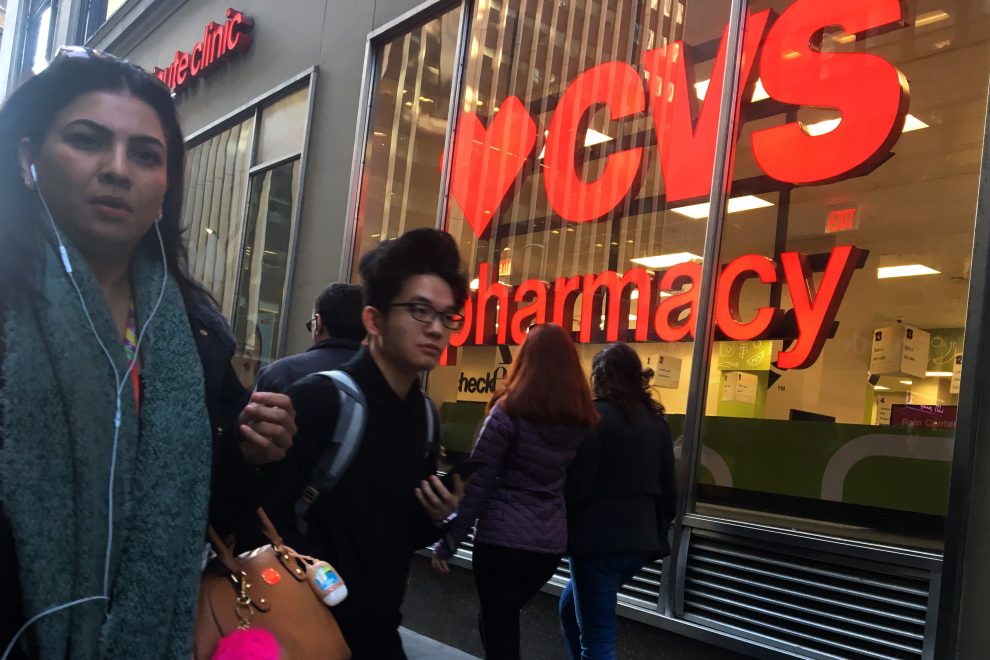

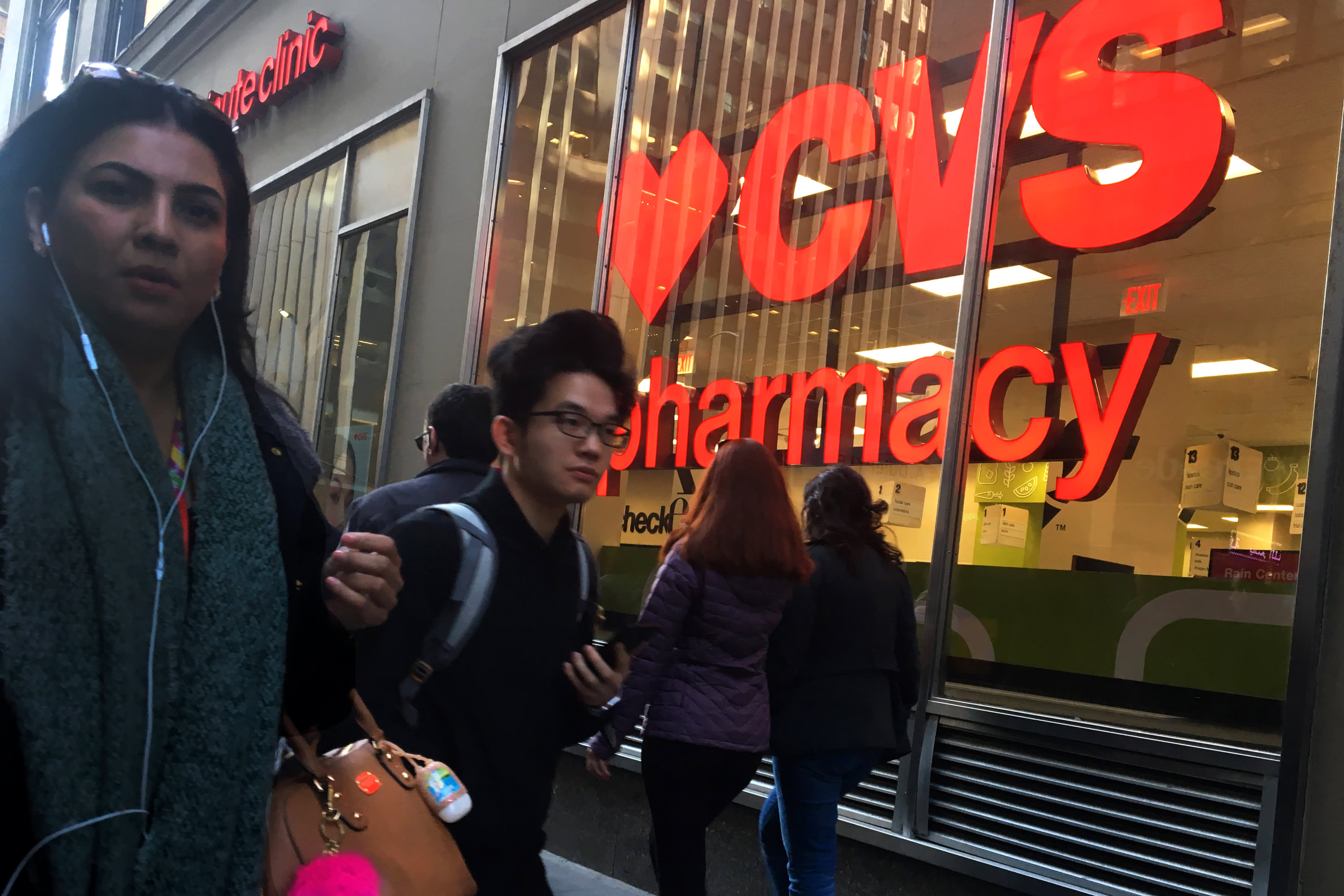

Pedestrians pass in front of a CVS location in New York.

Scott Mlyn | CNBC

CVS Health on Wednesday reported first-quarter earnings and revenue that beat analysts’ expectations and raised its full-year earnings forecast.

Here’s what the company reported compared with what Wall Street was expecting, based on average analysts’ estimates compiled by Refinitiv:

- Adjusted earnings per share: $1.62 vs. $1.50 expected

- Revenue: $61.65 billion vs. $60.39 billion expected

This quarter was the first full one since CVS closed its $70 billion acquisition of health insurer Aetna in November.

On an unadjusted basis, CVS’ fiscal first-quarter net income rose to $1.42 billion, or $1.09 per share, up from $998 million, or 98 cents per share a year earlier. When excluding the costs of integrating Aetna, store closures and some other items, CVS earned $1.62 per share, above the $1.50 per share expected by analysts surveyed by Refinitiv.

Revenue rose 35% to $61.65 billion — largely driven by the new Aetna business — beating expectations of $60.39 billion.

“Following the close of our Aetna acquisition in late November, our first full quarter of combined operations was a success in many ways,” CVS CEO Larry Merlo said in a statement.

CVS raised its 2019 earnings forecast to between $6.75 and $6.90 per share, up from the previously guided range of $6.68 to $6.88 per share.