Getty Images

Getty Images

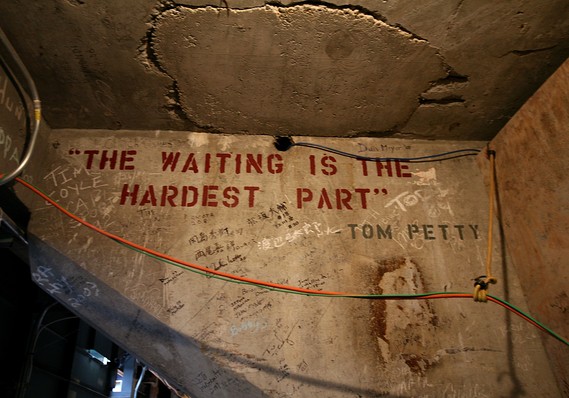

The waiting, rock star Tom Petty once sang, is the hardest part. But that’s what anxious investors will have to do.

Wait to see if the trade war with China is hurting the economy. Wait to see if President Trump’s next tweet triggers another stock-market selloff DJIA, -0.34%. And wait to see if the Federal Reserve signals another cut in interest rates.

Read: China fight seen dragging on through 2020 in threat to economy, Trump reelection

By some measures, the trade war has undoubtedly hamstrung parts of the economy. Farmers, manufacturers and exporters have borne the biggest brunt of the dispute.

Yet the kingpins of the economy — you, the worker and consumer — continue to spend enough to keep the U.S. expanding for a record 11th straight year. Americans have mostly ignored the spat with China, feeling secure enough in their jobs with layoffs and unemployment both near a 50-year low.

The headliner in a slew of economic reports this week is likely to show more of the same. Sales at U.S. retailers in July are forecast to rise again.

See: MarketWatch Economic Calendar

It could get even better, too. Falling interest rates have spawned a frenzy of new mortgage refinancings that are “putting more money in peoples’ pockets,” noted senior economist Sal Guatieri of BMO Capital Markets. “Consumers continue to spend freely.”

The same cannot be said for manufacturers.

Industrial production has slowed and investment, too. A trio of reports this week is likely to show little improvement in heavy industry, especially with new tariffs on $300 billion in Chinese imports set to kick in next month.

The uncertain effects of the new tariffs has fueled a growing belief on Wall Street that the Fed will cut interest rates again in September. And perhaps once more by the end of the year.

What could give the central bank more leeway to do so is the recent drop off in inflation. A pair of inflation barometers this week on consumer prices and the cost of imports aren’t going raise any alarms. Both are expected to show inflation is stable or even waning.

When it comes to the White House, however, Wall Street has come to expect the unexpected, usually via the president’s Twitter feed.

“Right now, the economic data are playing second fiddle to presidential tweets,” said Joel Naroff of Naroff Economic Advisors. “It’s all about the trade war. And that is a real problem for the Fed.”

Read: Trump is already painting the Fed as scapegoat if the economy tanks

Indeed, it is. The Fed is determining interest rates based on the ups and downs of U.S. negotiations with China, less so on what’s going on in the real economy right now.

In other words, watching and waiting.