Getty Images

Getty Images

It’s bad enough that the U.S. added only 75,000 jobs in May. Drilling down further into the report, there’s another worrisome feature.

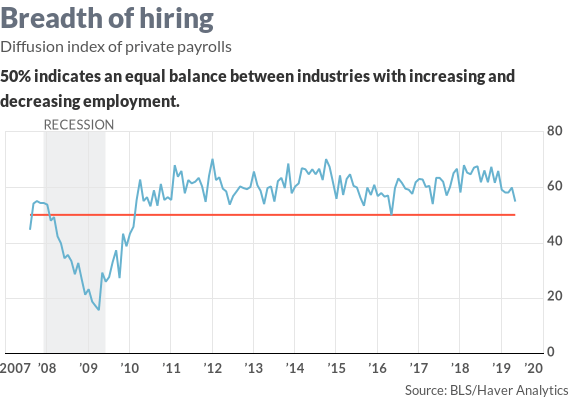

The diffusion index, which measures the percent of industries hiring, fell to a two-year low of 54.8%. Any reading above 50% indicates more companies are hiring than not.

This means that the hiring slowdown isn’t concentrated just in one field, something that is also clear in the sector breakdown of the report.

Manufacturing hiring was weak for a second month—no surprise given tensions over U.S. trade policy, a strong dollar DXY, -0.50% and slowing world economic growth—but the weakness spread much further.

Construction job growth dropped from 30,000 to 4,000. Transportation and warehousing—think Amazon AMZN, +2.83% among others — went from 6,700 to minus 200. Temporary help nearly was halved, falling to 5,100 from 9,900.

Also: U.S. creates just 75,000 jobs in May and wage growth slows in warning sign for economy

If you’re looking for silver linings, the diffusion index remained positive. In May 2016, the index very briefly went below 50%, when there were just 15,000 jobs created during the month, but growth bounced back strongly that June.

There’s reasons though why this May report may be gloomier. Keep in mind this jobs report doesn’t reflect the May 30 announcement that President Trump was considering tariffs on Mexico — companies reported their figures to the Labor Department in mid-May. The full pessimism of the China talks may not have been fully baked in, either.

Surveys of purchasing managers activity in both manufacturing and services have sunk to multi-year lows.

U.S. stocks DJIA, +1.02% SPX, +1.05% are rallying on Friday, but for the perverse reason that the market expects the weak jobs numbers will spur the Federal Reserve to lower interest rates.

“This is a disappointing payrolls report across-the-board on the headline, revisions and underlying details. The case for a Fed rate cut is very strong,” said Derek Holt, head of capital markets economics at Scotiabank.

Related: If Fed wants to inject positive surprise, June interest-rate cut might be the way