Bloomberg News/Landov

Bloomberg News/Landov

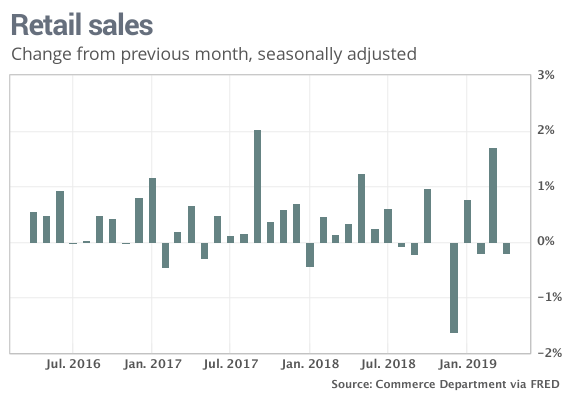

The numbers: Sales at U.S. retailers fell in April for the second time in three months, a sign that Americans are exercising caution over how much they spend with the economy facing increased headwinds.

Retail sales dropped 0.2% last month, the government said Wednesday. Sales declined in most major segments including automobiles, home centers and internet stores.

Economists polled by MarketWatch expected sales to climb 0.1%.

Stripping out automobiles and gas, sales also fell 0.2% to reflect broad weakness in the retail segment.

What happened: Receipts fell 1.1% at car dealers after a decline in sales of new cars last month. Sales also slid a sharp 1.3% for electronic stores and 1.9% at home and garden centers.

Clothing stores, pharmacies and Internet retailers all posted a 0.2% dip in sales.

Sales jumped 1.8% at gasoline stations, reflecting higher prices at the pump. That’s not good news for consumers or the economy, however.

Big picture: The latest look at retail sales suggests Americans are showing more restraint in 2019 compared with a year earlier, when some households got a boost from the Trump tax cuts. Consumer spending in the first quarter was the weakest in a year.

Some letup was expected last month after a 1.7% surge in retail sales in March, and it’s possible a late Easter or delays in personal tax returns this year skewed the numbers. Yet the drop in sales is also a caution sign for the economy. Consumer outlays account for more than two-thirds of the nation’s economic activity.

Among the challenges facing the U.S. are a slower business investment, a weaker manufacturing industry and a tit-for-tat trade fight with China that’s disrupting the world’s two largest economies.

Read: Trump takes a page out of early American history with steep tariffs on Chinese goods

Market reaction: The Dow Jones Industrial Average DJIA, +0.09% and S&P 500 SPX, +0.21% recovered modestly after lower opens on Wednesday. Stocks on Tuesday broke a string of deep losses after trade talks between the U.S. and China broke down and spurred another round of tariffs.

Read: The monster clash between U.S., China over trade dwarfs all other issues about the economy

The 10-year Treasury yield TMUBMUSD10Y, -1.10% fell to 2.38%. The yield has sunk from a seven-year high of 3.23% last October.