Insight into Wedgewood’s Latest Portfolio Adjustments and Key Stock Performances

David Rolfe (Trades, Portfolio), a seasoned portfolio manager with 18 years at the helm of Wedgewood’s investments, has recently filed the 13F for the second quarter of 2024. A University of Missouri alumnus with a B.S.B.A. in Finance/Economics, Rolfe’s investment strategy focuses on owning shares in dominant, profitable companies with sustainable growth and strong management teams. This approach aims to build significant long-term wealth by investing in companies that are leaders in their respective fields and show consistent financial performance.

Key Position Increases

During this quarter, David Rolfe (Trades, Portfolio) has increased his position in several stocks, with a significant focus on Edwards Lifesciences Corp (NYSE:EW). The additional 108,976 shares bring his total to 354,427 shares. This adjustment not only increased his share count by 44.4% but also had a 1.46% impact on his current portfolio, valuing at approximately $23,229,150.

Key Position Reductions

Conversely, Rolfe has made reductions in 18 stocks. Notable decreases include:

-

Motorola Solutions Inc (NYSE:MSI) saw a reduction of 19,983 shares, a 24.88% decrease, impacting the portfolio by -1.46%. MSI’s stock traded at an average price of $360.84 during the quarter and has seen a 15.52% return over the past three months and 32.47% year-to-date.

-

Alphabet Inc (NASDAQ:GOOGL) was reduced by 6,769 shares, a 2.53% decrease, with a -0.23% portfolio impact. GOOGL traded at an average price of $168.57 this quarter, with a -2.89% return over the past three months and a 17.58% increase year-to-date.

Portfolio Overview

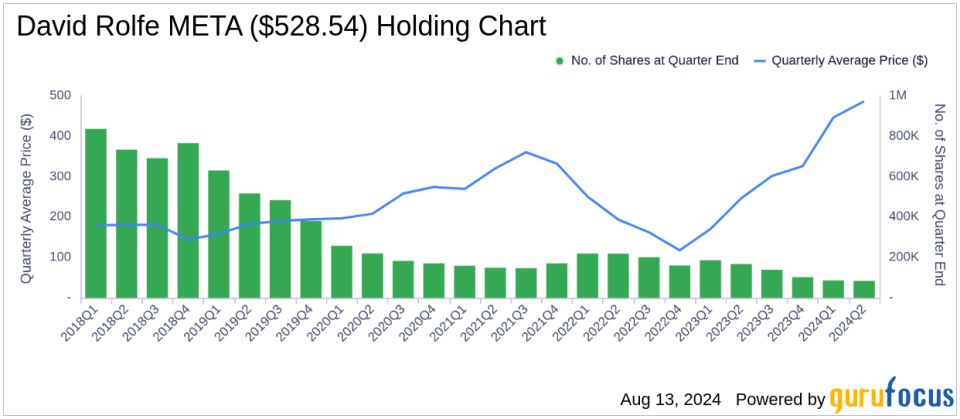

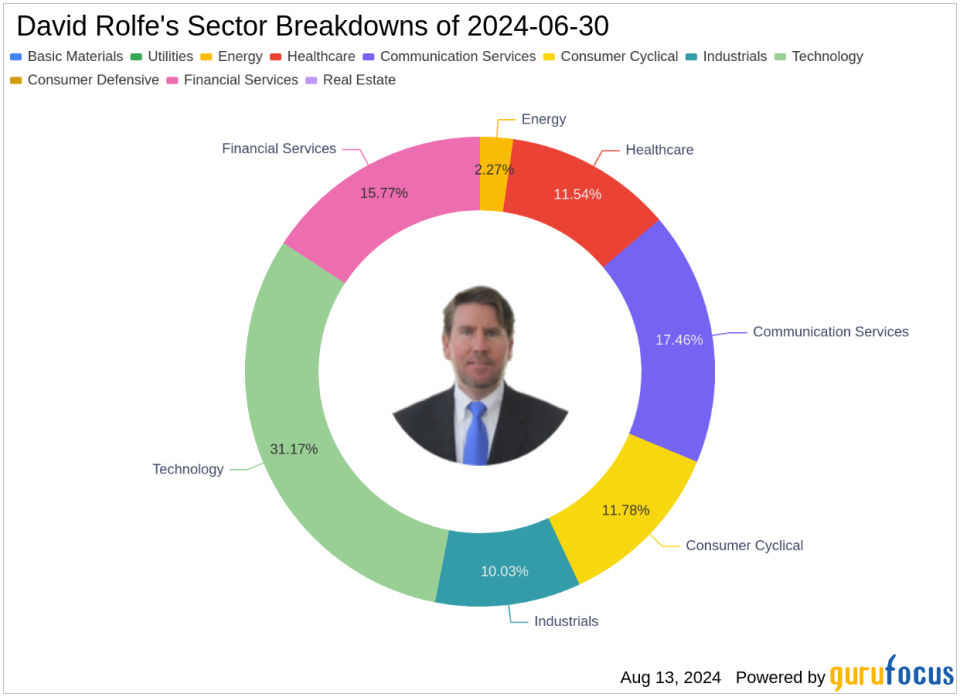

As of the second quarter of 2024, David Rolfe (Trades, Portfolio)’s portfolio consists of 19 stocks. The top holdings include 8.82% in Meta Platforms Inc (NASDAQ:META), 8.64% in Alphabet Inc (NASDAQ:GOOGL), 8.48% in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), 7.7% in Apple Inc (NASDAQ:AAPL), and 6.81% in Visa Inc (NYSE:V). These holdings are predominantly concentrated in seven industries: Technology, Communication Services, Financial Services, Consumer Cyclical, Healthcare, Industrials, and Energy, reflecting Rolfe’s strategic diversification across sectors.

This detailed analysis of David Rolfe (Trades, Portfolio)’s 13F filing for Q2 2024 highlights his strategic investment decisions, focusing on both increasing and reducing positions to optimize the portfolio’s performance. His significant increase in Edwards Lifesciences Corp and reductions in other key stocks like Motorola Solutions and Alphabet Inc reflect a dynamic approach to managing his investments in line with his long-term wealth creation philosophy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.