(Bloomberg) — A blockbuster Sunday of takeovers has bled into Monday for the fastest start to a week for global dealmaking so far this year.

Companies led by Japanese conglomerate SoftBank Group Corp. and U.S. pharmaceuticals group Gilead Sciences Inc. announced $68 billion of deals, the highest tally for the start of a week since late November 2019, according to data compiled by Bloomberg. That brings the volume of deals announced in September up to $145 billion, a 50% increase from the same period a year earlier.

A clutch of other potential deals also came to light, including plans by Czech billionaire Daniel Kretinsky to boost his stake in German wholesaler Metro AG. If deals keep flowing at the current pace — and there’s no certainty that they will — September could be one of 2020’s best months for M&A.

That would be a rare bright spot for advisers at a time when the coronavirus crisis continues to keep transaction volumes 33% below 2019 levels. While pharmaceutical and technology companies continue doing deals, activity in other industries remains muted.

Nvidia to buy Arm for as much as $40 billion

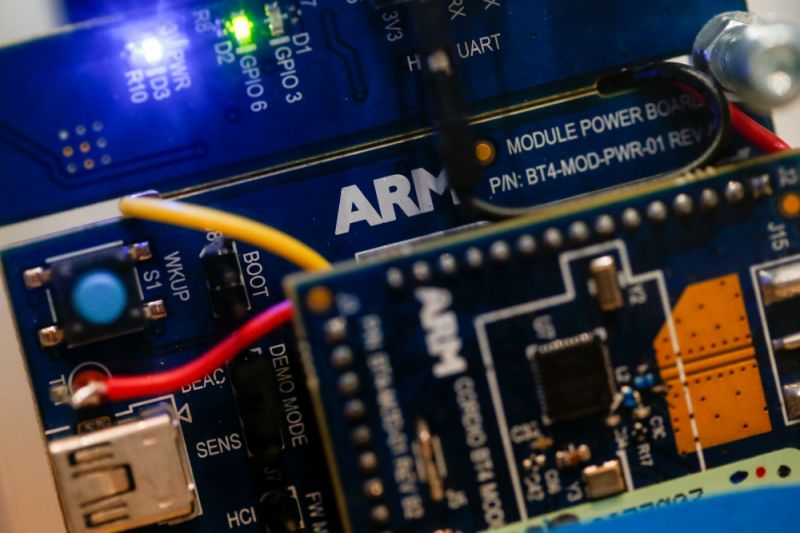

Nvidia Corp. agreed a cash-and-stock deal to buy SoftBank’s chip division Arm Ltd. and take control of some of the world’s most widely-used electronics technology.

Arm’s tech is at the heart of the more than 1 billion smartphones sold annually. Chips using its code and its layouts are in everything from factory equipment to home electronics and Nvidia’s purchase is fueled by the drive to bring artificial intelligence to everything that has an on-switch.Regulatory clearance may prove challenging, with signoffs required from China, U.K., European Union and U.S. authorities. Chinese approval may be particularly difficult given rising tensions with the U.S.Separately, SoftBank founder Masayoshi Son is revisiting a management buyout of the group in a bid to address the persistent gap between its market valuation and the value of its investments, according to people with knowledge of the matter.

Gilead agrees $21 billion deal for Immunomedics

Gilead on Sunday inked a deal to buy Immunomedics Inc., offering a substantial premium for the maker of a promising breast-cancer therapy. The proposed $88-a-share deal values Immunomedics at more than twice its closing price on Friday.

Gilead has been focusing on drugs that harness the immune system to fight tumors, and the Immunomedics deal is another big bet that the strategy can boost its fortunes. New Jersey-based Immunomedics makes a breast-cancer treatment called Trodelvy that gained approval from the U.S. Food and Drug Administration in April.Shortly after, Gilead started talking to Immunomedics about a partnership and in recent weeks discussions turned toward an outright acquisition.

Oracle edges out Microsoft for TikTok in U.S.

Oracle Corp. beat out rival Microsoft Corp. in negotiations for the U.S. operations of TikTok, people familiar with the matter said. While terms are still being discussed, a deal between TikTok owner ByteDance Ltd. and Oracle will look more like a corporate restructuring than the outright sale proposed by Microsoft.

It comes as the Chinese-owned music-video app attempts to avoid getting shut down amid a clash between the world’s two superpowers. The sale of TikTok — forced by U.S. President Donald Trump’s administration ban on grounds of national security — is one of the issues at the heart of fraying Washington-Beijing tensions and any deal will require signoff from both sides.The TikTok app lets people record and edit short video clips ranging from lighthearted lip-syncs to more serious political statements and has gained popularity during the global pandemic that’s kept people indoors.

Garda bids $3.8 billion for U.K. security firm G4S

Canadian private security firm GardaWorld on Monday approached shareholders of U.K. rival G4S Plc about a potential 2.9 billion-pound ($3.8 billion) hostile takeover bid after being rebuffed by the target’s board. Garda said it had made three unsuccessful attempts to engage with G4S in the last three months.

Its latest proposal of 190 pence cash per share represents an 86% premium to G4S’s share price prior to Garda’s initial approach in June. Garda, controlled by buyout firm BC Partners, is hoping to tempt G4S investors who have seen the company’s share price tumble this year.Garda Chief Executive Officer Stephan Cretier moved early to ease any concerns about job losses during the coronavirus pandemic, saying the company understands G4S’s importance as a U.K. employer and contractor to the U.K. government.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”48″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”49″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.