Bloomberg

Bloomberg The numbers: Americans increased spending in September for the seventh month in a row but did so at a more moderate pace, keeping the economy expanding at a steady if unspectacular rate.

Consumer spending rose 0.2% last month, the government said Thursday. That’s a touch below the 0.3% MarketWatch forecast.

Taking advantage of rising incomes and falling interest rates, consumers boosted spending by a robust 2.9% in the third quarter after a heady 4.6% increase in the spring. They’ve kept the economy moving forward even as businesses scale back.

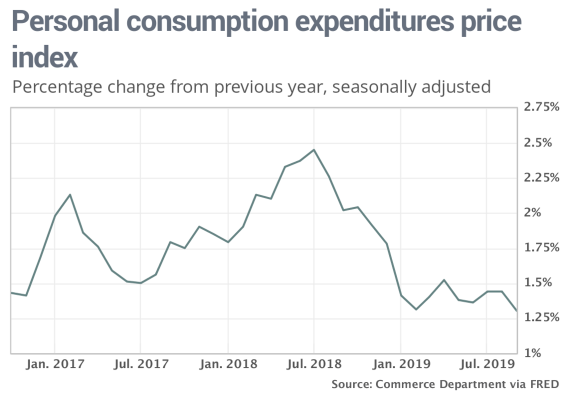

A key barometer of inflation, meanwhile, was unchanged in September. The Federal Reserve on Wednesday cited low inflation as one of the reasons it cut interest rates for the third time this year.

Read: Consumer sentiment shows Americans still fairly optimistic

What happened: Americans spent more on new cars and trucks in September. Falling interest rates have made it less expensive to buy big-ticket items such as autos or homes. Spending on health care also increased.

What’s enabled households to keep spending are steadily rising incomes, an offshoot of the tightest labor market in half a century. Incomes rose 0.3% in September.

At the same time, though, many households are trying to sock some money away. The savings rate moved up to 8.3% from 8.1%, keeping it near a postrecession high. Fewer Americans compared to a decade ago are spending beyond their means.

Inflation, for its part, poses little threat to costs for consumers.

The Fed’s preferred inflation barometer known as the PCE index was flat in September on both an overall and core basis, which excludes food and energy prices.

The 12-month rate of inflation slowed to 1.3% from 1.4% — well below the Fed’s 2% target. That matches the reading in February as the lowest in three years.

The more closely followed core measure dip to a 1.7% yearly rate from 1.8%.

Fed Chairman Jerome Powell said on Wednesday the central bank won’t even consider raising U.S. interest rates again until inflation reaches its target of 2% and stays there. The Fed views a stable 2% inflation rate as the best-case scenario to ensure a smoothly running U.S. economy.

Read: ADP says 125,000 private-sector jobs created in October

Big picture: The story of the longest economic expansion in American history is being written these days by strong consumer spending. Outlays have risen sharply for two quarters in a row, offsetting a big decline in business spending and investment.

Read: Confident consumers keep U.S. economy plugging along, GDP shows

Companies have scaled back production and hiring in response to slower sales and profit growth. The trade war with China and a teetering global economy have added to the angst.

The U.S. economy should be OK, however, so long as businesses avoid mass layoffs. Consumers are still confident because they still have jobs — unemployment has fallen to a 50-year low.

Market reaction: The Dow Jones Industrial Average DJIA, +0.43% and S&P 500 SPX, +0.33% were set to open modestly lower in Thursday trades. The S&P set an all-time high earlier this week.

The 10-year Treasury yield TMUBMUSD10Y, -2.07% fell to 1.73%.

Add Comment