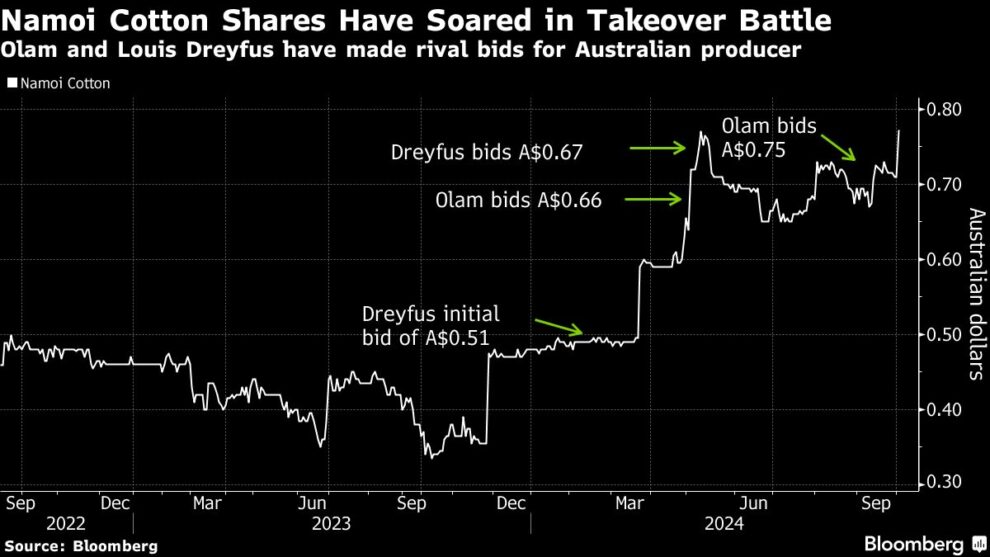

(Bloomberg) — Louis Dreyfus Co. raised its offer for Namoi Cotton Ltd. after acquiring nearly half of the Australian company’s shares, with Olam Agri Holdings Ltd. subsequently saying it would not extend its rival bid.

Most Read from Bloomberg

The two crop traders have been jostling to buy Namoi since January to gain a bigger foothold in Australia, the world’s sixth-largest cotton producer. Dreyfus’s most recent offer and it’s almost 48% shareholding has set it up to close the deal, given Olam looks like it will struggle to get support from more than half of Namoi shareholders.

LDC increased its offer to A$0.77 ($0.53) a share and said it now owned 47.66% of Namoi, according to an exchange filing on Tuesday. The bid, which values the cotton processor at A$158 million, is scheduled to close on Oct. 9. Samuel Terry Asset Management, Namoi’s biggest shareholder, had accepted its offer, Dreyfus said.

Olam said shortly after that it wouldn’t extend its offer for Namoi beyond Oct. 8. The Singaporean-based company’s most recent bid of A$0.75 a share was recommended by Namoi’s independent directors and major shareholders last month, but it ran into regulatory difficulties.

Subscribe to The Bloomberg Australia Podcast on Apple, Spotify, on YouTube, or wherever you listen.

Namoi shares rose 8.5% to A$0.77 as of 3:05 p.m. in Sydney, matching the LDC offer. The stock has rallied more 60% this year.

Dreyfus and Samuel Terry declined to comment, while Namoi didn’t immediately reply to requests for comment.

–With assistance from Harry Brumpton.

(Updates with details on Olam’s bid and share price from 1st paragraph. Earlier versions updated with additional details and corrected the currencies of the offers to Australian cents.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.