Hello! Welcome back to Distributed Ledger, our weekly crypto newsletter that reaches your inbox every Thursday. I’m Frances Yue, crypto reporter at MarketWatch, and I’ll walk you through the latest and greatest in digital assets this week so far. Find me on Twitter at @FrancesYue_ to send feedback or tell us what you think we should cover.

Subscribe here to the DL newsletter!

Crypto in a snap

Bitcoin BTCUSD, -2.98% is recently trading at around $42,900, with a 1.5% gain over the past seven days. Ether ETHUSD, -3.55% logged a 2.2% loss over the past seven days, recently trading at around $3,287. Meme token Dogecoin DOGEUSD, +3.50% rallied 6.9% over the past seven days, while another dog-themed token, Shiba Inu SHIBUSD, -7.78 recorded a 4.5% gain.

Crypto Metrics

| Biggest Gainers | Price | % 7-day return |

| Oasis Network | $0.51 | 32.9% |

| Harmony | $0.36 | 26% |

| Near | $18.4 | 19.3% |

| Dash | $143.6 | 16.2% |

| Osmosis | $9.3 | 15.5% |

| Source: CoinGecko as of Jan.13 |

| Biggest Decliners | Price | % 7-day return |

| Olympus | $226.3 | -28.4% |

| Wonderland | $2197.28 | -13.8% |

| Loopring | $1.59 | -12.5% |

| Helium | $34.36 | -11.7% |

| Celsius Network | $3.28 | -10.3% |

| Source: CoinGecko as of Jan.13 |

Crypto diversified?

Major cryptocurrencies often trade in tandem, as investor sentiment shifts around news about macroeconomics, regulatory oversight, and broad adoption of digital assets. However, such correlations are likely to weaken as the crypto space becomes increasingly mature with different industry verticals, some industry participants said.

“Every time there’s a huge correction, correlations go up very momentarily,” Jeff Dorman, chief investment officer at crypto asset management firm Arca told Distributed Ledger in an interview. But such correlations will decrease in a longer timeframe, according to Dorman.

Tokens in various sectors have posted drastically different returns during the past year. Bitcoin gained about 25%, while ether rose 216%. Among other blockchains, Terra’s LUNA rallied more than 10,770%, while Solana SOLUSD, -3.36% logged a gain of more than 4,000%. XRP XRPUSD, -4.10% and Cardano ADAUSD, -4.26% posted a return of 160% and 335%, respectively.

During the same period, DeFi Pulse index, a capitalization-weighted index that tracks the performance of decentralized finance tokens, gained 42%.

Blockchain gaming token Axie Infinity AXSUSD, -6.34% and Sandbox traded up 16,419% and 13,024%, respectively.

“There’s no reason why just because two assets are wrapped in a digital asset wrapper that they should behave the same way,” Dorman said. “In the same way, why would you expect the healthcare stock to move in the same way that a gold ETF moves that an early stage technology ETF moves? They’re all ETFs doesn’t mean they’re similar.”

“It’s the same thing with digital assets. Just because they’re wrapped in a digital asset wrapper doesn’t make them similar assets. They behave differently. There’s different inputs that drive outputs,” according to Dorman.

Bitcoin correlation with other crypto

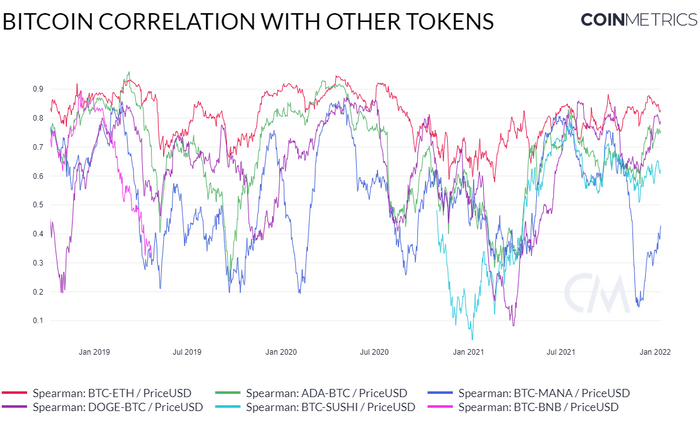

This chart shows bitcoin’s correlation during the past three years with smart contract blockchain Ether, proof-of-stake blockchain Cardano, Metaverse-related token Decentraland MANAUSD, -4.87%, meme token Dogecoin, decentralized exchange token SushiSwap SUSHIUSD, -1.54% and centralized crypto exchange token Binance coin, respectively.

Though an ideal version would be presenting bitcoin’s correlations with different market value-weighted indexes of various verticals, the chart provides some general idea of how bitcoin has been trading with other cryptocurrencies.

Correlation ranges in magnitude from -1.00 to 1.00. A positive correlation means assets have been moving in the same direction, while a negative correlation means they moved in the opposite direction. The larger the absolute value of the coefficient, the stronger the relationship.

Bitcoin has posted positive correlations with most of the selected crypto during the timeframe. Its correlation coefficient with ether is notably higher than that with other tokens. Bitcoin’s correlations with most crypto selected saw an uptick during the most recent round of market sell-offs.

Citadel’s potential crypto push?

Citadel Securities, the electronic market maker founded by Ken Griffin, on Tuesday announced a $1.15 billion investment from venture-capital giant Sequoia and cryptocurrency investment outfit Paradigm.

In an opinion piece, MarketWatch’s Thornton McEnery wrote about how the deal could give Citadel the liquidity to go bigger and go abroad. “It’s been an open secret for years that Griffin wants Citadel to be the next Goldman Sachs, a financial-services superpower with a global reach that can make markets, dominate equity trading and fund deals of spectacular size,” McEnery wrote.

The deal may also hint at Citadel’s potential push into crypto, as Paradigm is a venture capital firm that focuses on investing in crypto companies and protocols.

In a statement, Matt Huang, Co-Founder and Managing Partner of Paradigm wrote that “we look forward to partnering with the Citadel Securities team as they extend their technology and expertise to even more markets and asset classes, including crypto.”

Compared with some other major quantitative trading firms, Citadel has been somewhat late to the crypto game, which might be related Griffin’s long-time doubts around digital assets, though the billionaire in October said his firm would trade cryptocurrencies if they are regulated properly.

Other major high frequency trading firms, such as Jump Trading and Hudson River Trading have brought their quantitative approach to the industry, while quant hedge fund Two Sigma has also also hiring for crypto operations roles to build out its crypto trading business.

Coinbase acquires derivatives exchange

Coinbase announced Wednesday that it is purchasing derivatives exchange FairX in a push to expand the crypto exchange’s offerings for retail and institutional clients, giving them one spot to trade bitcoin and other cryptocurrencies, but also access to the growing world of related derivatives.

After Binance, Coinbase has the second-largest spot trading volume in cryptocurrencies, with a 24-hour trading volume of about $3.3 billion, according to CoinMarketCap.

The addition of FairX, a Chicago-based derivatives exchange with roots in the retail market, would help Coinbase expand by offering its clients access to certain crypto futures traded on a CFTC-regulated platform.

The trading volume of crypto derivatives stood at $2.9 trillion in December, surpassing that of spot trading, according to a report by data site CryptoCompare.

What else?

Changpeng Zhao, or CZ, founder of the world’s largest crypto exchange Binance, has a net worth of $96 billion, exceeding that of Mark Zuckerberg, according to the Bloomberg Billionaires Index. The wealth didn’t take into account CZ’s personal crypto holdings. Binance disputed the accuracy of Bloomberg’s estimates of Zhao’s net worth, saying that crypto is “susceptible to higher levels of volatility”, according to the Bloomberg article.

In a tweet last year, Zhao warned investors that it is important to manage their risks. “I could handle losing the house. I can always find a job at a bank if bitcoin went to 0. My (simple) life style would not be affected much. Not everyone is in the same situation,” Zhao wrote.

In other crypto-related news, more companies and banks are launching their own stablecoins, a type of cryptocurrency with its value pegged to another asset, often fiat currencies.

Pay Pal is exploring to launch its own stablecoin, while a consortium of banks, including New York Community Bank, NBH Bank, FirstBank, Sterling National Bank, and Synovus Bank, is launching their own stablecoin called USDF.

Crypto companies, funds

In crypto-related company trading, shares of Coinbase Global Inc. COIN, -1.72% traded down 1% to $232.75 Thursday afternoon. It was down 0.5% for the past five trading sessions. Michael Saylor’s MicroStrategy Inc. MSTR, -4.36% traded 3.4% lower on Thursday to $497.34, and lost 0.3% over the past five days.

Mining company Riot Blockchain Inc. RIOT, -4.33% shares fell 3.2% to $20.44, with a 0.2% loss over the past five days. Shares of Marathon Digital Holdings Inc. MARA, -7.61% plunged 6% to $28.53, and down 2.7% over the past five days. Another miner Ebang International Holdings Inc. EBON, -7.50% traded 7.1% lower at $0.98, with a 5.5% gain over the past five days.

Overstock.com Inc. OSTK, -3.26% tanked 2.85% to $52.23. The shares went down 2% over the five-session period.

Block Inc.’ SQ, -5.62% s shares are down 3.7% to $144.15, with a 3.12% loss for the week. Tesla Inc. TSLA, -5.86%’s shares traded down 4% to $1,061.5, while its shares logged a 0.3% loss for the past five sessions.

PayPal Holdings Inc. PYPL, -2.60% lost 1.5% to $184.52, while it recorded a 4% loss over the five-session stretch. NVIDIA Corp. NVDA, -4.57% lost 4% to $268.47, and was looking at a 4.8% loss over the past five days.

Advanced Micro Devices Inc. AMD, -3.00% went down 2.7% to $134.1 and lost 1.6% over the past five trading days, as of Thursday afternoon.

In the fund space, ProShares Bitcoin Strategy ETF BITO, -3.15% was 2.2% lower to $27.01 Thursday, while Valkyrie Bitcoin Strategy ETF BTF, -3.12% was down 2.2% to $16.71. VanEck Bitcoin Strategy ETF XBTF, -2.91% fell 2.5% to $42.2.

Grayscale Bitcoin Trust GBTC, -5.57% was trading at $30.97, off 3.4% Thursday afternoon.