Advanced Micro Devices Inc. is the chip maker to watch this earnings season, as the company takes on Intel Corp. and Nvidia Corp. amid problems in the sector that are expected to show signs of improvement.

AMD AMD, +3.55% is scheduled to report second-quarter earnings on Wednesday, July 24.

What to expect

Earnings: Of the 29 analysts surveyed by FactSet, AMD on average is expected to post adjusted earnings of 8 cents a share, down from the 9 cents a share expected at the beginning of the quarter. Estimize, a software platform that uses crowdsourcing from hedge-fund executives, brokerages, buy-side analysts and others, calls for earnings of 9 cents a share.

Revenue: Wall Street expects revenue of $1.52 billion from AMD, according to 28 analysts polled by FactSet. AMD predicted revenue of $1.47 billion to $1.57 billion. Estimize expects revenue of $1.54 billion.

Stock movement: AMD shares are up more than 24% since the company last reported earnings. In comparison, the S&P 500 index SPX, +0.02% has gained 2.3%, the tech-heavy Nasdaq Composite Index COMP, +0.17% has advanced 2.6%, and the PHLX Semiconductor Index SOX, +0.77% has declined 2.6% in that time.

Of the 34 analysts who cover AMD, 15 have buy or overweight ratings, 15 have hold ratings and four have sell or underweight ratings, with an average price target of $30.28, 12% lower than Monday’s record high close of $34.39.

What to look for in the call

At the beginning of the year, AMD was forecasting a better year than other chip makers, but relief to the beleaguered chip sector may be coming earlier than expected as research firms Gartner and IDC reported a rise in global PC shipments for the second quarter.

“Although we think there remain risks for the PC markets (and other electronic end markets), we believe that these latest estimates reflect positively on Intel INTC, +0.40% and AMD,” Instinet analyst David Wong wrote in a recent note. “In addition, we anticipate that new products from Intel and AMD could well provide some additional stimulus for the PC and server end markets in the second half of this year.”

For more: Rush to beat China tariffs drives PC shipments higher, but that may bode ill for rest of 2019

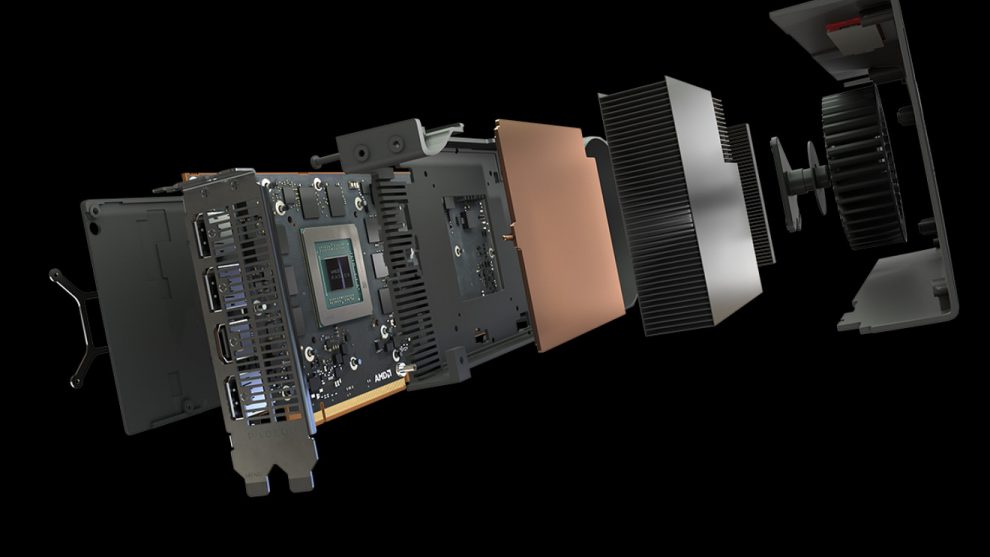

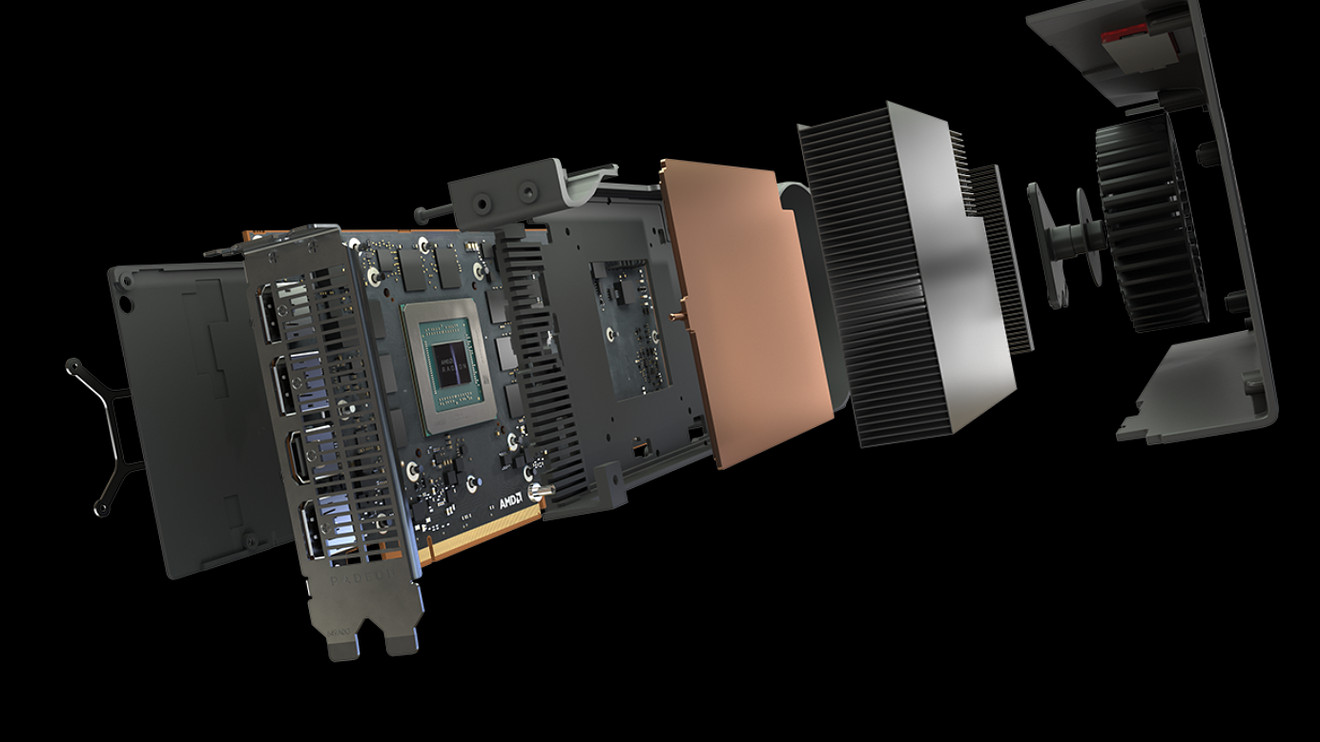

AMD launched its Ryzen desktop CPUs and APUs as well as new Navi GPUs recently, and those sales will figure in the third-quarter outlook. Wong has buy ratings on both AMD and Intel.

Susquehanna Financial Group analyst Christopher Rolland, who has neutral ratings on both AMD and Intel, said AMD had already gained share ahead of its recent product launches.

“AMD launched its first Ryzen 7nm CPUs on July 7, but already has achieved desktop share of 19.1% in 2Q19 (highest share in 5+ years),” Rolland said. “To combat these share gains, we have heard (our recent Asia trip) that Intel is offering price cuts of up to 15% on its Coffee Lake CPUs.”

Tech earnings preview: A test amid tumultuous times, and all the chips are on the table

In chip parlance, nanometers, or nm, refers to the size of the transistors that go on a computer chip, with the general rule being that smaller transistors are faster and more efficient in using power.

Also, AMD announced a price cut to its Radeon 5700 series graphics card just days after NVDA, -0.20% announced a line of competing cards in the arm race between the two companies.