(Bloomberg) — Dell Technologies Inc. reported quarterly revenue that topped analysts estimates on strong demand for business PCs and networking services, a sign that companies have been modernizing their technology stacks as workers return to the office. The shares jumped in extended trading.

Most Read from Bloomberg

Sales climbed 16% to $26.1 billion in the fiscal first quarter, which ended April 29. Analysts, on average, projected $25 billion, according to data compiled by Bloomberg. Revenue was bolstered by a 22% rise to $12 billion from commercial PCs, one of Dell’s highest-grossing products, the Round Rock, Texas-based company said Thursday in a statement. Profit, excluding some items, was $1.84 a share, also topping analyst estimates.

Co-Chief Operating Officer Jeff Clarke touted growth across business units in the statement. “We are built to outperform, in a balanced and consistent way across the company.”

Revenue from the Infrastructure Solutions Group, which includes most of Dell’s technology services, increased 16% to $9.3 billion from a year earlier. Server and networking sales climbed 22% to $5 billion, while storage revenue gained 9% to $4.2 billion.

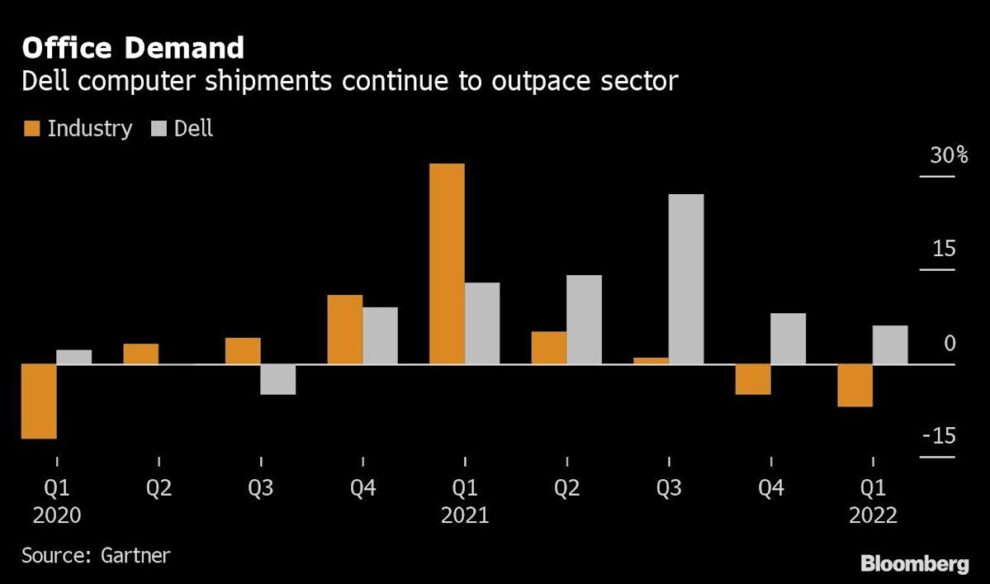

While Dell saw gains, personal computer shipments across the industry declined 6.8% in the first three months of 2022 compared with the same period a year earlier, according to Gartner Inc., an industry analyst. Much of the decline, however, came from reduced demand for Chromebooks used by schools, which saw a huge jump during the pandemic. Business PC shipments increased in the quarter driven by hybrid work and the return to offices, which created a need for new desktop machines, Gartner said.

That trend of greater demand for PCs in the enterprise market was seen in Dell’s numbers. The company’s global shipments increased 6.1% in the quarter, Gartner reported.

Dell said fiscal first-quarter revenue from consumer PCs increased 3% to $3.6 billion.

The shares gained about 5% in extended trading after closing at $43.93 in New York. The stock has tumbled 22% this year.

Last year, Dell spun out VMware Inc., the software vendor acquired in 2016 as part of its $67 billion purchase of EMC. The two companies have remained important business partners since, but this relationship could be weakened by Broadcom Inc.’s planned $61 billion takeover of VMware, which was announced earlier Thursday, said Bloomberg Intelligence’s Woo Jin Ho.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.