Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

-

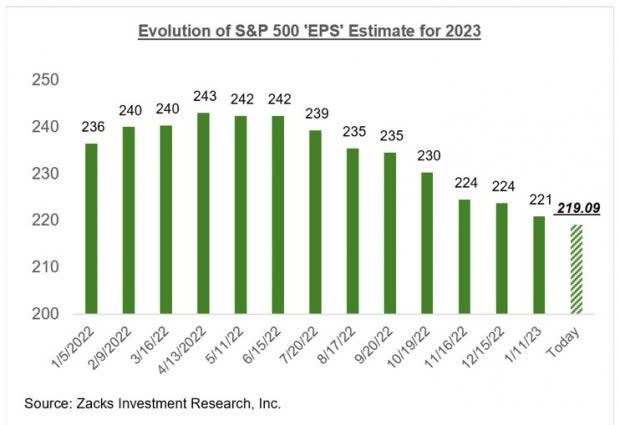

For the 96 S&P 500 companies that have reported Q4 results, total earnings are down -6.0% from the same period last year on +5.5% higher revenues, with 71.9% beating EPS estimates and 67.7% beating revenue estimates.

-

Looking at 2022 Q4 as a whole, aggregate S&P 500 earnings are currently expected to be down -7.2% on +3.9% higher revenues. Excluding the Energy sector’s strong contribution, Q4 earnings for the rest of the index are expected to be down -11.1% on +3.2% higher revenues.

-

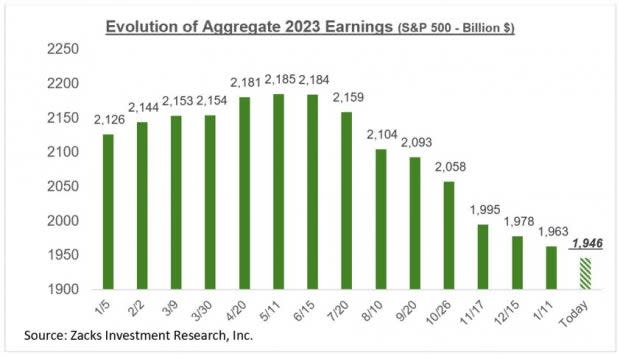

Earnings estimates for full-year 2023 have been coming down as well. From their peak in mid-April 2022, the aggregate total for the year has been cut by -10.6% for the index as a whole and -12.8% excluding the Energy sector’s contribution.

-

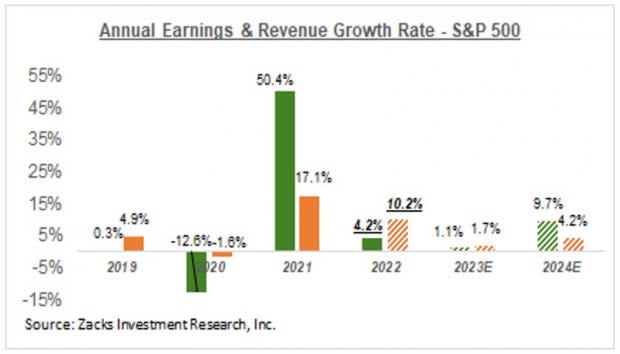

Looking at the calendar-year picture, total S&P 500 earnings are on track to be up +4.2% in 2022 and expected to increase +1.1% in 2023. On an ex-Energy basis, total 2022 index earnings would be down -2.5% (instead of +4.2%, with Energy).

We are starting to see clear signs of growth moderation at the consumer and the business end. It isn’t a precipitous fall, but it is nevertheless a pronounced deceleration in the growth trend.

We saw this in the soft guidance from Microsoft (MSFT) with the software giant’s December-quarter revenues growing at their lowest pace in years. The engine of Microsoft’s growth lately has been its cloud business where growth slowed down considerably as customers have become cautious in their IT spending plans. These cloud developments provide negative read-throughs for other cloud players, including Amazon (AMZN) and Alphabet (GOOGL).

We knew already that global PC shipments were down more than -25% in December quarter and the market expected Microsoft’s results to reflect that development. In the December quarter, Microsoft’s personal computing revenue was down -19% and sales related to its Windows operating system were down -39% from the year-earlier level.

None of this is a surprise given macroeconomic developments in the wake of the Fed’s extraordinary tightening cycle that many in the market see as nearing completion over the next few months. After all, GDP growth estimates for the current and coming quarters have been steadily coming down, with full-year 2023 GDP growth now barely in positive territory.

We have been pointing out for a while now how estimates for this year have been steadily coming down for months now, in anticipation of this macroeconomic development.

The chart below shows the evolution of aggregate earnings estimates for 2023 since the start of 2022.

Image Source: Zacks Investment Research

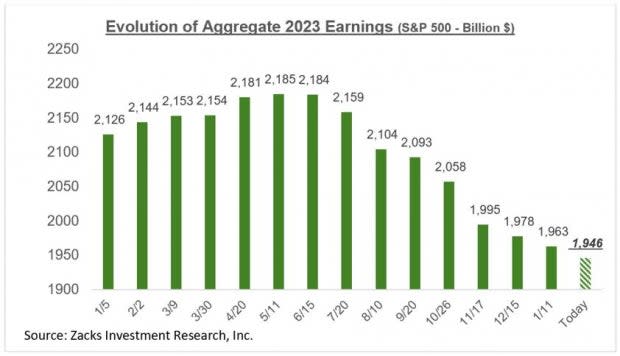

As noted earlier, the current aggregate earnings total for the index approximates to an index ‘EPS’ level of $219.09, down from $242.98 in mid-April, 2022.

The chart below tracks these index ‘EPS’ values since the start of 2022. Please note that these ‘EPS’ values are imputed approximations and have been previously published on the dates listed in the chart below.

Image Source: Zacks Investment Research

The Overall Earnings Picture

The chart below provides a big-picture view of earnings on a quarterly basis. The growth rate for Q4 is on a blended basis, where the actual reports that have come out are combined with estimates for the still-to-come companies.

Image Source: Zacks Investment Research

The chart below shows the overall earnings picture on an annual basis, with the growth momentum expected to continue.

Image Source: Zacks Investment Research

As you can see above, earnings next year are expected to be up only +1.1%. This magnitude of growth can hardly be called out-of-sync with a flat or even modestly down economic growth outlook. Don’t forget that headline GDP growth numbers are in real or inflation-adjusted terms while S&P 500 earnings discussed here are not.

As mentioned earlier, 2023 aggregate earnings estimates on an ex-Energy basis are already down by almost -13% since mid-April. Perhaps we see a bit more downward adjustments to estimates over the coming weeks, after more companies report Q4 results and provide guidance along the lines of what we saw with Microsoft. But we have nevertheless already covered some ground in taking estimates to a fair or appropriate level.

This is particularly so if whatever economic downturn lies ahead proves to be more of the garden variety rather than the last two such events. Recency bias forces us to use the last two economic downturns, which were also among the nastiest in recent history, as our reference points. But we need to be cautious against that natural tendency as the economy’s foundations at present remain unusually strong.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.