The Justice Department is widening its antitrust crackdown as it goes after Live Nation (LYV), filing a lawsuit Thursday that seeks a breakup of the entertainment giant.

US prosecutors and a group of states argue that Live Nation used its Ticketmaster ticketing monopoly to suppress competition. The lawsuit follows a two-year investigation into the company.

The suit comes 14 years after DOJ approved a merger between Live Nation and Ticketmaster. Ticketmaster is a dominant provider of ticket sales across the US that processes more than 80% of sales, while Live Nation owns and operates hundreds of high-profile venues and is a giant concert promoter.

The combined company has long faced criticism of what lawmakers and regulators consider to be exorbitant fees, problematic customer service and unfair practices.

Live Nation’s stock was down roughly 5% as the suit was filed in the Southern District of New York.

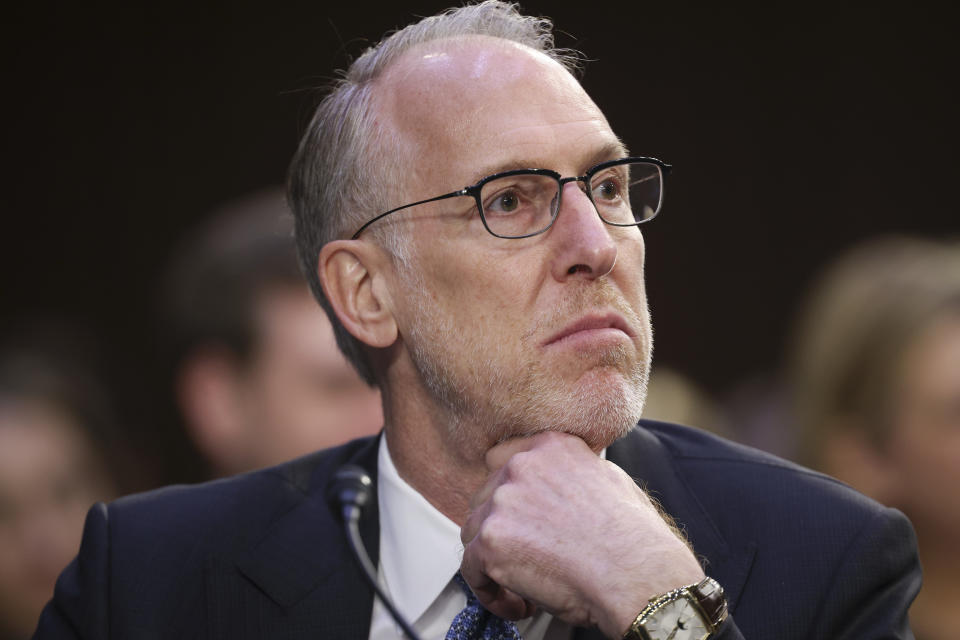

“Live Nation relies on unlawful, anticompetitive conduct to exercise its monopolistic control over the live events industry in the United States at the cost of fans, artists, smaller promoters, and venue operators,” Attorney General Merrick Garland said in a statement.

“The result is that fans pay more in fees, artists have fewer opportunities to play concerts, smaller promoters get squeezed out, and venues have fewer real choices for ticketing services,” he added. “It is time to break up Live Nation.”

In a press conference following the announcement, Garland and the DOJ alleged Live Nation controls more than 60% of concert promotions.

“It is time for fans and artists to stop paying the price for Live Nation’s monopoly,” he said.

Live Nation immediately refuted the lawsuit, calling the allegations “baseless.”

“The DOJ’s complaint attempts to portray Live Nation and Ticketmaster as the cause of fan frustration with the live entertainment industry,” said Dan Wall, Live Nation executive vice president for corporate and regulatory affairs.

“It blames concert promoters and ticketing companies—neither of which control ticket prices—for high ticket prices. It ignores everything that is actually responsible for higher ticket prices, from increasing production costs to artist popularity, to 24/7 online ticket scalping that reveals the public’s willingness to pay far more than primary tickets cost.”

The new legal action is part of a wide-ranging effort by the Biden administration to rein in what it views as anticompetitive behavior across a number of industries, from healthcare to groceries to tech.

The administration has alleged antitrust violations by tech giants Apple (AAPL), Amazon (AMZN), and Microsoft (MSFT), while taking to trial a case filed by the Trump administration against Alphabet (GOOG, GOOGL).

It is also trying to block mergers that could eliminate competition in other industries.

Since the Live Nation-Ticketmaster merger was approved in 2010, the company has been at the center of antitrust concerns, with critics taking aim at sky-high ticket fees and accusing the entertainment giant of anti-competitive behavior.

In 2020, the Justice Department updated the company’s consent decree, an agreement which barred Live Nation from strong-arming venues into using Ticketmaster for its tours, and extended it until 2025.

It did so after it said it found evidence the company repeatedly and over the course of several years engaged in conduct that violated its earlier agreement.

Meanwhile, Capitol Hill ramped up its fight against Live Nation during a Senate Judiciary Committee hearing at the start of last year following a 2022 fiasco with Taylor Swift concert tickets.

Ticketmaster’s online software struggled to handle the demand for presale orders and fans complained they were denied tickets as they tried to buy.

At the time, multiple senators called for a breakup of the company, although some Wall Street analysts have argued a breakup wouldn’t necessarily solve the problems surrounding the unregulated secondary ticket market.

Analysts have also said Live Nation would be a “shell of itself” without Ticketmaster as that entity makes up the bulk of the profits.

In its latest earnings report, the company saw its fiscal year 2023 revenue surge 36% year over year to $22.7 billion, while its earnings per share more than doubled to $1.37. Concert attendance climbed 20% as over 145 million fans attended over 50,000 events.

Analyst Matthew Harrigan sees a DOJ lawsuit against Live Nation as being “significantly politicized” amid the US election year, and says the department “has been generally unsuccessful in applying horizontal M&A theories.”

“We remain adamant that any targeted unwinding of the 2010 Live Nation Ticketmaster merger likely has only a remote likelihood under accepted antitrust law although we would be wary of the likely initial New York State Federal Court venue,” he said.

Deutsche Bank, meanwhile, said “the pursuit of a breakup of Live Nation by the DOJ is somewhat surprising, and raises the stakes of the investigation.”

“We would anticipate that Live Nation plans to defend its position in court, and could still win, but this issue is likely to remain an overhang for some time,” the bank added, noting a possible drag on the stock price.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance