Traders work on the floor of the New York Stock Exchange (NYSE) on November 04, 2019 in New York City.

Spencer Platt | Getty Images

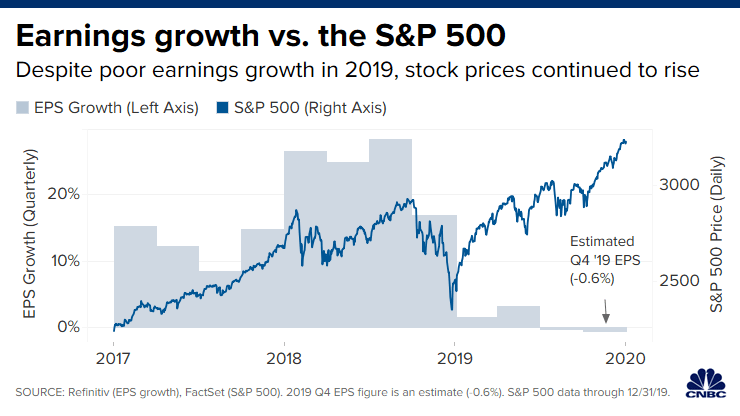

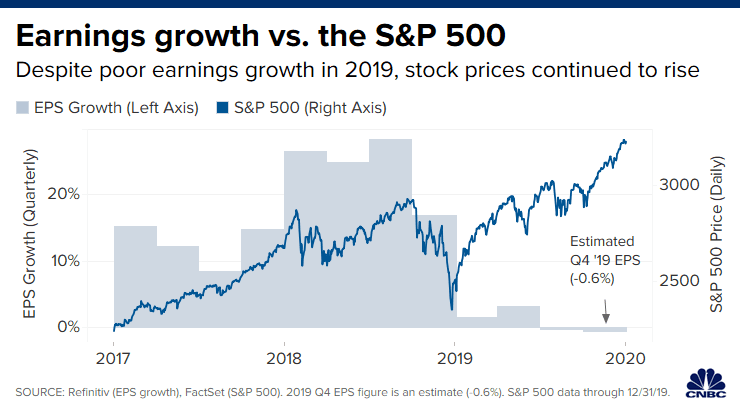

This week’s kick-off of the fourth quarter earning season comes with low expectations for profit growth but high expectations for stock prices.

Earnings are expected to decline by 0.6% for the S&P 500, according to Refinitiv. At the same time, major market indices are at new highs.

The two phenomena seem disjointed, and a recipe for a sell-off of some size. But strategists say stocks could continue higher, any pullback should be shallow, and companies are probably going to handily beat those reduced forecasts.

“We expect to see a 2% beat in 4Q earnings. Estimates have reset sufficiently, in our view,” wrote Bank of America Securities stock strategists, adding estimates are down 5% over the past three months. “Consensus expects the biggest margin drop since 4Q18 (when tariffs started to hit), which we think is too bearish.”

If earnings don’t beat the slightly negative forecast, it would be the second quarter in a row of profit declines, or an earnings recession. According to Refinitiv, earnings declined 0.3% in the third quarter.

“What would be a surprise is if you don’t have the typical beat rate,” said Julian Emanuel, head of equity and derivatives strategy at BTIG. Companies often beat earnings estimates at a pace of 70% or more.

Emanuel said that he expects “offensive” sectors, like financials and health care to continue to head higher, over “defensive” plays, like utilities or consumer staples.” He said the market “turned” significantly in the beginning of September, when the yield curve began to steepen, sentiment began to improve, and the Fed balance sheet was at its recent low.

“We think the stocks that turned with all these turns in the fourth quarter will continue to work through earnings season,” he said. “Analysts have been taking those numbers down in financials…and yet they’ve had a history of beating on their earnings at the same time they start outperforming, after protracted underperformance.”

Bank earnings kick off the season

Financial sector earnings are expected to grow at 11.3%, a solid gain but lower than the 12.3% expected back on Jan. 1, according to Refinitiv data. Since Sept. 1, the sector is up 15%.

J.P. Morgan, Citigroup, Wells Fargo, and Delta Air Lines report Tuesday, in the first big day of earnings. (See complete coverage.) Bank of America, BlackRock, and Goldman Sachs report Wednesday.

“The more cyclical areas beating their estimate have a much higher probability of having that translate into stock price gains, looking out over the next month or two than many of the defense areas, where they have estimates revised up and their stocks continue to lag,” Emanuel said.

Market pullback?

Strategists say it’s possible, but not necessarily likely, that earnings season could be the catalyst for a stock market sell-off.

Sam Stovall, chief investment strategist at CFRA, points out that the price to earnings ratio for the S&P 500, at 19.3 on a forward basis, an identical level to that in January 2018, just ahead of the market’s last big correction in February 2018.

“We’ve got to correct in price or in time. In terms of time, it’s let’s wait for the earnings season to catch up with us,” he said. “If it’s price, we digest some of the gains, similar to what happened in 2018, where we might have some exogenous event that scares us.”

Stovall said a correction could be as steep as 5% to 10%.

James Paulsen, chief investment strategist Leuthold Group, said the market can keep going higher, but it will ultimately need to see better profits, as many analysts are forecasting for later in the year.

“Profits do not need to be robust this year for the stock market to do well. Yields are very low, policy support is quite strong, and most investors are under-allocated toward risk,” he said. “Consequently, even modest earnings gains should keep the bull healthy. Nevertheless, earnings need to show life soon or “end of cycle anxieties” seem likely to overtake the stock market.”

Emanuel said there are signs the overbought market could pull back, including the CBOE total put/call ratio which has been at an extreme reading. There is a high level of calls, or bets on higher stock prices, and that can signal investor complacency, a contrarian indicator. “Last week’s reading appears to suggest that the stock market, overbought in the wake of the [fourth quarter] rally, may be due for a pullback, or at least a breather,” Emanuel notes.

But a positive that supports the stock market is the Fed’s program to add liquidity to the market through Treasury bill purchases. The Fed stopped shrinking its balance sheet and has cut interest rates three times, after a rate hiking cycle. That is in contrast to early, 2018 when the Fed was looking to raise interest rates.

BofA analysts said Wall Street is too bearish when it comes to its view on profit margins. They said the market expects the biggest quarter-to-quarter margin contraction since the fourth quarter of 2018, when tariffs started to hit, to 10.5%. “But our Corporate Misery Indicator, a macro gauge of margins, ticked up in 4Q after five straight quarters of declines,” they noted.

While earnings forward guidance is often market moving, the BofA analysts say first-quarter guidance is typically conservative and price reactions to lowered first-quarter guidance is usually less severe than other quarters.