(Bloomberg Opinion) — Citigroup Inc.’s Mike Corbat is under the gun. While most shareholders appreciate what the CEO has done to cut costs and steady the ship, they now want him to narrow the bank’s gap in return on equity with JPMorgan Chase & Co. and Bank of America Corp.

Few could quarrel with that. But selling the Asian retail business, as some have advocated, would defy common sense. That may be one of the suggestions of a dissident group of large investors, analysts and some bank insiders, according to a recent article in the Financial Times titled “Citigroup: pressure builds for strategic shift.” Corbat and the board should say a firm but polite “no.”

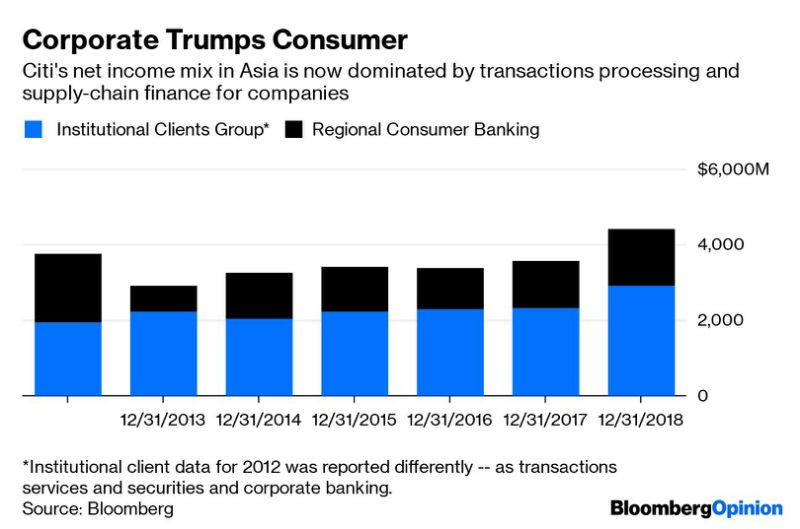

At first blush, it may appear that the activists have a point. Out of 19 consumer banks Citi operates globally, 17 are part of its Asia business.(1) The consumer franchise in Singapore, Hong Kong, China, Taiwan, South Korea, India and Southeast Asia has gone nowhere in seven years under Corbat. Revenue, at $7.5 billion revenue last year, was practically unchanged from 2013. When Corbat replaced his crisis-fighting predecessor Vikram Pandit, roughly half of Citi’s net income in Asia came from the consumer bank. Now the institutional clients group – the corporate and investment bank – contributes twice as much.

Yet there are other, more important considerations. For one thing, the business isn’t a laggard any more. Citi’s Asia consumer banking profit rose 19% from a year earlier in the June quarter. If the idea is to lift Citi’s 12% return on tangible common equity toward Bank of America’s 16% or JPMorgan’s 20%, it’s difficult to see how that goal would be met by selling a unit that earns as much as 21% on that basis.

Going beyond the numbers, the consumer bank is increasingly critical for Citi to defend its global leadership in serving the day-to-day banking needs of multinationals. As I wrote recently, that business brings in $715 billion in low-cost corporate deposits.

To offer a suite of services to new-age Asian companies like Grab, which aims to be a “super app” for Southeast Asia, Citi needs the balance sheet and products of its consumer bank – such as credit cards – to be available in countries where the ride-hailing service operates. Paytm, the popular Indian mobile wallet, wants to embed consumer credit into its vanilla payment services, something the firm’s license conditions restrict it from doing alone. A co-branded credit card with Citi would solve the problem for the Berkshire Hathaway Inc.-backed unicorn, which now has 8 million customers in Japan alongside more than 250 million in India.

Think of Grab and Paytm as prototypes of the new Asian multinationals. While their services will be consumed digitally, many of their supply-chain partners – cabbies and retail stores, for instance – will remain ensconced in the brick-and-mortar world. Citi needs its consumer bank to be able to lubricate this hybrid supply chain effectively with money and credit.

To retreat from retail banking just as Asia’s digital consumption is about to explode would be a strategic blunder. It would hurt the bank’s institutional client franchise. What the bank learns from being embedded in state-of-the-art Asian payment apps such as WeChat Pay and Alipay (over half of Citi’s credit card bills in China are now settled via Alipay) could prepare it to take on the U.S. tech giants as they come with rival products, such as Facebook Inc.’s proposed digital currency, Libra, or Apple Inc.’s credit card with Goldman Sachs Group Inc.

It’s imperative that Citi double down on Asia retail for Corbat to achieve – and build on – his goal of a 13.5% return on tangible equity by 2020. Investment in digital technologies is already helping cut costs in the region, with 44% of new credit card and loan business in the second quarter generated online. Activist investors are barking up the wrong tree.

(1) Of the 17,12 are in the Asia-Pacific region. The bank also considers the remaining five in Europe, the Middle East and Africa as part of its consumer banking operations in Asia.

To contact the author of this story: Andy Mukherjee at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services. He previously was a columnist for Reuters Breakingviews. He has also worked for the Straits Times, ET NOW and Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”59″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.