Get used to paying more for food, gas, autos and a variety of other goods and services. High U.S. inflation is going to stick around for awhile.

The Federal Reserve had contended for months that a bout of high inflation this year would be short-lived. Yet the central bank has finally admitted that the reversal in inflation is going to take longer than it thought — perhaps a lot longer.

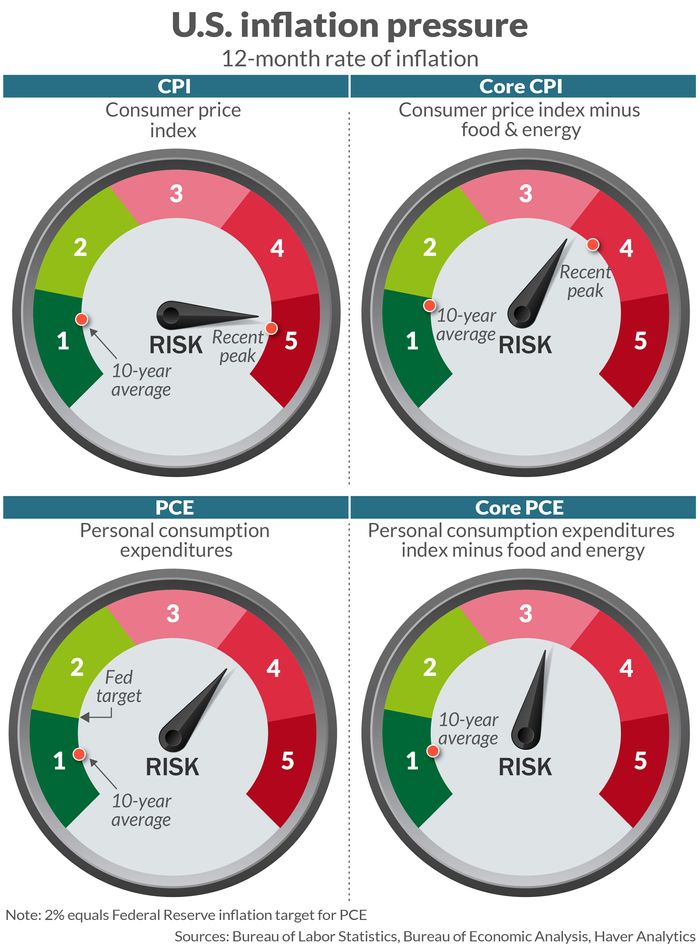

The Fed on Wednesday raised it estimate of average inflation this year to 4.2% from 3.4%, using its preferred PCE inflation gauge. The next PCE report is on Friday.

See: MarketWatch Economic Calendar

Just 10 months ago, the Fed was expecting inflation to average just 1.8% in 2021.

A separate and more widely known inflation barometer, the consumer price index, shows inflation cresting at an even higher 5.3% yearly pace.

Read: The Fed has bet on a future of low inflation. Here’s what could go wrong

The central bank officially predicts inflation will drop back down to 2.2% in 2022, but that’s 0.4 percentage points higher than its forecast last December. It’s still a sizable increase for an conservative institution prone to incremental changes in forecasts.

What’s more, many Wall Street DJIA, +0.10% economists and even some top Fed officials doubt inflation will decelerate quite as rapidly as the central bank’s official forecast suggests. They point to widespread shortages of labor and business supplies that are worse than anyone expected and aren’t letting up.

The labor shortage is forcing companies to pay higher wages to retain existing talent and to hire new employees . In some cases, that’s led businesses to sharply raise prices even though demand is still depressed.

Take hotels. The cost of renting a room is 9% higher compared to pre-pandemic levels even though total spending is down 16%, noted Kansas City Federal Reserve President Esther George.

A shortage of business supplies is an even bigger problem. Companies cannot obtain enough materials or components to keep production running at full bore, and even when the supplies are available, they are paying sharply higher prices.

Not surprisingly, companies are trying harder than they have in years to pass those extra costs onto customers. Fedex FDX, -1.00% just announced it would raise shipping costs in 2022 by almost 6% to mark the biggest increase in eight years.

At the giant retail-club Costco COST, +3.31%, meanwhile, the company’s chief financial officer said this week that inflation is increasing the cost of what they sell by 3.5% to 4.5%. That’s going to hit consumers hard in their wallets and pocketbooks if it keeps up.

Read: Fed ‘dot plot’ signals higher U.S. interest rates in 2022, but Powell warns it’s not set in stone

It’s not all bad news. Assuming the pandemic doesn’t get any worse, economists say, the labor and supply shortages should fade over time. That will relieve a lot of price pressures.

Consider autos. Carmakers can’t make enough cars to meet demand because of a global shortage of computer chips tied to the pandemic. These shortages are expected to ease in 2022 and disappear by 2023, analysts say, and put an end to a record surge in prices.

Government spending is also helping to ease the blow on consumers from higher prices. Americans have been willing to pay more in part because their savings are high owing to federal stimulus.

Read: The pre-Covid economy is not coming back, Fed’s George says

An unsually large increase in Social Security benefits next year will also help retired Americans. The cost of living adjustment is likely to be a whopping 6% in 2022.

Yet it’s unlikely consumers would remain so tolerant if inflation remains above 3% over the next year. For millions of workers that would wipe out their annual increase in pay.

The Fed is still betting it won’t come to that.

“Inflation is elevated and will likely remain so in coming months before moderating,” Fed Chairman Jerome Powell said at the bank’s most recent strategy session. “While these supply effects are prominent for now, they will abate. And as they do, inflation is expected to drop back toward our longer run goal.”

Add Comment