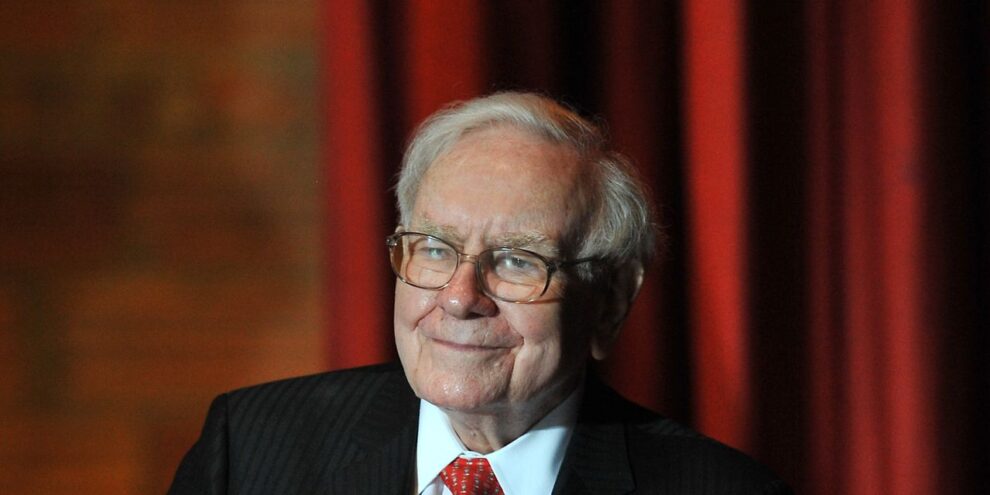

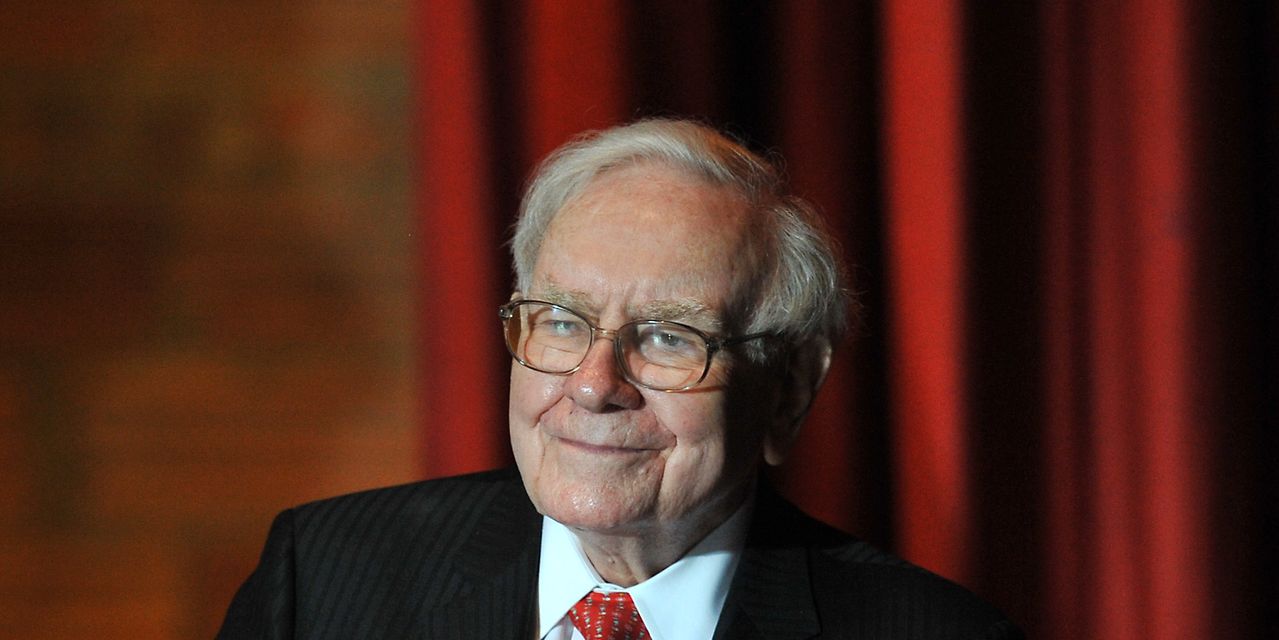

A vote of confidence by Warren Buffett in a particular stock doesn’t mean you should jump on the bandwagon, but the Berkshire Hathaway CEO’s long-term track record speaks for itself. The man knows how to spot a bargain.

Below is a screen of stocks inspired by Buffett’s two new picks that feature attractive dividend yields that are expected to be well-covered by free cash flow.

Word of Buffett’s new investment positions can send shares higher as other investors’ ears perk up. This happened after Berkshire Hathaway Inc. BRK.B, -0.02% disclosed late Feb. 16 that it had purchased shares of Verizon Communications Inc. VZ, +4.28%. and Chevron Corp. CVX, +1.64% — two stocks with attractive dividend yields, one of which is cheaply priced when compared to the weighted valuation of the S&P 500 Index SPX, -0.73%.

Shares of Verizon were up 3% in early trading Feb. 17, while Chevron was up 3.5%. With dividends reinvested, Verizon had declined 7% for 2021 through Feb. 16, following a flat performance in 2020. Chevron was up 1.5% early Feb. 17 and had already risen 12% for 2021 following a 26% decline in 2020. Oil is on the upswing as investors look ahead to life after the pandemic. West Texas Intermediate crude oil CL00, +0.20% had risen 68% from the close on Oct. 31 through Feb. 16, when it settled at $60.05 a barrel.

All of the following is based on closing prices Feb. 16 and consensus estimates among analysts polled by FactSet for the next 12 months.

Verizon’s stock trades at a forward price-to-earnings ratio of 10.7, compared to a weighted aggregate forward P/E of 22.5 for the S&P 500. The shares have a dividend yield of 4.64%.

One way to gauge a company’s ability to cover its dividend (and hopefully raise it) is to look at its free cash flow, which is its remaining cash flow after planned capital expenditures. This is money that can be used for any corporate purpose, including expansion, share repurchases or dividend increases. We can measure a company’s free cash flow yield by dividing trailing or estimated free cash flow by the current share price. Because of the disruptions to the U.S. economy in 2020, all the free cash flow yields that follow make use of consensus estimates for the next 12 reported months.

Verizion’s forward free cash flow yield is 8.97%, showing “headroom” of 4.34% over the current dividend.

Chevron’s stock trades at a forward P/E ratio of 24.8, which is higher than that of the S&P 500. Then again, 2021 is expected to be a recovery year for oil and natural gas, and analysts’ earnings estimates may not have caught up with rising fuel commodity prices. Chevron’s dividend yield is 5.54% and its forward free cash flow yield is 7.99%, leaving “headroom” of 2.45%.

None of this is to say that Buffett is overly fixated on stocks with high dividend yields. He isn’t. Among the publicly traded holdings the company disclosed Feb. 16, there are plenty of companies that pay no dividends, including Amazon.com Inc. AMZN, +0.62%, Biogen Inc. BIIB, -1.82%, Charter Communications Inc. CHTR, +0.41% and General Motors Co. GM, -1.25%, which suspended its quarterly dividend in April.

A Buffett dividend stock screen

Working from Buffett’s selections of Verizon and Chevron and excluding stocks Berkshire Hathaway doesn’t already hold, here are the 22 stocks among the S&P 500 with dividend yields of at least 4.00%, for which free cash flow estimates for calendar 2021 are available, with headroom indicated. The list is sorted by dividend yield.

Scroll the table to see all the data, including forward P/E ratios and total returns for 2021 and 2020.

For real estate investment trusts, the industry standard for measuring dividend-paying ability is funds from operations, a non-GAAP figure that adds depreciation and amortization back to earnings and subtracts gains on the sale of property. So forward FFO estimates are used in the “estimated FCF yield” column on the table.

The list excludes four stocks already held by Berkshire Hathaway — Verizon, Chevron and two more:

- AbbVie Inc. ABBV, +2.25% has a dividend yield of 4.99%, with a forward free cash flow yield of 10.54% for headroom of 5.55%.

- Kraft Heinz Co. KHC, +2.06% has a dividend yield of 4.52% and a forward free cash flow yield of 7.59% for headroom of 3.06%. The company cut its dividend by more than a third in February 2019.

A high dividend yield might indicate investors are sour on the company’s business prospects or its ability to maintain the dividend over the long term, despite a high FCF yield. For example, the highest-yielding stock on the list is Lumen Technologies Inc. LUMN, -0.51%, which was CenturyLink before it was renamed in September. The dividend yield is 8.48%. CenturyLink cut its quarterly dividend by 26% on the same day it authorized a $2 billion stock repurchase plan in February 2013. The company’s quarterly dividend remained 54 cents a share until it was cut to the current 25 cents a share in February 2019. For five years through Feb. 16, shares of Lumen/CenturyLink were down 34%, with dividends reinvested, while they were down 38% for 10 years.

Other companies on the list that have cut dividends over the past 10 years include Williams Cos. WMB, -0.83%, Kinder Morgan Inc. KMI, -0.86%, Vornado Realty Trust VNO, -1.26% and Simon Property Group Inc. SPG, -2.24%, which reduced its payout by 38% in June.

All of this emphasizes the importance of doing your own research to form your own opinion about a company’s long-term prospects if you see any stocks of interest here.

Aside from CenturyLink, the stock listed above with the lowest forward P/E valuation is AT&T Inc. T, +1.32%, with a dividend yield of 7.18% and P/E of 9.2, followed by Pfizer Inc. PFE, +0.12%, with a yield of 4.50% and forward P/E of 10.3.