Advanced Micro Devices Inc. is about to get its turn to show if it was affected by problems in the chip market, or if it was able to capitalize on the weakness and siphon off market share from larger rival Intel Corp.

AMD AMD, +0.80% is scheduled to report first-quarter earnings after the closing bell on Tuesday, fresh on the heels of those from larger rival Intel INTC, -8.99% which saw its shares plummet Friday following a very scaled-back “cautious” outlook for the year. Back in January, AMD had forecast a weak first quarter but won investors with an optimistic 2019 outlook, when the chip maker said it expected “high single-digit percentage revenue growth” for the year when the Street was looking for 6% growth.

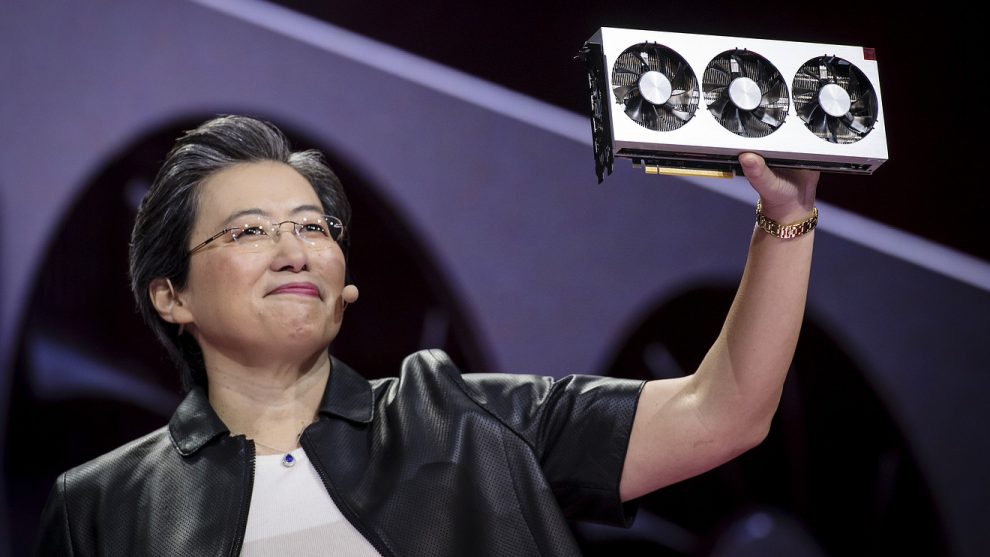

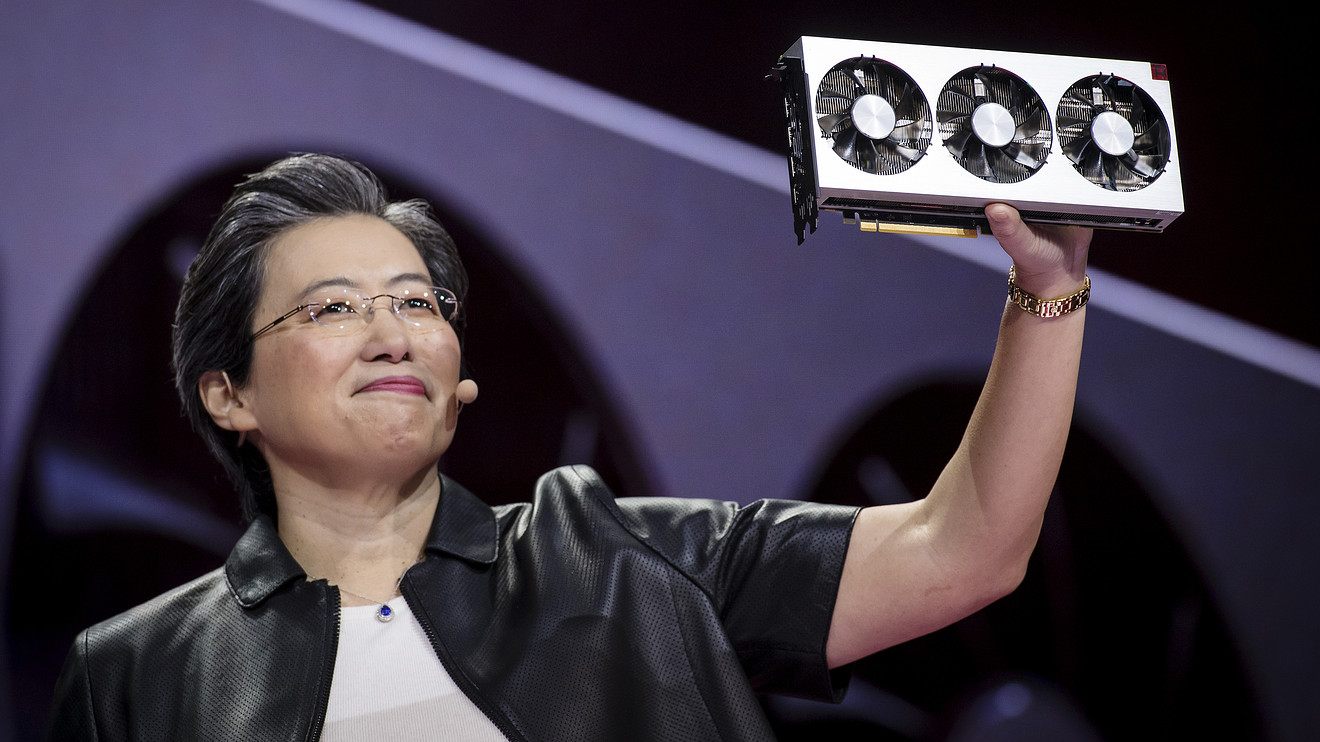

After Intel chopped billions off its annual forecast, AMD Chief Executive Lisa Su will have to prove she still believes AMD can actually live up to that forecast.

Opinion: Tech giants made so much money in 2018 that 2019 is bound to look pretty bad

Bernstein analyst Stacy Rasgon, who has a market perform rating and a $16 price target on AMD, said the company’s forecast “has given the bulls a solid handhold for now, even following a miss and sharp guide-down last quarter.”

“That being said, the key near-term controversy hinges upon the achievability of that outlook,” Rasgon said.

AMD has already benefited from central processing unit shortages from Intel, according to reports from IDC and Gartner, so that poses the question as to how “weak” AMD’s first quarter will be. Santa Clara, Calif.-based AMD also got a big boost in March when Alphabet Inc.’s GOOG, +0.69% GOOGL, +0.80% Google said its Stadia streaming videogame service would be powered by custom AMD chips.

What to watch for

Earnings: Of the 28 analysts surveyed by FactSet, AMD on average is expected to post adjusted earnings of 5 cents a share, down from 11 cents a share in the year-ago period and down from the 8 cents a share expected at the beginning of the quarter. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, calls for earnings of 7 cents a share.

Revenue: Wall Street expects revenue of $1.27 billion from AMD, according to 28 analysts polled by FactSet. That’s down from the $1.49 billion expected at the start of the quarter and from the year-ago period’s $1.65 billion. Estimize expects revenue of $1.29 billion.

Analysts surveyed by FactSet expect computing and graphics sales to decline 23% to $855.6 million from the year ago quarter, and enterprise embedded and semi-custom sales to decline 10% to $479.9 million.

Stock movement: AMD shares have rallied 45% since the company’s previous earnings report in late January, while the PHLX Semiconductor Index SOX, -0.83% has gained 25% since late January, the S&P 500 index SPX, +0.47% is up 11%, and the tech-heavy Nasdaq Composite Index COMP, +0.34% is up 16%.

What analysts are saying

Instinet analyst David Wong, who started coverage on AMD with a buy rating in early April, said he was encouraged by several aspects in the chip maker’s business because of “solid” positioning in both the CPU and graphics processing unit markets, which Intel and Nvidia Corp. NVDA, -4.72% dominate, respectively.

“Though the near-term GPU outlook remains messy until July and likely weighs on 1H19 results/guidance, we are increasingly confident in AMD’s 7nm x86 PC and server CPU road map and competitive positioning against Intel as midyear product launches near,” said Cowen analyst Matthew Ramsay in a recent note. Ramsay has a buy rating and a $33 price target on AMD.

See also: The promise of a magical rebound for tech comes with little evidence to back it up

“Sources in the PC supply chain indicated to us that they expect AMD’s PC-CPU share to increase to the low-to-mid-teens over the next several quarters, with more AMD programs ramping in 2H19,” said Jefferies analyst Mark Lipacis in a recent note.

“Intel’s mis-execution on 10nm appears to have created a need in the supply chain to diversify CPU supply by giving AMD higher market share,” he said. Lipacis has a buy rating and a $34 price target on AMD.

Of the 36 analysts who cover AMD, 15 have buy or overweight ratings, 16 have hold ratings and five have sell or underweight ratings, with an average price target of $24.70.

Get the top tech stories of the day delivered to your inbox. Subscribe to MarketWatch’s free Tech Daily newsletter. Sign up here.