UiPath’s operations center around AI and automation, and yet it has been a horrible investment this year.

Artificial intelligence (AI) stocks generally aren’t cheap these days, so when they go on sale, it’s worth paying attention. One AI stock that has been under enormous pressure lately is UiPath (PATH). A favorite of Cathie Wood, the company helps businesses use software to automate repetitive tasks and increase overall efficiency.

At a market capitalization of less than $7 billion, the stock could have a lot of room to rise in value if it proves to be the real deal. Let’s take a closer look at both the risks and opportunities for the business, and whether it may be a good fit for your portfolio.

CEO departure sparks worries among investors

On May 29, UiPath announced both its first-quarter results for fiscal 2025 and that its CEO Rob Enslin was resigning, effective June 1. Daniel Dines, who founded the company, will be taking over as CEO again. Dines has been either CEO or co-CEO from 2005 until Jan. 31 of this year, when he transitioned to chief innovation officer. Enslin stated he was stepping down for “personal reasons.”

Anytime there’s a resignation, particularly in a top leadership position, it can result in a sell-off. Regardless of the reason, investors are often tempted to speculate about what the change may mean for the business. As a result of the surprise news, shares of UiPath plummeted by 34% the next day. For UiPath, this has made an already bad year an even worse one — the stock has now lost more than half of its value since January. And it’s now down around 57% from its 52-week high of $27.87.

A change in CEO isn’t the biggest reason to worry

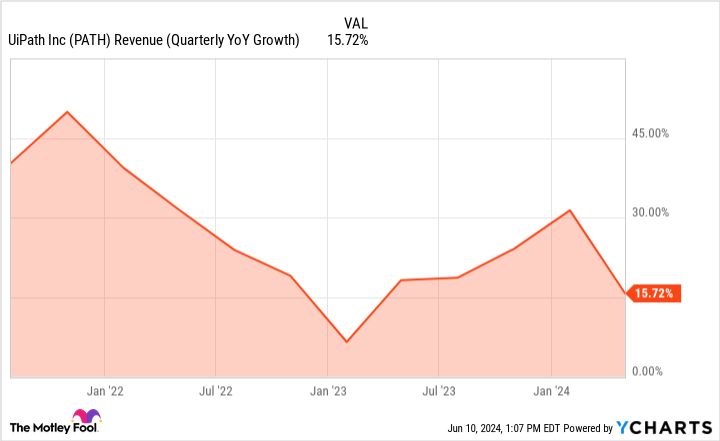

For prospective investors, there are multiple reasons to be worried about UiPath. The first is that its growth rate has been slowing despite a seeming uptick in interest surrounding AI and automation. The company’s Q1 revenue for the period ended April 30 totaled $335 million and was up 16% year over year. A few years ago, UiPath’s growth rate was far higher.

With many comparable services out there, the company faces a lot of competition, and just because interest in AI is taking off, it doesn’t mean that its sales will too.

PATH Revenue (Quarterly YoY Growth) data by YCharts

Another concern is a lack of profitability. Last quarter, UiPath incurred a net loss of $28.7 million, which was only slightly better than the $31.9 million loss it reported a year ago. While the company is going in the right direction and growing its business, that’s not resulting in a big payoff for the bottom line — at least, not yet.

Could more growth lie ahead?

The good news for long-term investors is that with AI there will inevitably be more opportunities for UiPath to grow its business. One example is through integrating with Microsoft‘s Copilot. Copilot is available in Microsoft’s suite of business software products and it uses AI to help draft emails, write memos, and do other tedious tasks.

But UiPath can help take it to the next level and add more opportunities for greater automation capabilities. UiPath says that it’s “one of the first ecosystem partners for Copilot for Microsoft 365 and Teams.” It may take time as businesses enhance their AI capabilities but with greater interest in automation and machine learning, there’s room for UiPath’s growth rate to improve through its partnership with Microsoft.

Is UiPath stock a buy?

UiPath’s stock has been struggling this year and I would hold off on investing in it just yet. There are a lot of competing services when it comes to automating repetitive tasks and it still has to prove that it offers superior products and services. That proof will come in the way of its financial results.

Right now, with UiPath’s growth rate slowing, it isn’t entirely convincing that this company is the real deal. And until there’s a more compelling reason to invest in the AI stock, investors are better off putting UiPath on a watch list rather than in their portfolios.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and UiPath. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.