Energy partnerships are usually considered to be income plays, and rightly so — most have high dividend yields. But investment manager Martin Sosnoff says this little corner of the energy sector is a place for capital gains this year.

Almost any investor could have made a killing by scooping up battered stocks last March and holding them through the recovery. Here’s a chart showing how the S&P 500 Index SPX, -0.81% has moved since the end of 2019:

The energy sector had been worse off even before the coronavirus led the government to shut down the economy. Pipeline operators had been especially maligned.

But Sosnoff — a money manager for six decades who has written four books, most recently “Train to Outslug the Market” — points to what he sees as a particular opportunity for quick growth in what is ordinarily considered a space for income.

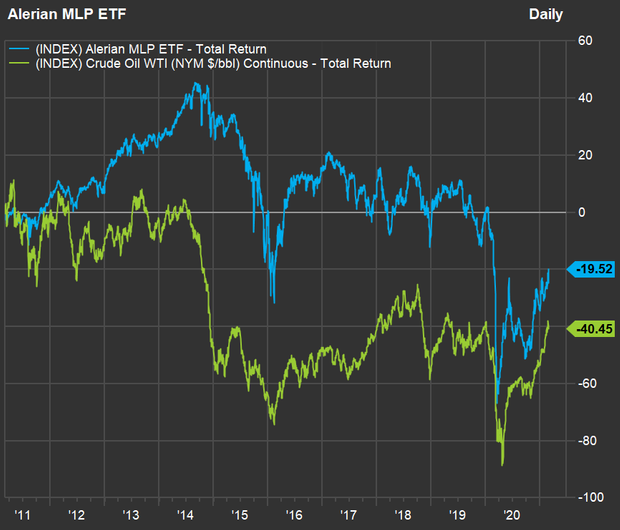

Let’s look at how the Alerian MLP ETF AMLP, +1.54% has performed over the past 10 years, against the movement of continuous quotes for West Texas Intermediate crude oil CL00, +1.71% (WTI):

(FactSet)

Oil is down 40% over the past 10 years, but the Alerian MLP ETF has fallen only half as much, with dividends reinvested. This exchange traded fund invests in 19 pipeline master limited partnerships, known as MLPs. It pays quarterly, and the dividend yield is 9.08%, based on its most recently quarterly distribution of 68 cents and the closing price of $29.95 on March 1. That is very high in an environment with 10-year U.S. Treasury notes TMUBMUSD10Y, 1.447% yielding about 1.41%.

If you invest in an MLP outside a tax-deferred retirement account, your taxes become a bit more complicated. The limited-partnership structure provides a tax advantage — instead of a company paying its own income taxes and its shareholders paying taxes on their dividends, the income passes right through the limited partners. The partners can also have their taxable income reduced to reflect their portion of the partnership’s capital outlays and expenses.

Going back to the second chart, you can see oil prices have been recovering. At the end of October, continuous forward-month WTI futures traded for $35.79.

“I cannot this year rationalize for you energy futures selling in the $60s,” Sosnoff said in an interview, after WTI hit $61.50 at the end of February. “It is really not explainable on the fundamentals, [which] haven’t changed that much.”

As we move closer to a post-pandemic economy, investors are becoming more confident in pipeline operators’ ability to maintain dividends, Sosnoff said. He sees this as a special situation in a particular class of income-oriented investments that presents an opportunity now.

To emphasize this point, he said he wouldn’t buy any preferred stocks now, because most are trading above their par values (the prices at which they will be redeemed by the issuers). During times of high volatility, some preferred stocks can trade very low, relative to par, setting up significant gains when, and if, prices recover.

Four energy plays

Sosnoff named two MLPs that he considers to be of the highest quality:

• Enterprise Products Partners L.P. EPD, -0.13% has a dividend yield of 8.04%. The share price (actually the unit price, as these are technically partnership units) has risen 14% during 2021 through March 2, after falling 30% in 2020. Those price changes exclude dividends. “This is the most conservatively managed [among the pipeline MLPs], in terms of payout ratio of cash flow,” Sosnoff said, adding “there is no question of their financial stability — it is there in spades.”

• Magellan Midstream Partners L.P. MMP, +1.51% has a dividend yield of 9.57%. The units are up only 1% this year, after falling 32% in 2020.

When asked about non-LP pipeline operators, Sosoff named two more companies:

• Williams Cos. WMB, +0.55% has a dividend yield of 6.95%, and its shares are up 18% in 2021 after a 15% decline in 2020.

• Kinder Morgan Inc. KMI, +0.33% has a dividend yield of 6.99%. The stock is up 10% this year after dropping 35% in 2020.

“I think the yields will go down to 6% or 5%, and you can make a lot of money in the stocks as they do,” Sosnoff said. This table takes you through what those moves would mean from the close March 1 — scroll to the right to see those numbers:

Don’t miss: 25 stocks of companies backed by rapid earnings growth as the economy reopens