A lawsuit brought by the Securities and Exchange Commission this week could set a precedent against initial coin offerings that started out raising money from wealthy investors but then targeted a broader base.

The SEC sued a Canadian social-media messaging company on Tuesday, charging Kik Interactive with raising $100 million without registering the offering of securities with the regulator.

The SEC alleges that Kik did not do enough to determine whether all investors qualified as “accredited investors,” despite a know-your-customer process and other anti-money-laundering policies. It also allegedly did not determine whether investors intended to profit from their purchase or to immediately resell and distribute the digital coin. The SEC says it should have excluded retail purchasers of the token who intended to speculate on the value of its token, Kin.

Kik used what’s called a Form D offering to reach investors initially in late 2017.

Form D is the notice filed by a company for an offering that is exempt from full SEC registration requirements. The key criteria for the Form D exemption is that only “accredited investors” — that is, individuals that have a net worth of over $1 million or who have consistently made more than $200,000 per year in income, or companies with $5 million or more in assets — can invest. Companies don’t have to file the Form D with the SEC before the offering takes place but instead must file within 15 days after the first sale of offered securities.

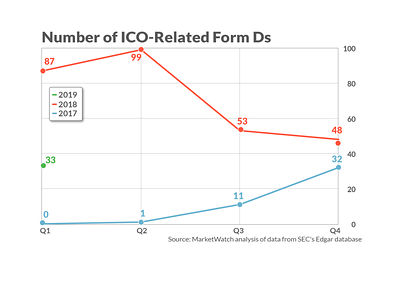

MarketWatch has previously pointed out that hundreds of coin offerings were coming to the market through the Form D back door. Often the ultimate goal was for the cryptotokens issued as a result of these fund raisings to be distributed beyond accredited investors and into the hands of retail investors and consumers.

The volume skyrocketed to a peak of 99 in the second quarter of 2018. MarketWatch estimated there were 287 ICO-related fund raisings accepted by the SEC, with a total stated value of $8.7 billion, in 2018. That was a significant increase from 44 fund raisings filed, with a total stated value of $2.1 billion, in 2017. The pace slowed in the last half of 2018 but MarketWatch counted 33 ICO-related fund raisings accepted by the SEC in the first quarter of 2019, with a total stated value of $1.9 billion.

“If Kik loses to the SEC in court, the vast majority of ICOs that raised money using similar fund-raising mechanisms could suffer negative consequences as a result,” attorney and cryptocurrencies expert Katherine Wu told MarketWatch.

See also: ICO promoters more careful but still using SEC back door to raise funds

Read: Number of ICOs getting regulation-lite treatment is growing

Most token sales shunned U.S. investors, out of fear of SEC scrutiny, but not all of them did so, including Kik and one of the biggest, Telegram, another chat-software company. Telegram filed its Form D in February 2018, saying it had raised $850 million out of a billion-dollar-plus target beginning on Jan. 29 to use for the development of “the TON Blockchain, the development and maintenance of Telegram Messenger and the other purposes described in the offering materials.”

Kik’s CEO, Ted Livingston, was unintimidated, saying in a press release, “We have been expecting this for quite some time and we welcome the opportunity to fight for the future of crypto in the United States. We hope this case will make it clear that the securities laws should not be applied to a currency used by millions of people in dozens of apps.”

Kik’s general counsel, Eileen Lyon, said, according to a press release after the SEC’s announcement, that the regulatory agency’s complaint against Kik is based on a flawed legal theory because the regulator stretches the so-called Howey test — named for the legal precedent forming the SEC’s basis for judging whether something is an investment contract and, therefore, a security — well beyond its definition. “We do not believe they will withstand judicial scrutiny,” Lyon said.

Kik, represented by the law firm Cooley LLP, plans to fight the charges aggressively after refusing to settle with the SEC. In May, it pledged $5 million to a “defend crypto” fund that has also received outside contributions.

Kik’s primary defense against the SEC’s charges is that Kin is not a security but instead possesses the characteristics of such currencies as Bitcoin and Ether, which the SEC does not regulate as securities. In its first public announcement in May 2017, Kik described Kin as “the transaction currency inside of the Kik app,” which, over time and with mainstream consumer adoption, would become “one of the most adopted and used cryptocurrencies in the world.”

According to the website Coinmarketcap.com, Kin trades on 34 active markets, with over $1 million changing hands on Thursday.

“Kik is going to have an uphill battle in winning against the SEC,” said Wu, the lawyer and crypto expert. “The argument that Kin is a currency not a security is a good one, but so far the SEC is not having it.”

Kik has claimed the token can be used to pay for goods and services on both the Ethereum and Kin blockchains. In its response to the SEC’s Wells Notice, it claims that “Kin earn and spend transactions within digital applications currently reflect a higher blockchain activity that of Bitcoin and Ethereum.”

Wu is skeptical. “I don’t think Kin can argue its utility level is anywhere near Ethereum,” she told MarketWatch.