweet renewed questions about bitcoin’s carbon footprint and the impact of mining for the popular crypto, which had gained in popularity on the back of endorsements from celebrities and high-profile executives like Musk.

Bitcoin’s proof-of-work blockchain protocol draws more electricity than nearly any other crypto, and that has increasingly become a hot-button topic in blockchain circles.

Musk, who has thrown some of his outsize heft behind dogecoin, which requires less power to digitally mine than bitcoin, has been blamed for abandoning bitcoin and sending the broader crypto market into a tailspin after raising his environmental concerns.

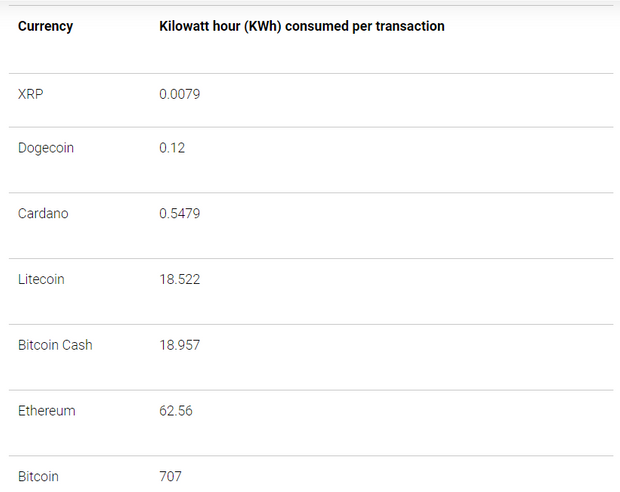

Dogecoin consumes 0.12 kilowatt-hour, according to technology company TRG Datacenters. Ripple Lab’s XRP coin uses the least amount of energy, 0.0079 KW/h, and bitcoin consumes 707 KW/h.

A popular report from the Cambridge Centre for Alternative Finance estimates that bitcoin mining consumes about 148 terawatt-hours of energy annually—consuming more emerging than countries like Sweden in a year.

Musk, viewed as a longtime bitcoin bull, has said that he wouldn’t sell the $1.5 billion that Tesla bought in bitcoin. But his recent environmental views have thrown into question his enthusiasm for bitcoins, while Dorsey and Co. appear to be ramping up their support of the No. 1 crypto.

Bitcoin’s flaws, beyond its energy efficiency, are numerous, but its supporters are still inclined to hope it will emerge as the most dominant digital asset in the future, as the crypto sector matures.

Musk and Dorsey will likely have a major say on which assets take center stage. The Tesla CEO boasts a networth of $149 billion, while Dorsey’s is $11.7 billion, according to Forbes.

Bitcoin was changing hands at $49,777 on CoinDesk, off its 24-hour high at around $51,000. The crypto has gained 71% so far this year, with that year-to-date gain eroded over the past two days of volatility in the broader crypto market.

Still, bitcoin’s return has surpassed those of more traditional assets. Gold futures GC00, +1.09% are off by around 3% in the year to date, while the Dow Jones Industrial Average DJIA, +1.06% has gained 12% and the S&P 500 SPX, +1.49% has climbed by more than 11% over the period. The technology-laden Nasdaq Composite Index COMP, +2.32% is up over 4% thus far in 2021.