It’s a crypto chicken-and-egg story for bitcoin. Internet searches for bitcoin are on the rise, and that has come as bitcoin prices have seen wild price swings.

It’s hard to say whether searches lead to higher prices or vice versa, but the correlation thus far has been eerie.

Bitcoin searches on Google, for example, between June 19 and June 26 have risen by more than 158% (see chart above), according to media analytics company SemRush.

“We also identified that there’s an 80.8% correlation ratio between Google searches and bitcoin price,” from June 19 to June 26, wrote Olga Andrienko, head of global marketing at SEMrush. A 100% positive correlation means that two variables are moving in perfect tandem.

Bitcoin prices BTCUSD, +3.91% this week had been staging a parabolic rise toward $14,000, which would have represented a roughly 40% weekly return on the No. 1 cryptocurrency in the world, until gains began to disintegrate late Wednesday.

Most recently, bitcoin prices were down an unsettling 22% on Thursday, or $3,150, to $10,700, according to FactSet data, based on bitcoin futures BTCM19, +1.29% prices trading on CME Group.

To be sure, despite the plunge, bitcoin prices are still up about 7.5% on the week and 194% in the year to date.

By comparison, the Dow Jones Industrial Average DJIA, -0.04% is down 0.6% so far this week, with a year-to-date rise of nearly 14%. The S&P 500 index SPX, +0.38% is on pace for a 0.8% weekly loss and a 16.7% gain over the past six months, while the Nasdaq Composite Index COMP, +0.73% is on track to shed about 0.8%, with a more than 20% gain so far in 2019.

Still, the drop for those unfamiliar with bitcoin’s volatility must be jarring even if the digital currency has been mostly rising. Thursday’s decline represents the third-sharpest daily fall for the asset on record, according to Dow Jones Market Data

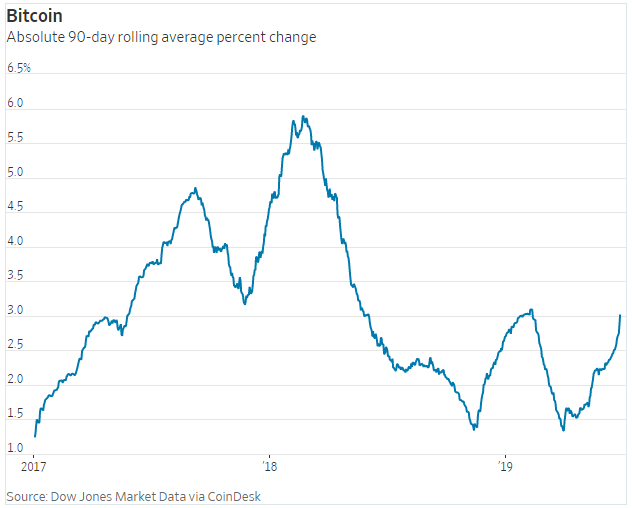

Volumes for bitcoin, however, are worth noting. A 90-day rolling average of trading in the digital currency shows that gains are far from the frothy activity of 2017 or early 2018 (see chart below). Bitcoin reached a peak in December 2017 at around $20,000 and tumbled to a nadir at $3,194.96, a year later.

Since that low, bitcoin has rallied about 234%, including its recent skid. Those gains for bitcoin, originally created back in 2009, have come as traditional companies, which had mostly eschewed digital assets as a wonky fad backed by libertarian-leaning fanatics, have begun to show greater interest in the digital-ledger technology blockchain, which underpins most cryptocurrencies.

Notably, Facebook Inc. FB, +0.98% last week announced a crypto-related venture, which the social-media giant hopes will evolve into a global payment system. The effort is backed by dozens of companies, including Uber Technologies Inc. UBER, +6.19% , Visa Inc. V, +0.10% , Mastercard Inc. MA, -0.08% and PayPal Holdings Inc. PYPL, -0.42% .

Bicoin internet searches and prices also were uncannily correlated back in 2017 when the asset was soaring by some 1,500%.

On Thursday, MarketWatch’s Mark Hulbert said the surge in bitcoin’s prices make it susceptible to a crash, citing a study, “Bubbles for Fama.”

—Ken Jimenez has contributed to this article