The numbers: New applications for U.S. unemployment benefits rose in late March, but they’re likely to be begin falling again soon as the economy revs up, governments loosen pandemic-related restrictions and companies seek to hire more workers.

Initial jobless claims filed traditionally through the states jumped 61,000 to 719,000 in the week ended March 27, the government said Thursday.

Economists surveyed by Dow Jones and the Wall Street Journal had forecast new claims would fall to a seasonally adjusted 675,000.

New state claims had fallen to a pandemic low of 658,000 two weeks ago.

Read: U.S. adds 517,000 private-sector jobs, ADP says, as economy speeds up

Also: Jobs are coming back as the economy gains steam

Another 237,025 applications for benefits were filed last week through a temporary federal relief program. These numbers are unadjusted.

Combined state and federal jobless claims totaled an unadjusted 951,548 last week. Two weeks ago, they fell below 1 million for the first time since the start of the pandemic.

Read: It’s no time to celebrate unemployment applications falling below 1 million

What happened: New claims rose the most in Virginia, along with smaller increases in Kentucky, Georgia, New Jersey and California.

They fell the most in Ohio, Massachusetts and Florida.

The number of people already collecting traditional unemployment benefits, meanwhile, declined by 46,000 to a seasonally adjusted 3.79 million. These so-called continuing claims are now at the lowest level in a year.

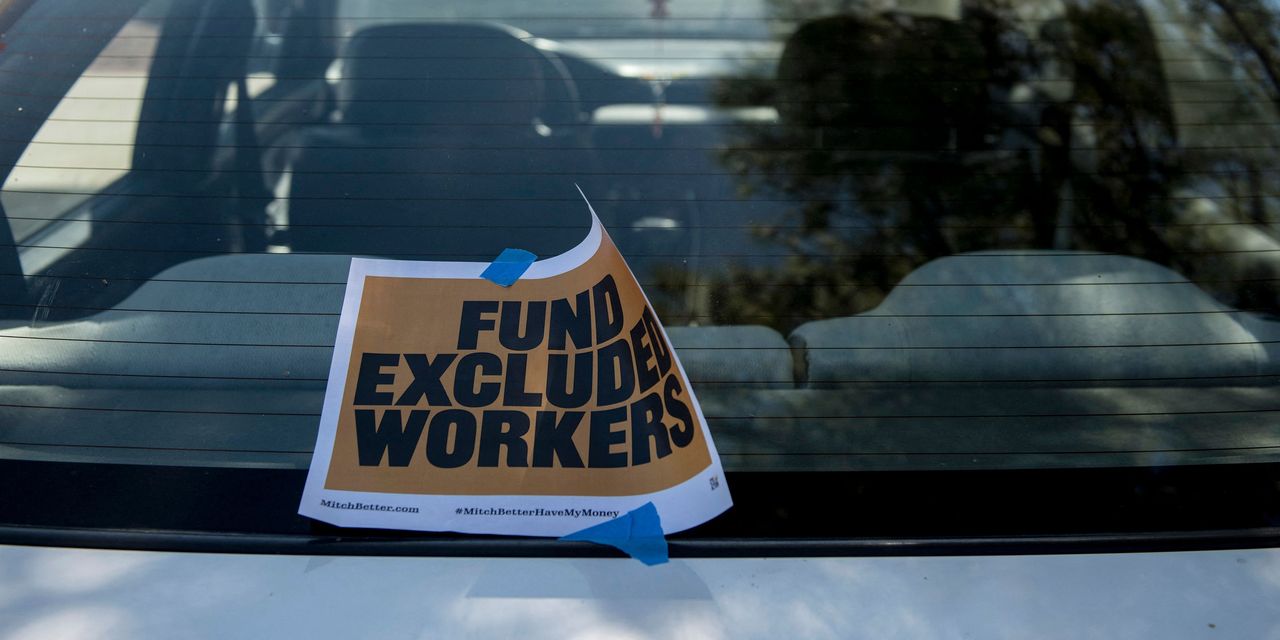

The decline is not quite as steep as it seems, however. An additional 5.5 million people who have exhausted state compensation were reportedly getting extra benefits through an emergency program funded by the federal government.

Taken together the number of people reportedly collecting benefits from eight separate state and federal programs was reported at an unadjusted 18.2 million as of March 13.

By contrast, fewer than 2 million people were getting benefits before the pandemic erupted.

Note to readers: A government review found the number of distinct individuals collecting benefits has been inflated by fraud and double counting. Widespread fraud has also resulted in estimated $63 billion in improper payments, a Labor Department review concluded.

The big picture: Americans who lost their jobs during the pandemic and have unemployed for months are slowly returning to work thanks to a drop in coronavirus cases and another huge dollop of federal stimulus.

Read: Consumer confidence surges to a pandemic high

Governments are lifting restrictions, and many companies are eager to hire, especially those hardest hit by the pandemic, such as airlines, restaurants and entertainment venues. The government on Friday is expected to report the economy created 675,000 new jobs in March.

Market Extra: The Good Friday jobs report will be released to a closed stock market — which has only occurred 12 times since 1980

The momentum is sure to continue if the vaccinations do their job in keeping the coronavirus at bay, but only time will tell.

See: A visual look at how an unfair pandemic has reshaped work and home

What they are saying? “Job growth will accelerate dramatically in coming months as the U.S. reaches herd immunity and the high-contact service sector revives,” said senior economist Bill Adams of PNC Financial Services.

“The overall trend is down, but the level remains extremely elevated by pre-pandemic standards,” said chief economist Scott Brown of Raymond James.

Market reaction: The Dow Jones Industrial Average DJIA and S&P 500 SPX rose in Thursday trades. The Nasdaq Composite COMP, +1.50%, up more than 200 points in the early going, was outpacing both.