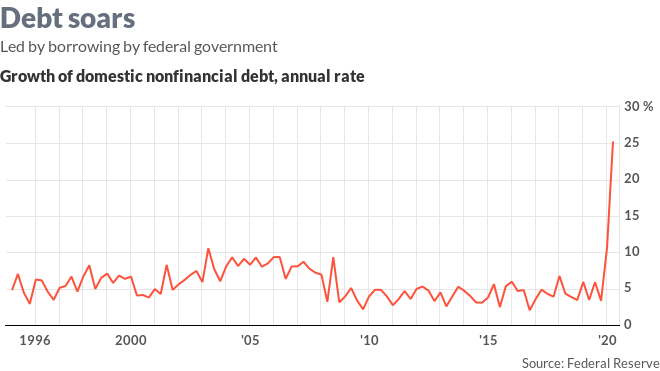

The numbers: The debt burden on the U.S. economy increased at a record pace in the second quarter led by government borrowing needed to cushion the blow of the coronavirus pandemic, according to a report from the Federal Reserve released Monday.

Total domestic nonfinancial debt rose at a record seasonally adjusted annual rate of 25.3% in the April-June quarter to $59.3 trillion. That’s above the prior record of 19.25% during 1985.

What happened: Federal government debt increased a record 58.9% in the second quarter to $22.58 trillion, up from a 11.4% gain in the first quarter. Congress has approved $2.89 trillion in coronavirus relief spending this year.

Household debt rose 0.5%, with consumer credit down at a 6.6% annual rate. Mortgage debt grew at a 3% rate.

Nonfinancial business debt rose at a 14% rate in the second quarter, down from a record 18.4% in the first three months of the year.

Total household net worth rose 6.8% to $119 trillion in the second quarter as stocks rose and households received government checks.

Big picture: Economists recognize that the government’s emergency actions are warranted but are worried the spike in debt could affect growth in the future. The U.S. had an unsustainable long-term fiscal picture even before the pandemic struck this year. At some point, taxes will have to be raised and spending will need to be trimmed.

What are they saying: “It’s an issue. I hope it doesn’t become a problem,” said Robert Brusca, chief economist at FAO Economics.

Market reaction: Stocks were down sharply on Monday with the S&P 500 index SPX, -2.00% down 77 points in early afternoon trading.