Walt Disney Co. is locked in a nasty proxy fight with an activist investor as it prepares for its first earnings report since the return of its longtime CEO.

Just another ho-hum quarterly report from the Magic Kingdom, which is navigating an austerity program while fending off some of the biggest media companies in the world for consumers’ entertainment dollars.

Disney DIS, -0.04% on Wednesday is scheduled to report fiscal first-quarter results with Chief Executive Bob Iger back in charge. Among his action items is propping up the stock to help fend off billionaire Nelson Peltz and his hedge fund, Trian Fund Management. Trian, which has amassed about $1 billion in Disney stock, wants the media giant to revamp its streaming business, lift profit growth, trim costs, reinstate its dividend, and improve succession planning. Trian also targeted Disney board member Michael Froman, vice chair of Mastercard Inc. MA, -0.79% and one of the 12-person board’s longest-serving members, calling for him to be replaced by Nelson Peltz or his son, Matthew Peltz.

Iger’s 59th quarterly earnings report as Disney CEO will require a bravura performance of tone-setting messaging and agenda-changing proclamations, according to financial analyst

“With a proxy battle looming, management’s best avenue to defend against activism is a higher stock price,” Wells Fargo analyst Steven Cahall said in a recent note. “We expect DIS to back away from FY24 DTC subscriber targets, in favor of empowering content creation and streaming profitability.”

UBS analyst John Hodulik, in a mid-January note, expressed confidence that Iger — who succeeded short-term Disney CEO Bob Chapek in November — can expect to benefit from improved Disney+ revenue via new pricing and an advertising tier, and an upward trajectory in park revenue. The box office success of “Avatar: The Way of Water,” now up to $1.54 billion in ticket sales, should help greatly.

What to expect

Earnings: Analysts tracked by FactSet expected Disney to post 79 cents a share in adjusted earnings, down from 63 cents a share a year ago. According to Estimize, which crowdsources projections from hedge funds, academics, and others, the average estimate was 79 cents a share in adjusted earnings.

Revenue: The FactSet consensus called for Disney to post revenue of $23.4 billion for its first quarter, up from $21.8 billion a year prior. Those contributing to Estimize were looking for $23.4 billion in sales.

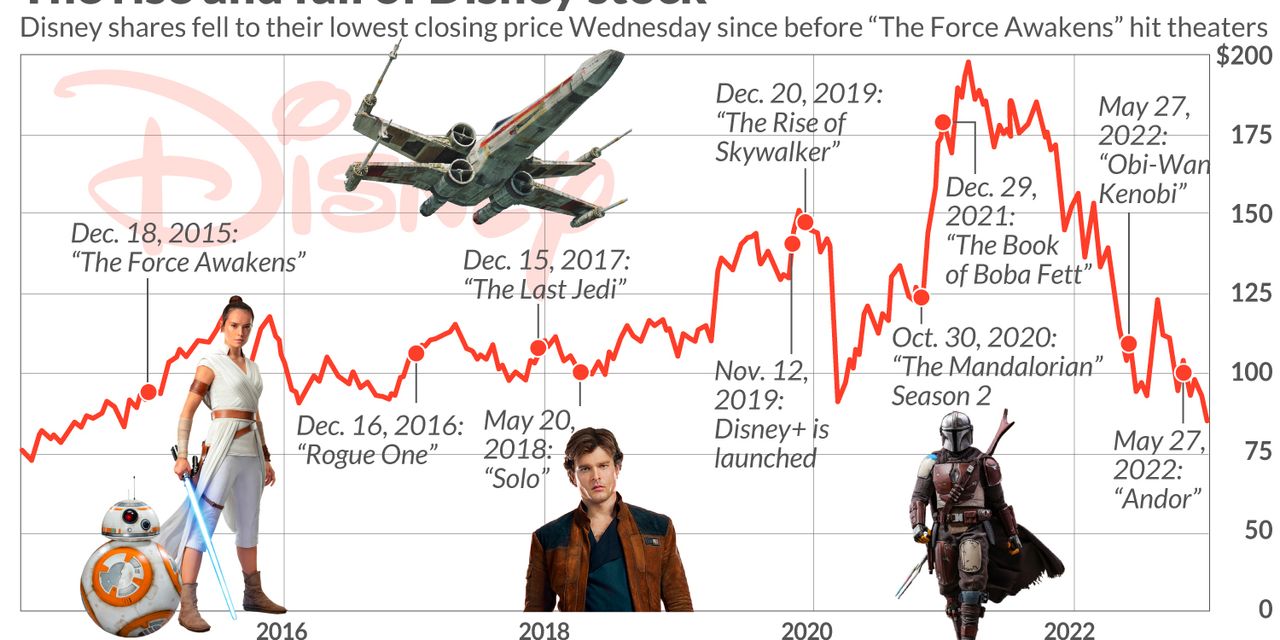

Stock movement: Shares of Disney have lost 23% over the past 12 months, while the S&P 500 SPX, -0.29% has declined 9%.

What else to watch for

Industry watchers in the entertainment industry believe Disney+ will hold its own, if not gain ground, on rivals Apple Inc. AAPL, +0.26%, Netflix Inc. NFLX, -1.63%, Amazon.com Inc. AMZN, -3.44%, Comcast Corp. CMCSA, -0.95%, Paramount Global PARA, -4.43%, AT&T Inc. T, -2.17%, and others for several reasons.

“Competition in streaming is heating up with Netflix launching an ad-supported tier. Disney has incredible assets with Hulu, Disney+ and ESPN+ but the key to success is packaging up audiences in combination with linear television ads,” Bill Wise, CEO of Mediaocean, told MarketWatch. “Recent deals with VideoAmp, EDO, and Samba TV are a sign that Disney recognizes the cross-screen imperative and that bodes well for future growth.”

Disney’s shift from acquiring Disney+ customers to retaining them — a strategy mirrored by Netflix — plays within its wheelhouse since it appeals as a “year-round ‘must have’ service for the family,” Dallas Lawrence, senior vice president at Samba TV, told MarketWatch.