Charity by William Adolphe Bouguereau

Superstock/Everett Collection

The Issue:

Research and policies aimed at addressing poverty tend to focus on family income. Yet, the future financial resilience of U.S. households with children will be shaped not only by the income they earn but also by their wealth holdings.

Wealth is a critical resource that enables households to deal with unexpected economic shocks—including recent experiences of job loss related to the pandemic—when parents must draw on saved assets to meet the needs of their children. Wealth, like income, supports parental investments in their children and reduces family stress; wealth also can inform and direct parents’ hopes and expectations about their children’s futures.

“ More households are vulnerable to having insufficient economic resources than previous research suggests. ”

Importantly, the negative correlations between child-development outcomes and wealth cannot statistically be attributed to income. Children living in households that have similar income levels but lower levels of wealth have increased risk of compromised academic outcomes—including college enrollment and college attainment—as well as greater risk of negative behavioral outcomes.

The Facts:

Households that have scarce wealth holdings can be considered “net-worth poor.”

In our research, we define net-worth poverty as net-worth levels that are less than one-fourth of the federal poverty line. This threshold measures whether a household has a stock of assets sufficient to meet its basic needs, as defined by the poverty line, for three months. A family of four would be classified as “net-worth poor” if their wealth were less than $6,500 in 2019.

“ The long-term consequences of growing up with insufficient economic resources (such as the effects on children’s education) are particularly acute and enduring. ”

Wealth, or net worth, is the value of total household assets—which typically include savings and checking accounts, retirement accounts, and the value of a family’s home, among others—less total debts, such as mortgages, credit-card debt, and car or educational loans.

Wealth, or net worth, for households with children has declined in recent years, putting many families at risk of “net-worth poverty.”

Households with children in the bottom half of the wealth distribution had lower levels of median wealth in 2016 than in 1989, with Black households experiencing the largest relative declines. Our study provides the first estimates of net-worth poverty among child households, defined as households with at least one resident child under the age of 18.

“ Factors such as structural racism can particularly impact net-worth poverty by restricting accumulation of assets. ”

We focus on child households because the long-term consequences of growing up with insufficient economic resources (such as the effects on children’s education) are particularly acute and enduring. Our data come from the 1989-2019 waves of the Survey of Consumer Finances (SCF), which offers rich data on both income and wealth.

One-third of child households were net-worth poor in 2019, three times as many as were income poor.

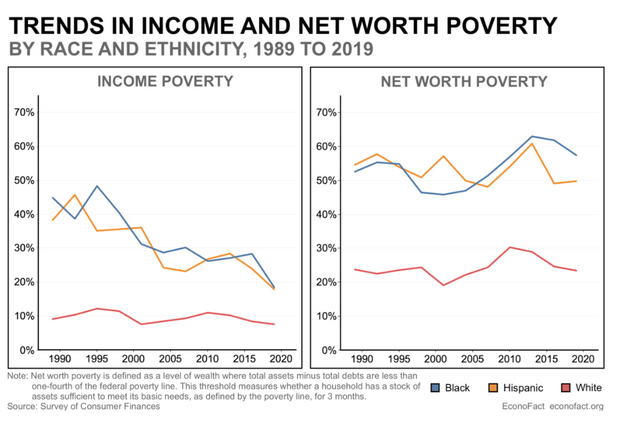

In 2019, 35% of child households were net-worth poor whereas 11% were income poor. Moreover, during a time when income poverty rates for child households have been falling, net-worth poverty rates among child households have largely been stagnant or even rising since 1989.

The majority of households that were net-worth poor were not income poor, indicating that these households would be overlooked by policies and programs that focus exclusively on income poverty, and that more households are vulnerable to having insufficient economic resources than previous research suggests.

The majority of Black-child households are net-worth poor, and racial gaps in net-worth poverty exceed those for income poverty.

In 2019, 57% of Black-child households were net-worth poor, compared to only 22% for white-child households. The Black-white gap in net-worth poverty has grown over time, whereas the gap in income poverty has not (see chart). Latino-child households were twice as likely to be net-worth poor as were white families, though the Latino-white net-worth poverty gap has not increased statistically over time.

Income poverty has fallen over time for Black and Latin families, but net-worth poverty has not.

Disparities in net-worth poverty between Black- and white-child households cannot be fully explained by differences in characteristics such as education, marital status, or age that have been found to predict income poverty. Factors such as structural racism can particularly impact net-worth poverty by restricting accumulation of assets (such as historical strategies that have impeded homeownership among Black families) and affects the presence of predatory-lending behavior (see here and here).

Net-worth poverty is more common than income poverty among all child households, but a substantial fraction of nonwhite households with children experience both types of economic scarcity.

Across years, two-thirds to three-quarters of white-child households were neither income poor nor net-worth poor. In contrast, in any given year, between 54% and 67% of Black- and Latino-child households experienced income poverty, net-worth poverty, or both types of poverty. The most common type of poverty, among those who were poor, was net-worth poverty.

Approximately 15% of Black and Latino households were both net-worth and income poor, suggesting that they may be particularly economically vulnerable.

Differences in net-worth poverty among racial and ethnic groups are not merely a reflection of differences in homeownership.

One-fifth of Black-child and one-fourth of Latino-child households in 2019 experienced net-worth poverty even if they owned homes. High rates of Black net-worth poverty for homeowners are consistent with the contention that policies promoting homeownership would be insufficient to close the Black-white wealth gap (see here).

Policy solutions focused solely on income enhancement will likely do little to support wealth accumulation or reduce wealth deficits on their own.

Regulating predatory-lending behavior, including underwriting of mortgages and loan structure, that occurs at higher rates in low-income and communities of color can also reduce net-worth poverty traps by preventing foreclosure and debt accumulation. Such regulation could be coupled with opportunities to be banked and access credit at low fees with the formal financial sector that is particularly relevant given that our findings show that net-worth poverty is not reducible to homeownership.

Child-directed policies to reduce intergenerational transmission of wealth deficits, such as baby bonds and child development accounts that are gaining public and political support, are additional considerations, though the implementation of such strategies to date have had mixed success (see here, here, and here).

What This Means:

A focus on income deprivation alone will tend to overlook the precarious economic conditions related to family net worth and ignore growing disparities in wealth by race and ethnicity. The increasing prominence of net-worth poverty in the lives of child households before the pandemic, particularly those who are Black or Latino, underscores the economic precarity faced by many children in the U.S.

Whether this vulnerability has translated to disproportionately harsher impacts from the pandemic is unknown. Policy attention should be paid to both income and net-worth poverty. Children who are net-worth poor, but not income poor, have been overlooked but may nevertheless be a vulnerable group.

This commentary was published with permission of Econofact — Many Families With Children Experience a “Hidden” Source of Poverty

Editor’s Note: The analysis in this memo is based on “Net Worth Poverty in Child Households by Race and Ethnicity, 1989-2019,” C.M. Gibson-Davis, L.A. Keister, L.A. Gennetian. Journal of Marriage and Family (2020).

Christina Gibson-Davis is a professor of public policy and sociology at the Sanford School of Public Policy at Duke University. Lisa A. Keister is a professor of sociology at Duke University. Lisa A. Gennetian is an associate professor of early learning policy studies at the Sanford School of Public Policy at Duke University.

More on the wealth gap

Millions of families have no financial cushion to last three months

Meritocracy isn’t an alternative to inequality — it’s a justification, says this Harvard philosopher

Woodrow Wilson’s segregation policies of 100 years ago decimated the Black middle class for decades