(Bloomberg Opinion) — No matter how many times you’ve ridden it, when your log-flume boat is clicking its way up the track to the final brow of Splash Mountain, the jitters set in. Soon you’ll be hurtling down five steep stories, getting doused at the bottom.

And that’s how it feels to be a Walt Disney Co. shareholder right about now.

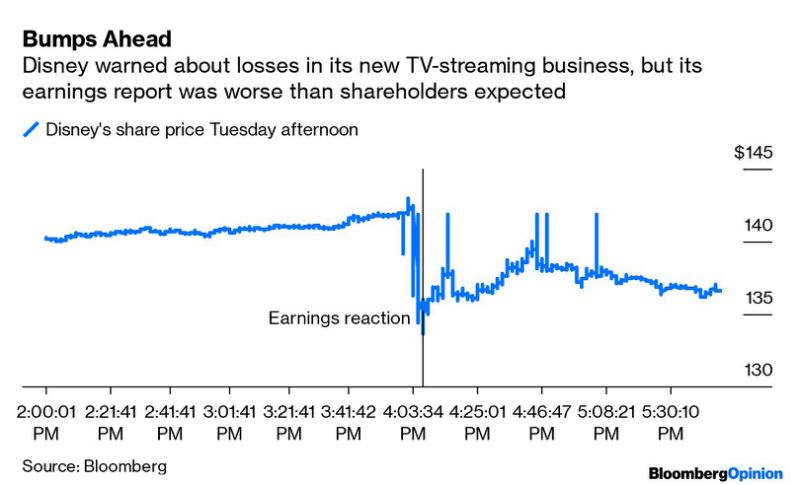

Disney reported earnings on Tuesday that fell short of analysts’ lowest estimate as the company takes the TV-streaming plunge. Investments in its Disney+ online-video app and its recent takeover of 21st Century Fox predictably weighed on results. But lighter attendance at its U.S. theme parks didn’t help matters, nor did its write-down of “Dark Phoenix,” a film flop the company inherited in the Fox deal. The strength of Disney’s theme-park and movie businesses – i.e., its new “Star Wars” attractions and record-shattering year at the box office – are what’s supposed to be distracting from its other costly endeavors. Instead, its shares sold off in after-hours trading.

Creating Disney+ and buying Fox are decisions viewed positively – necessary even – by investors, but they’re still certain to be disruptive to its financial performance and usual internal harmony in the coming periods. Tuesday’s results are the start of that. The company’s new direct-to-consumer (aka streaming) and international division recorded $553 million in operating losses in the three months ended June 29. That figure may grow to $900 million in the current quarter, Christine McCarthy, Disney’s chief financial officer, said on the earnings call.

It’s been no secret that Disney was about to take shareholders on a thrill ride – it was literally my column headline in March, and Disney held up a big PowerPoint slide in April warning that this little streaming adventure wouldn’t turn a profit until fiscal 2024:

The good news for investors is that the closer it gets to Disney+ launch day on Nov. 12, the clearer it’s becoming that Disney poses a significant threat to the market incumbent, Netflix Inc., and is making the right move to bet that streaming is the future.

Among the many milestones Disney had in the latest quarter, the company took full operational control of Hulu, a step toward being able to offer a discounted bundle for viewers who want Hulu, Disney+ and ESPN+, a combo that at $12.99 a month starts to look like a fairly decent replacement on its own for a traditional cable package. That’s in line with a Netflix standard subscription. Disney can also draw on its incredibly large fan base, whether it be Vacation Club members, Disney Visa cardholders or theme-park patrons, to promote its streaming products in a way that its rivals can’t. There are challenges ahead, such as supplying enough fresh streaming content to attract and retain subscribers. Its added scale with Fox and Hulu give it an advantage, and the Disney+ monthly rate is already less than half what AT&T Inc.’s HBO Max service is expected to price at when it launches in the subsequent months.

If in a quarter when Disney released the highest-grossing film of all-time, “Avengers: Endgame,” it still couldn’t ease shareholders’ concerns, then the next few quarters aren’t going to be very exhilarating either. In a year’s time, though, investors may finally be drying off and rounding the corner to Doo-Dah Landing.

To contact the author of this story: Tara Lachapelle at [email protected]

To contact the editor responsible for this story: Beth Williams at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering deals, Berkshire Hathaway Inc., media and telecommunications. She previously wrote an M&A column for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”30″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.