Getty Images

Getty Images

The U.S. economy is being powered by the most muscular labor market in arguably 50 years and it’s unlikely to diminish much in strength anytime soon.

Economists predict another robust increase in hiring in April. Here’s what to watch in Friday’s employment report.

200,000-plus new jobs

The U.S. likely added 213,000 new jobs last month, according to economists polled by MarketWatch.

Such a sizable increase would be a bit surprising after the pace of hiring slowed to an average of 180,000 a month in the first quarter of 2019. But there might be a good reason: The government is already beginning to hire workers to conduct the 2020 Census.

Morgan Stanley is even more bullish. “We look for a large 233,000 gain in total nonfarm payrolls, boosted by early hiring for the 2020 Census on top of robust private employment growth,” the firm told clients.

Odds of a shortfall

Don’t be shocked if job gains fall short, however. Manufacturers and construction firms have cut back on hiring because of slower sales and greater difficulty in finding skilled workers to fill open jobs. And retailers have eliminated more than 30,000 jobs this year.

The weakness in some portions of the economy helps explain why monthly hiring has fallen off last year’s pace of 223,000 a month.

Read: Americans say it’s easier to find a job now than at any time in the past 18 years

Low unemployment

Wall Street is looking for the unemployment rate to fall a tick to 3.7%, matching the lowest rate of an expansion that began in 2009 and reaching back to levels last seen in the late 1960s.

The demand for labor is even inducing many Americans who dropped out of the labor force to look for work again.

Read: Has the economy finally found the secret sauce to faster growth and worker paradise?

Wages

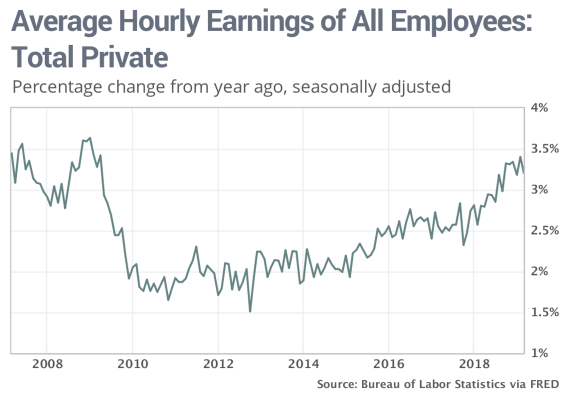

What’s also pulling more Americans back into the labor market is rising wages. Economists predict hourly wages increased 0.2% in April, keeping the increase over the past year at a little over 3%.

Although worker pay is increasing at the fastest pace in about a decade, the growth in wages appears to have leveled off. Wages typically rise 3% to 4% a year in the best of times.

The upside of stable wages is stable inflation. So long as inflation remains low, as it is now, the Federal Reserve will hold raising interest rates. The result is low borrowing costs for home buyers, small businesses and large companies — more fuel for economic growth.

Read: Mortgage rates tumble as one economist waves the white flag