First published on Simply Wall St News

Hopes on cannabis decriminalization have rallied the market for companies like Tilray Brands (NASDAQ:TLRY), which gained 14% on the news. This comes after news that the U.S. House is cooking up the “Marijuana Opportunity Reinvestment” bill, which also needs to pass in the Senate in order to be successful. A similar bill in 2020 failed in the Senate, however this time the Senate is controlled by the Democrats that support the bill.

While the company may capitalize on penetrating the U.S. market, there are significant risks to the company, which we will analyze today.

There is a reason why investors are excited for the stock, as the company might be valuable, especially if it gains more market exposure.

What is the Company Worth

In order for Tilray to become a worthwhile business for investors, it needs to grow and come up with positive cash flows.

We can build a projected cash flow model based on analyst forecasts and the assumption that growth decelerates as the company’s market matures. For Tilray, analysts project negative cash flows until 2023, at which point the company is expected to start turning positive and reach about US$483 in 2031. Summing up and discounting to present value, we get an intrinsic value of US$8.6b for the company.

Take a look how we do our discounted cash flow valuations HERE.

Keep in mind that unprofitable companies like Tilray, have difficulties executing, and analysts forecasts may change as things progress.

Analyzing Key Risks

In order to see if Tilray is a good investment, we need to assess some of the risks of the company. In this early stage of the lifecycle, Tilray is likely a high risk stock, and we need to see if they can develop their business into a good investment.

The first signs of risk were spotted by our team in January, where our analyst discussed the unusual CEO compensation of the unprofitable company, as well as the issue with the 47% share dillution from last year. Even if a company manages to turn a profit, poor management discipline and lack of responsability to shareholders can make this company a bad investment for shareholders.

Divinng into the financials, we can see some possible financial problems for the company.

View our latest analysis for Tilray Brands

Tilray’s Financial Standing

In order for the company to become profitable, it needs to exist, and the byrocratic decriminalization (and possibly licencing) process in the U.S. may take longer than anticipated.

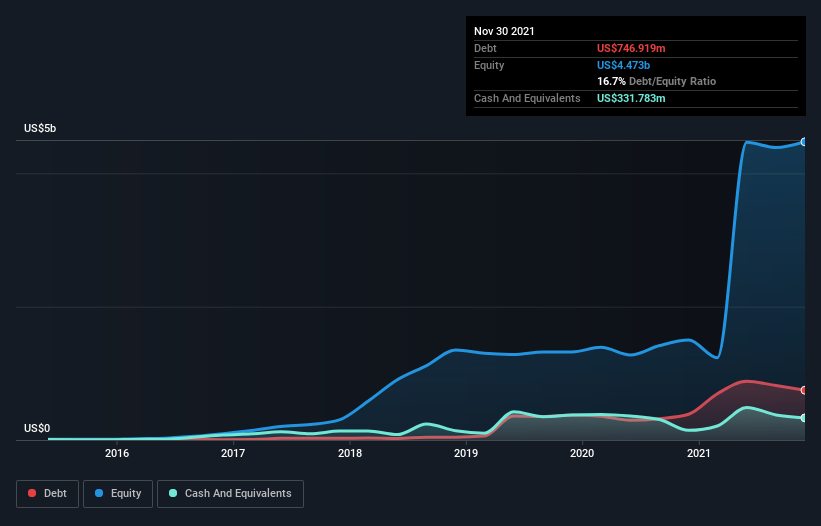

Tilray Brands has engaged in debt financing since 2019. This is generally bad for pre-profit companies, as it imposes future fixed costs and increases financial risk. While analysts can argue that the company used this debt in productive ways, it currently represents some 22% of the market value of equity and that is a significant level for a pre-profit company.

So, we got one factor that is decently concerning.

Now, we will evaluate if the company has enough cash to develop untill it can reach the right side of 0. For this, we analyze Tilroy’s cash runway.

Cash Runway

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn.

The comapny held about US$332m in cash by November 2021. Looking at the last year, the company burnt through US$134m.

Therefore, from November 2021 it had 2.5 years of cash runway. Importantly, though, some analysts have revised when they think Tilray Brands will reach cashflow breakeven and the company may be in need of additional financing.

Depicted below, you can see how its cash holdings have changed over time.

The best case scenario would be if the comapny picks up revenue growth and the U.S. allows it to enter the market, and hopefully the company can pull it off just in time.

Future Financing Options

What can the company do, in case it needs more financing?

The company can raise more debt, which will be harder in the future, as interest rates keep increasing. Alternatively, they can raise funds from issuing more shares, but that comes at the expense of investors which are arguably not impressed with the 65% drop in share price from 1 year ago and the current amount of dillution. Management has arguably some explaining to do, and should be held accountable from the people that fund the company.

Key Takeaways

While it is great to hear buzz that the U.S. may decriminalize marijuana, we hope that this process happens soon enough in order for the company to smoothly enter the market.

While not drastic, Tilray has some financing risks and management doesn’t seem to be able to execute as well as investors had hoped.

If investors believe that the company will overcome these challanges, then they may potentially see significant upside, as the company’s cash flows seem to have a value of US$20 per share. In any case, Tilray is a high risk-return stock.

On another note, Tilray Brands has 2 warning signs (and 1 which is concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.