Earlier this month the U.S. got a grade of C-minus for infrastructure from the American Society of Civil Engineers. And that was an improvement.

President Biden on Wednesday is releasing details of his “Build Back Better” batch of spending plans, which include $2 trillion for infrastructure spending across the country.

So it is time for an updated look at which infrastructure stocks may be best positioned to benefit.

Read: Here’s what’s in the White House infrastructure spending and corporate tax hike plan

Here are lists of infrastructure stocks favored by analysts at Stifel and Truist.

The Global X U.S. Infrastructure Development ETF PAVE, +0.24% provides an easy way to make a diverse investment in U.S. infrastructure. You can read more about it in this article from earlier this month after the U.S. got its poor infrastructure grade.

On March 30, with rumors about Biden’s plan swirling, PAVE rose 1% and in premarket trading March 31 it was up another 2%.

Updated list of infrastructure stocks

Here is an updated list of Wall Street analysts’ favorite U.S. infrastructure stocks.

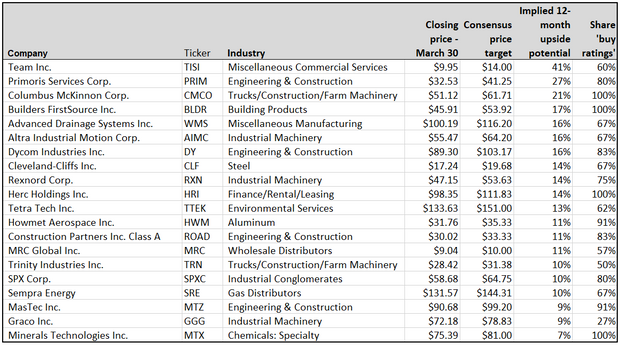

Starting with the 100 stocks held by PAVE, there are 75 covered by at least five analysts polled by FactSet. Among those 75, here are the 20 with the most upside potential over the next 12 months implied by consensus price targets:

The company on the list with the most aggressive consensus price target is Team Inc. TISI, +15.88%, which provides testing and repair services to the energy industry.

None of the companies on the list have “sell” or equivalent ratings among any of the analysts polled by FactSet. Only four have 100% “buy” or equivalent ratings:

- Columbus McKinnon Corp. CMCO, +3.21% makes cranes, hoisting equipment and other motion control products to secure materials.

- Builders FirstSource Inc. BLDR, +1.00% sells building supplies through 550 locations in 40 states.

- Herc Holdings Inc. HRI, +3.03% rents construction and earth-moving equipment. It was included in a list of favored small-cap value stocks by Christian Stadlinger of Columbia Threadneedle Investments.

- Minerals Technologies Inc. MTX, -0.09% produces a variety of synthetic materials used in various industries.

Don’t miss: These small-cap value stocks still have upside despite the big rally in the sector, managers say