Getty Images

Getty Images

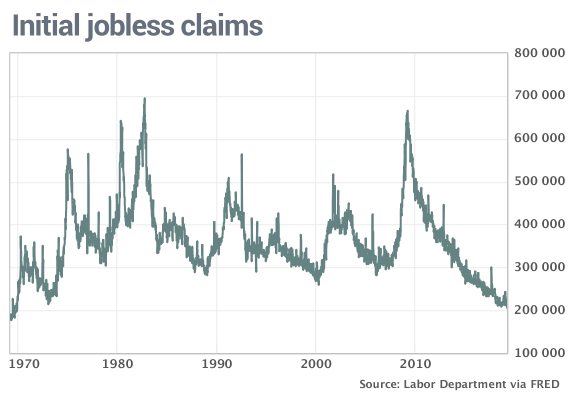

The numbers: The number of people who applied for unemployment benefits in early April fell below 200,000 for the first time since 1969, the latest sign that an ebullient labor market remains an island of strength for a slower-growing U.S. economy.

Jobless claims, a rough measure of layoffs, fell by 8,000 to 196,000 in the seven days ended April 6, the government said Thursday. Economists polled by MarketWatch had forecast a 210,000 reading.

The decline in jobless claims follows closely on the heels of government report showing a rebound in job creation in March after a near-hiring freeze in February. The U.S. added 196,000 new jobs last month.

What happened: Jobless claims have fallen four weeks in a row to the lowest level in 50 years, just a few months after spiking to as high as 244,000.

The more stable monthly average of claims, meanwhile, declined by 7,000 to 207,000. That was also the lowest mark since 1969.

Read: It’s hard to believe, but the U.S. has experienced a quarter-century of low inflation

The last time jobless claims were as low as they are now, the working population in the U.S. was far smaller and the economy looked much different. While changing eligibility standards and other differences in the claims report over time make comparisons with past periods difficult, the low level of layoffs is still quite remarkable.

The number of people already collecting unemployment benefits, known as continuing claims, fell by 13,000 to 1.71 million.

Read: Is the tax code fair? Trump tax cuts trigger biggest partisan rift in 20 years

Big picture: Steady hiring, declining jobless claims, rising wages and the lowest unemployment rate in half a century are likely to help the U.S. economy endure a recent soft patch in growth. Most economists predict growth will pick up in the spring.

Read: Goldilocks economy? No. But steady job gains, low inflation to keep recession at bay

What they are saying?: “Truly remarkable,” said chief economist Joshua Shapiro of MFR Inc.

Market reaction: The Dow Jones Industrial Average DJIA, +0.11% and S&P 500 SPX, +0.07% rose slightly in Thursday trades.

The 10-year Treasury yield TMUBMUSD10Y, +1.12% was unchanged at 2.50%. Yields are much lower compared to late last year, when they hit a seven-year high of 3.23%.