Partnerships don’t fix everything, but they can help with a broken narrative.

It can pay to have rich friends.

This is especially true when that friend runs the largest cloud computing business in the world and you are a manufacturer of computer chips. That is why Intel (INTC 3.31%) stock soared after the company announced a new partnership with Amazon (AMZN 0.91%) for custom chip designs for its Amazon Web Services (AWS) subsidiary.

Intel stock shot up from around $19 to $21 on this news, stemming painful losses that shareholders have incurred for the last few years. Intel shares are down 70% from its five-year high as the company struggles to build its new foundry business and compete in the age of artificial intelligence (AI). Today, Amazon is stepping up to the plate and saying it will invest in Intel’s computer chip business for the long haul.

Does this make Intel stock a buy after falling 70% from recent highs?

Partnerships for chip design

On Sept. 16, Amazon and Intel announced a co-investment in custom chip design intended to cost billions of dollars. In other words, both companies have agreed to pool resources to design computer chips together. Amazon will also be spending $7.8 billion in central Ohio on data center development. This is close to where Intel is building a $20 billion semiconductor manufacturing plant.

The relationship between Amazon and Intel is tightening. This makes sense for two key reasons. First, Intel is one of the largest suppliers of computer chips for AWS data centers. Amazon spends billions of dollars with Intel each year, so if they can improve chip designs, both companies will make money. Second, Intel has lost market share during the AI boom of the last few years to Nvidia and Advanced Micro Devices.

Nvidia specifically is pulling far ahead in AI and has increased its pricing to customers such as Amazon. Amazon likely sees this chip design partnership with Intel as a way to increase competition with Nvidia, which will hopefully lower its computer chip costs. Intel can win by stealing market share back from Nvidia.

An independent foundry

Intel’s business has suffered in recent years due to its vertically integrated chip manufacturing business. Nvidia and AMD do not make computer chips, they simply design them using software. They are made by Taiwan Semiconductor Manufacturing (TSMC), which operates what is known as a foundry business model. This company serves as a manufacturer of semiconductors for multiple parties, but never competes directly with its chip-designing customers. TSMC has aggregated a huge portion of the semiconductor manufacturing market and has taken the crown from Intel as the most advanced developer in the entire sector.

A few years ago, Intel began planning to build its own foundry business to compete with TSMC. So far, the business has not done well. Last quarter, revenue was $4.3 billion, not growing, and the segment had a $2.8 billion operating loss. Intel is playing the long game with the foundry business. It has plans to invest tens of billions of dollars in the United States for manufacturing in places such as its Ohio facility. With the CHIPS Act from the U.S. government, it should be eligible for subsidies on this spending.

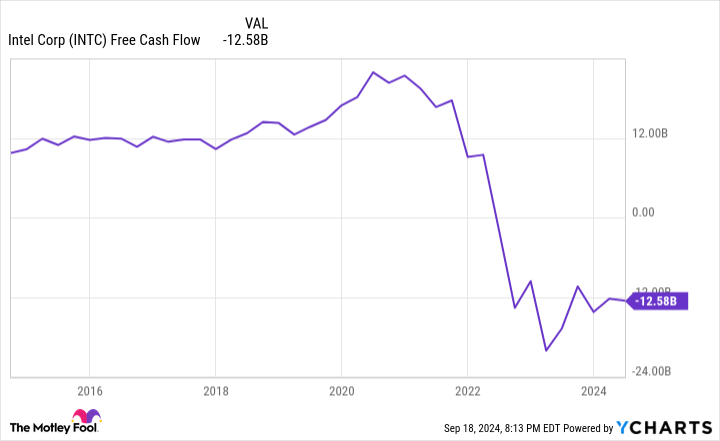

This bet needs to work out, because these capital investments in new manufacturing facilities are burning a hole in Intel’s pocket. Free cash flow was negative $12.6 billion in the last 12 months and has turned sharply negative after being positive for decades. In order to revert to positive free cash flow, Intel will need to procure spending on chips from its partners, such as Amazon (a current customer of TSMC) for its foundry business.

INTC Free Cash Flow data by YCharts

Should you bet on Intel stock?

At current prices, it is hard to value Intel stock. The company is going through a heavy investment cycle and is currently unprofitable. It trades at a market cap of $88.6 billion, which looks cheap compared to its historical cash-flow generation of over $10 billion per year before its competitive struggles.

I think this Amazon partnership is a positive development, but it doesn’t save Intel’s business and/or stock. The company has been a laggard in the semiconductor market for several years now. It is making a risky bet to transition its business over to the foundry model in the middle of that market-share slump. It is not clear whether this will be successful. In the meantime, it is burning over $10 billion a year in free cash flow.

However, if Intel is successful and becomes the American version of TSMC, there is a lot of upside for the stock. TSMC is closing in on a $900 billion market cap, which is 10 times the size of Intel today. It is not implausible for Intel to reach this valuation if the business model transition is successful.

Investors looking to bet on Intel should make it a small position in their portfolios, given the high upside and large downside potential of the stock.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.