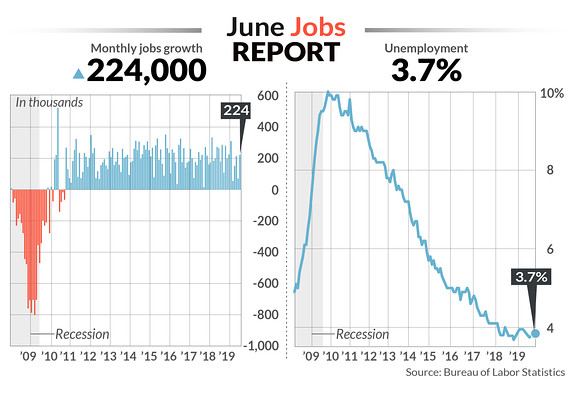

Economists said Friday’s June jobs report showed a labor market that was “roaring back,” with the U.S. creating 224,000 jobs, easily beating the 170,000 forecast.

Read more about the jobs data from MarketWatch.

• “The U.S. labor market came roaring back in June, with 224K jobs being created, well above the consensus forecast. That was in line with our expectations and the encouraging readings on jobless claims, and was only slightly offset by -11K in revisions to the prior two months together. The unemployment rate ticked up but that was a reflection of the increase in the participation rate, which still has room to rise further ahead.” — Katherine Judge, CIBC Economics.

• Jared Bernstein, former chief economist to Joe Biden, said there was a “nice pop” on jobs but asked where the wage pressure is. The average wage paid to American workers rose 6 cents to $27.90 an hour.

• “The rebound in construction and manufacturing has been particularly encouraging considering the hit that those industries have taken from the tariffs and trade war.” — Thomas Simons, Jefferies LLC.

• Northern Trust’s Carl Tannenbaum said the jobs report would be “seen as a relief” — adding it’s “probably not enough to change the Fed’s tracking to a 25 [basis-point] cut” at its July 30-31 meeting.

• “The strong June jobs numbers start the summer off on a strong footing for the American worker, and a big disappointment for the markets that are hoping for substantial interest rate cuts from the Fed. The 224,000 jobs added were broad based, with good gains in everything from manufacturing to construction to business services. The one weak category is retailing, as that industry moves from brick-and-mortar to online.” — Robert Frick, Navy Federal Credit Union.

U.S. stocks DJIA, -0.14% fell by triple digits, and the yield on the 10-year Treasury TMUBMUSD10Y, +4.75% climbed back above 2% after the payrolls data.

See: Stocks retreat from record levels as strong jobs report puts interest-rate cuts in question.