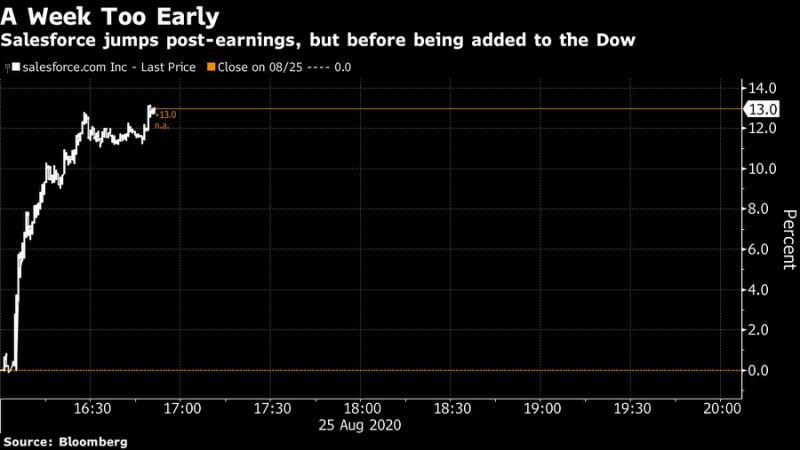

(Bloomberg) — Fans of the Dow Jones Industrial Average looked on longingly as its newest tech name, Salesforce.com Inc., surged after its earnings report.

Up 13%, Exxon Mobil Corp.’s replacement in the 124-year-old stock gauge would’ve added upward of 150 points to the price-weighted benchmark, based on its after-hours surge. Alas, the software maker doesn’t go into the Dow till next week, according to the reshuffling announced Monday.

Salesforce beat analysts’ expectations for profit and revenue in the second quarter and raised its annual sales forecast. Before the release, the company’s shares were already up 33% in 2020.

A fair amount of academic literature has explored how companies do after entering and exiting the Dow. And while Salesforce’s surge is just bad timing for the Dow, the events highlight a phenomenon that has gotten a bit of notice in recent weeks — a tendency for stocks to put their best days behind them after entering marquee benchmarks.

While focusing on the S&P 500 and therefore not an apples-to-apples comparison, a study by René Stulz of Ohio State and Zexi Wang of Lancaster University showed that positive stock pops linked to the announcement of a company’s inclusion in an index have largely faded. If anything, after a stock was added to an index, on average the effect on share price was negative.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”37″>For more articles like this, please visit us at bloomberg.com

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”38″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment