SoundHound AI’s growth rate could accelerate next year thanks to a key acquisition, but is that enough to make the stock a buy?

Companies that are growing at fast rates can make for exciting investments. The more growth they generate, the more excitement they can attract from investors along the way. SoundHound AI (SOUN 2.03%) offers artificial intelligence (AI) voice services that can help enhance experiences for customers in many ways, such as by improving the ordering process at drive-thrus or making it easier to ask AI chatbots questions while driving.

There’s plenty of potential for SoundHound AI, which is why many investors have been bullish on its prospects, especially after learning earlier this year that Nvidia was an investor in the business. But while SoundHound AI has been growing its business at a fast rate, its losses and cash burn have also been accelerating. Should investors be worried, or could this be a solid AI stock to buy right now?

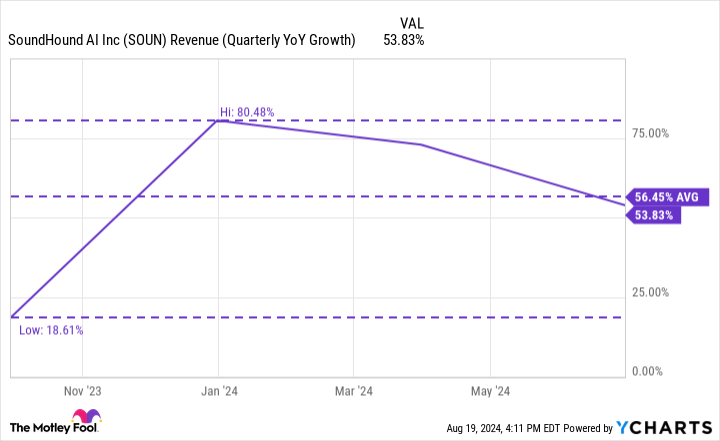

SoundHound’s growth rate remains above 50%

For an up-and-coming AI stock like SoundHound AI, what attracts a lot of attention from investors is its impressive growth rate. Since its sales aren’t as large as they would be for a megacap stock, there’s the hope that its valuation can take off if the company continues to grow its operations at a high rate.

SoundHound AI’s revenue during its most recent quarter (which ended in June) totaled $13.5 million. While that may not seem like much when compared to many larger growth stocks, what stood out was the company’s impressive growth rate On a year-over-year basis, its sales jumped by 54%. Its growth rate has been impressive over the past few quarters as spending on AI-related products and services has remained high.

SOUN Revenue (Quarterly YoY Growth) data by YCharts

The company’s growth may remain strong. SoundHound AI recently announced plans to acquire Amelia, an enterprise AI software company that it says will allow it to expand its reach into new verticals, including healthcare, insurance, financial services, and other industries. Combined, the two business are expected to generate at least $150 million in revenue next year — nearly double the $80 million that SoundHound AI is projecting for 2024.

Profitability remains a big question mark

There appears to be a lot of growth on the horizon for SoundHound AI, both organically and via its recent acquisition. But the big question is how strong its bottom line will look. Right now, the company remains unprofitable and its losses have been rising. In the most recent quarter, its net loss expanded from $23.3 million in the prior-year period to now coming in at more than $37.3 million. That’s a 60% increase in net loss, which is a faster rate than its revenue growth.

The company does say that the deal with Amelia will result in cost synergies and result in “profitability expansion in subsequent years,” but it falls short of actually saying if and when the company will get out of the red. It’s not just profitability that matters, either. Cash burn is particularly concerning for SoundHound AI. If the company can’t generate positive cash flow, it may need to raise money through debt or the equity markets — which results in dilution and can send the stock into a tailspin.

During the first six months of the year, SoundHound AI has burned through $40.4 million from its day-to-day operations, which is more than the $34.2 million it used up during the same period last year. The company finished the quarter with just under $201 million in cash and cash equivalents, but that wouldn’t have been the case if not for a significant $237.6 million it raised through stock sales this year.

Is SoundHound AI stock a good buy right now?

SoundHound AI is generating some good growth on the top line but investors shouldn’t ignore the problems on the bottom line and with respect to its cash burn. The excitement surrounding the AI stock has showed signs of slowing down with its value down around 2% in the past three months. Even if the business continues to grow at a high rate, without an improvement in cash flow or profitability, SoundHound isn’t demonstrating it can expand its operations in a sustainable way.

A high growth rate on the top line is impressive but that’s not enough of a reason to look past the company’s troubling fundamentals, as this has the potential to be a dilution machine. There are better and safer AI stocks to buy than SoundHound AI.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.